- Key Benefits of AI in Finance

- Operational Efficiency

- Improved Customer Experience

- Competitive Advantage

- Accurate Models

- Speed and Precision

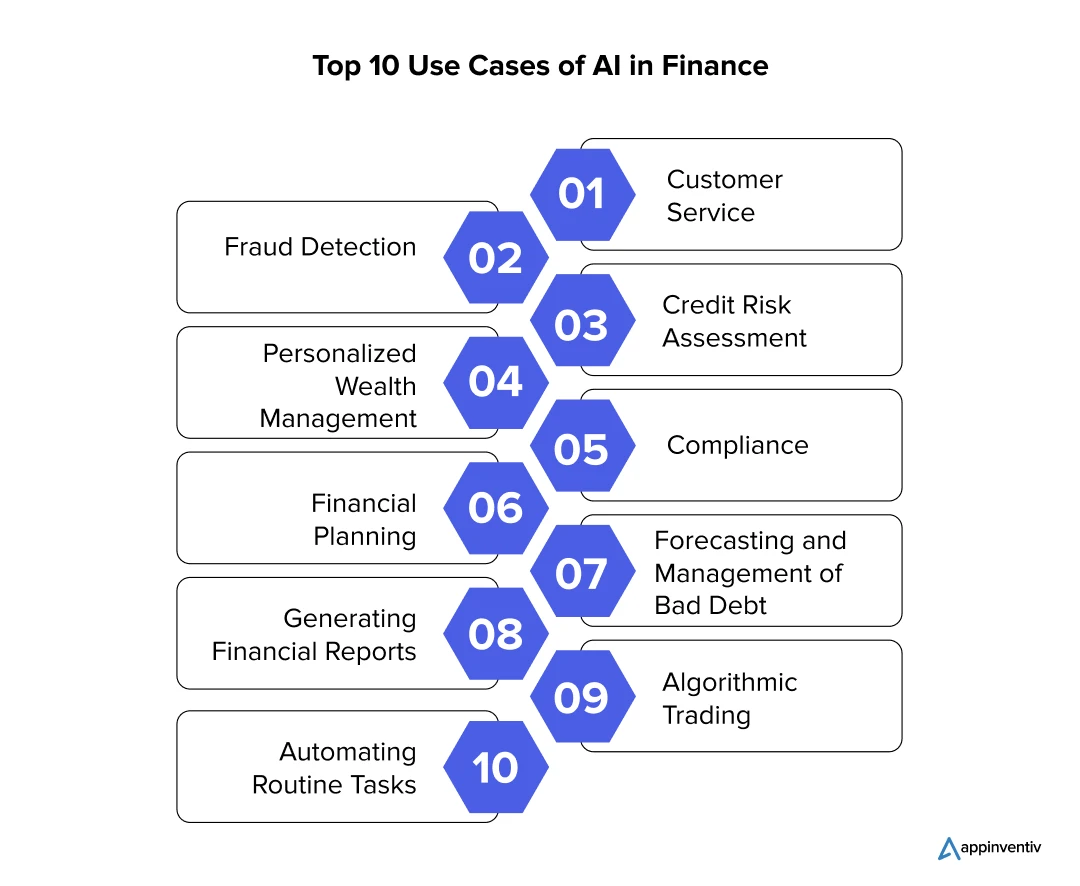

- Top 10 Use Cases of AI in Finance

- 1. Customer Service

- 2. Fraud Detection

- 3. Credit Risk Assessment

- 4. Personalized Wealth Management

- 5. Compliance

- 6. Financial Planning

- 7. Forecasting and Management of Bad Debt

- 8. Generating Financial Reports

- 9. Algorithmic Trading

- 10. Automating Routine Tasks

- How to Implement Artificial Intelligence in Financial Services

- Define Objectives and Use Cases

- Collect and Prepare Data

- Choose the Right Tech Stack

- Develop and Train AI Models

- Integrate AI with Existing Systems

- Conduct Thorough Testing

- Monitor and Maintain the AI Model

- Challenges of AI in Finance and Solutions to Overcome Those

- Explainability and Interpretability

- Ethics and Regulatory Compliance

- Data Accessibility and Quality

- Cybersecurity Risks

- Connecting to Legacy Systems

- The Future of AI in Financial Services

- How Appinventiv Can Help You Leverage the Power of AI in Finance

- FAQs

By 2030, the adoption of AI in the financial services sector is expected to add $1.2 trillion in value, according to a report by McKinsey & Company. Artificial Intelligence (AI) is rapidly transforming the finance industry, revolutionizing the way financial institutions operate and profoundly impacting various aspects of finance. The integration of AI in finance has brought forth numerous benefits of AI in finance, and nowadays, there is a wide range of AI applications in finance that can prove to be game changers in the future.

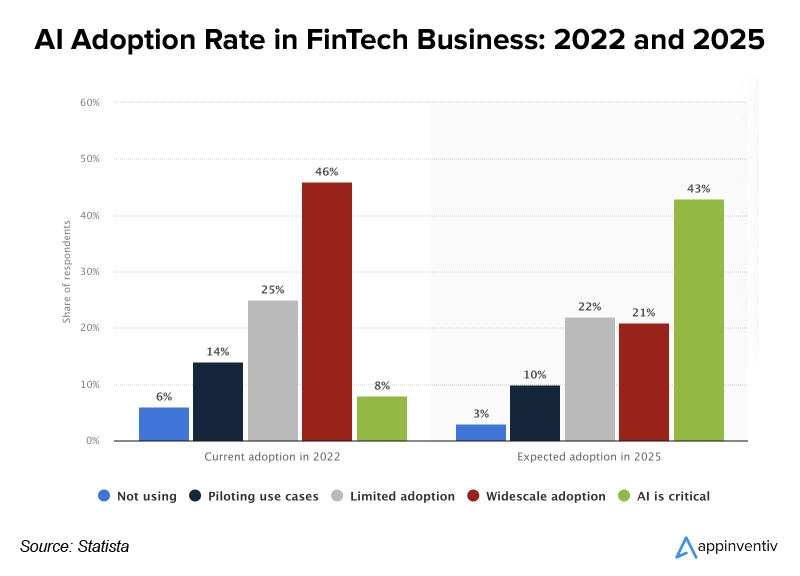

As per a report by Statista, the adoption rate and applications of AI in finance is expected to rise from 2022 to 2025. Data from 2022 show that 54% of financial institutions either widely used AI or thought it was an essential tool. Remarkably, at that time, technologies like Generative AI were not common.

However, with the increasing recognition of AI’s importance, it is projected that by 2025, a higher percentage of companies will view AI as critical to their business, surpassing its role as merely a supportive element. This shows that AI technology is becoming more widely accepted and integrated into finance, highlighting its disruptive potential.

In this blog, we shall take a detailed look at the top 10 use cases of AI in the finance industry.

Key Benefits of AI in Finance

The integration of AI in finance presents a myriad of benefits. From enhancing decision-making accuracy to fostering sustained growth, AI emerges as a pivotal force in reshaping the industry landscape. Let’s have a look at its key advantages in the FinTech industry.

Operational Efficiency

Implementing AI in finance simplifies operations by automating repetitive processes like document processing and data entry. Automation lowers the chances of human error, ensuring data correctness and integrity. AI frees up resources and enables financial organizations to repurpose human capital for strategically important tasks by reducing manual labor requirements.

Improved Customer Experience

AI technology, such as NLP-powered chatbots and virtual assistants, allows for tailored customer interactions. Chatbots offer 24/7 assistance by quickly and effectively responding to inquiries. AI can analyze data to provide customized financial advice and suggestions based on customers’ interests and habits, thereby improving customer experience.

Competitive Advantage

Using machine learning algorithms, financial companies can now obtain important insights into risk factors, market trends, and client behavior. FinTech organizations can make sound decisions quicker than they can with traditional approaches with AI’s capability to analyze large amounts of data rapidly. With AI-driven analytics, organizations can adapt to changing market conditions more swiftly, giving them a competitive edge.

(Also read: 10 Use Cases and Real Examples of Generative AI in Financial Services)

Accurate Models

AI systems are highly skilled at deciphering intricate datasets and producing precise forecasts for risk evaluation, investing tactics, and fraud identification.

Artificial intelligence in finance improves decision-making processes by seeing patterns and trends that human analysts might miss. With more accurate models, financial organizations can optimize investment portfolios, detect fraudulent activity more precisely, and efficiently limit risks.

Speed and Precision

AI swiftly processes vast amounts of data, uncovering patterns and relationships that can often elude human analysis. This capability facilitates quicker insights crucial for decision-making, trading, risk assessment, compliance, and various financial operations, ultimately enhancing efficiency and agility within the industry. AI’s speed enables real-time adjustments to market conditions and enhances responsiveness to dynamic financial landscapes, empowering institutions to stay ahead of the curve and capitalize on emerging opportunities with agility and precision.

Top 10 Use Cases of AI in Finance

The AI revolution has started for finance. Here are the top 10 use cases of AI in financial services.

1. Customer Service

Conversational AI for finance has emerged as a game-changer in customer service. By deploying AI-powered chatbots and virtual assistants, banks and financial institutions can handle a large volume of customer queries efficiently and in real time. These virtual assistants utilize natural language processing (NLP) capabilities to understand complex financial questions and provide accurate responses promptly.

One notable example of AI in finance is the adoption of AI-powered voice assistants. These voice assistants, integrated into mobile banking apps or smart devices, enable customers to interact naturally through voice commands. Customers can check their account details, perform transactions, and obtain personalized financial insights by simply speaking to the AI assistant.

For example, Wells Fargo uses a Facebook Messenger chatbot powered by machine learning to efficiently engage with its customers. Customers can access all the information they require about their accounts and passwords with the help of the chatbot. The use of conversational AI in financial services is transforming customer service by enabling personalized and efficient support.

One of the most remarkable artificial intelligence applications in financial services is the use of AI algorithms for sentiment analysis. Financial institutions can analyze customer feedback, social media posts, and reviews using AI-powered sentiment analysis algorithms. This provides valuable insights into customer preferences and sentiments, enabling organizations to proactively address customer concerns and improve service quality.

The integration of AI in financial services has revolutionized customer service within the financial sector. Conversational AI, voice assistants, and sentiment analysis are just a few examples of how AI is transforming customer service by delivering personalized experiences and efficient support in the finance industry.

2. Fraud Detection

With the latest AI solutions for finance, financial institutions can effectively combat fraudulent activities, protecting both themselves and their customers.

By utilizing machine learning algorithms and predictive analytics, the use of AI in financial services enables the analysis of vast amounts of data to identify and prevent fraud in real time. These AI-powered systems continuously learn from new data, detecting emerging fraud patterns that may go unnoticed by traditional rule-based systems.

Anomaly detection algorithms are a prime example of AI for finance in fraud detection. They can identify unusual patterns and deviations from normal behavior, raising alerts for further investigation. For instance, if a customer suddenly conducts multiple high-value transactions from an unfamiliar location, the AI system can promptly flag it as a potential fraud case.

AI is used by JPMorgan Chase to identify fraud in its credit card business. The bank has created a proprietary algorithm that examines each credit card transaction’s specifics in real-time in order to spot fraud patterns.

The AI solutions for finance leverage diverse data sources, including social media and external databases, to enhance fraud detection capabilities. By incorporating unstructured data and employing natural language processing (NLP), AI systems can identify fraud indicators and accurately detect fraudulent activities.

Also Read: How to adopt artificial intelligence in your business – A complete guide

3. Credit Risk Assessment

Credit risk assessment is a crucial process in the finance industry, and AI has revolutionized this area by providing advanced financial AI solutions. With the integration of AI in financial services, credit risk assessment models in the finance industry have become more accurate and efficient.

Traditionally, credit risk assessment relied on manual evaluation and subjective decision-making. However, with the advent of AI in the financial industry, financial institutions can automate and streamline this process. Machine learning algorithms and predictive analytics analyze extensive data, including credit history, financial statements, and market trends, to evaluate the risk associated with extending credit.

An excellent example of the application of AI and ML in finance is the use of AI-powered credit scoring models. These models analyze historical data, identify patterns, and predict the likelihood of default or delinquency. Lenders can make informed decisions, improve risk management, and offer competitive interest rates to creditworthy borrowers.

AI in banking and finance enables real-time monitoring of credit risk. AI systems in the finance industry continuously analyze financial data and market conditions to provide early warnings and alerts regarding potential credit defaults or deteriorating creditworthiness.

4. Personalized Wealth Management

With advanced algorithms and machine learning (ML) capabilities, AI is transforming the role of AI in finance and enabling creative AI solutions for finance. Personalized wealth management is one of the key areas where AI is revolutionizing finance.

The integration of AI in financial services empowers institutions to offer personalized advice and solutions. Through the analysis of vast amounts of data, including market trends and historical performance, AI provides valuable insights for making informed decisions. By leveraging AI for finance, institutions can customize investment strategies to individual preferences, risk tolerance, and financial goals.

For instance, imagine an investor seeking to optimize their portfolio in the face of market fluctuations. Through the use of ML in finance, AI algorithms can continuously monitor and analyze market conditions, making real-time adjustments to the investment portfolio to maximize returns.

The Aladdin platform from BlackRock analyzes massive amounts of financial data, identifies risks and opportunities, and provides investment managers with real-time insights.

The role of AI in finance is revolutionizing the industry by facilitating personalized wealth management and introducing innovative AI solutions for finance. This paradigm shift enables financial institutions to deliver superior services, enhancing customer experiences and outcomes. In the realm of personalized financial services, AI in finance is reshaping how institutions operate.

5. Compliance

Compliance is an essential aspect of the financial industry, ensuring that businesses adhere to regulatory standards and legal obligations. AI has emerged as a game-changer in the field, revolutionizing compliance processes with its advanced capabilities.

The use of AI in financial services has brought significant improvements to compliance procedures, including PCI-DSS. One notable example of the use of AI in banking and finance is the automation of compliance tasks, such as Know Your Customer (KYC) procedures. Machine learning algorithms can analyze customer data, identify potential risks, and flag suspicious individuals, streamlining the verification process. This saves time, reduces costs, and ensures regulatory compliance.

Related article: Blockchain technology for KYC: The Solution to Inefficient KYC Process

The use of AI in finance has revolutionized compliance by automating manual tasks and improving overall efficiency in financial services and banking and finance. This enhancement in efficiency is particularly impactful in the banking and finance sectors, where IT consulting companies provide cutting-edge solutions that ensures optimal performance.

6. Financial Planning

The integration of AI in finance has transformed financial planning by leveraging data analytics and machine learning algorithms. For instance, AI-powered platforms can analyze historical financial data, market trends, and economic indicators to generate accurate and personalized financial forecasts. This feature of AI helps banks in wooing millennials, who form an important customer segment in most countries. This empowers individuals and businesses to make informed decisions and optimize their financial strategies.

One prominent AI in finance example is the use of AI-driven robo-advisors in financial services. These platforms utilize AI for finance to offer personalized investment advice based on individual goals, risk tolerance, and market conditions. Through sophisticated algorithms, robo-advisors can provide cost-effective and real-time portfolio management, enabling individuals to access professional financial planning services at a fraction of the cost.

In recent times conversational AI for finance has gained traction, allowing users to interact with virtual assistants for financial planning. These AI-powered chatbots can answer queries, provide insights, and even execute financial transactions, offering personalized assistance and convenience. Conversational AI seems to be the future of AI in finance as it promises to bring a tectonic shift in the way financial planning is done.

7. Forecasting and Management of Bad Debt

The forecasting and management of bad debt is a critical aspect of financial services, and the use of AI in finance is revolutionizing this aspect of financial management.

The use of AI in accounting and finance and its applications in financial services have introduced powerful tools for bad debt forecasting. Machine Learning (ML) algorithms can analyze vast amounts of historical data, including customer payment patterns, credit scores, and economic indicators, to identify potential default risks. By leveraging these insights, financial institutions can make data-driven decisions and take proactive measures to mitigate bad debt.

Moreover, generative AI for finance is being utilized to develop innovative approaches to bad debt management. For example, generative AI models can simulate different economic scenarios and assess their impact on loan portfolios, allowing financial institutions to evaluate potential risks and adapt their strategies accordingly.

The AI applications in finance extend to the automation of debt collection processes as well. AI-powered systems can analyze customer behavior, communication patterns, and demographics to personalize debt collection efforts, improving the chances of successful debt recovery while optimizing resources.

Generative AI for finance, along with ML in finance, is transforming the forecasting and management of bad debt. By leveraging AI’s analytical capabilities and automation, financial institutions can make more accurate predictions, devise effective strategies, and improve debt collection outcomes, enhancing their overall financial health.

8. Generating Financial Reports

The role of AI in finance is nowadays becoming more prominent in the arena of generating financial reports. AI-powered systems can analyze vast amounts of financial data, including transactions, invoices, and account statements, to automate the report generation process. Companies can leverage the power of AI in financial services by utilizing machine learning algorithms that can extract relevant information, perform data validation, and generate comprehensive and error-free financial reports.

One of the key AI use cases in finance is the automation of regulatory reporting. Financial institutions are required to comply with complex regulations and submit accurate reports to regulatory authorities. By using AI in finance, companies can streamline this process by automatically extracting relevant data, performing calculations, and generating reports that comply with regulatory standards.

Moreover, the usage of ML in finance facilitates the generation of real-time financial reports by analyzing data in near real-time, allowing stakeholders to access up-to-date information for decision-making. The integration of AI in accounting and finance has revolutionized the generation of financial reports, transforming how financial data is processed, analyzed, and utilized.

9. Algorithmic Trading

Algorithmic trading is one of the major use cases of AI in finance. With its advanced capabilities, AI is transforming stock trading, enabling faster, more accurate, and data-driven decision-making.

The extensive use of AI in finance has paved the way for algorithmic trading. AI-powered algorithms can analyze vast amounts of market data, including historical price trends, market indicators, and news sentiment, to identify patterns and predict market movements. This allows financial institutions to execute trades with precision and efficiency.

Conversational AI in financial services is also playing a significant role in algorithmic trading. Virtual assistants equipped with AI capabilities can process natural language queries from traders, provide real-time market insights, analyze trading strategies, and execute trades based on predefined parameters.

For example, Virtu Financial is a global electronic trading firm that uses AI to power its algorithmic trading platform. The company’s AI-powered platform can scan millions of data points in real-time and execute trades at the optimal price. Based on predefined trading strategies and risk parameters, the system can automatically execute trades at optimal times and prices, capitalizing on market opportunities and minimizing human errors.

The integration of AI and ML in finance is enabling algorithmic trading systems to continuously learn and adapt to market conditions. Machine learning algorithms can dynamically adjust trading strategies based on real-time data, optimizing performance and maximizing returns.

10. Automating Routine Tasks

By leveraging AI in finance, financial organizations are automating their operations and reaping the benefits of this technology.

One prominent example is the use of conversational AI for finance. Virtual assistants powered by AI technology can interact with customers, providing support and assistance in real time. These intelligent chatbots can handle routine inquiries, account management, and basic transactions, freeing up human resources for more complex tasks.

Also read:- What are the Use Cases and Benefits of RPA in Finance?

Within the finance industry, the combination of AI and machine learning (ML) is instrumental in automating processes. ML algorithms can analyze vast amounts of financial data, detect patterns, and make predictions. This enables automated data entry, document processing, and reconciliation, reducing manual effort and improving accuracy.

The benefits of AI in finance are significant. By automating routine tasks, financial institutions can streamline operations, reduce costs, and enhance accuracy. Moreover, employees can focus on higher-value activities like financial analysis and decision-making, leading to improved strategic outcomes.

The use of AI in financial services for automating routine tasks is a game changer for the finance sector.

How to Implement Artificial Intelligence in Financial Services

To successfully implement artificial intelligence in financial services, businesses should follow a step-by-step process that ensures seamless integration of the product into their business operations.

Define Objectives and Use Cases

Begin by defining specific objectives for AI implementation, such as enhancing fraud detection, automating customer service, or optimizing investment strategies. Identify relevant use cases that align with these goals to ensure targeted and impactful AI applications.

Collect and Prepare Data

Gather the necessary data from diverse sources, such as social media, customer feedback, etc., ensuring it is accurate, clean, and relevant to your chosen use cases. Proper data preparation, including collection, cleansing, normalization, and labeling, is crucial for training finance AI models.

Choose the Right Tech Stack

Select the right technology stack to support finance AI development, including data storage, processing power, and AI frameworks. This is one of the most essential steps for implementing AI in finance.

Develop and Train AI Models

Partner with a reputed AI development company to develop and train models tailored to your specific financial use cases. A reliable technology partner ensures the seamless development and deployment of the AI model into your business operations.

Integrate AI with Existing Systems

Ensure that the AI solutions integrate seamlessly with your current financial systems and workflows, like CRM platforms and transaction processing systems. Ensure smooth data flow and interoperability between AI and finance systems.

Conduct Thorough Testing

Rigorously test the AI models in real-world scenarios to validate their effectiveness and reliability. Address any issues, errors, bugs, or discrepancies before full deployment to minimize risks.

Monitor and Maintain the AI Model

Once you have deployed the AI model into your existing system, it is time to continuously monitor its performance and ensure it remains effective. Regular maintenance and updates are necessary to adapt to changing business needs.

Challenges of AI in Finance and Solutions to Overcome Those

Managing AI integration in finance involves several challenges, from guaranteeing data quality to resolving interpretability issues. However, there are several solutions to these challenges. Let’s have a look at the potential challenges and solutions of AI integration in FinTech.

Explainability and Interpretability

Challenge: Since AI models frequently function as “black boxes,” it can be difficult to understand their decisions and explain their results, which is important in regulated financial contexts.

Solution: To improve transparency and confidence in AI systems, use interpretable AI techniques, including explainable machine learning algorithms and model-agnostic interpretability methodologies.

Ethics and Regulatory Compliance

Challenge: Using AI in finance might be complex due to ethical and regulatory compliance norms, as well as fairness, accountability, and transparency.

Solution: Throughout the AI development lifecycle, prioritize ethical AI concepts, create strong governance structures, and set up compliance monitoring systems.

Data Accessibility and Quality

Challenge: Ensuring data quality and availability for training AI models can be challenging due to disparate data sources and inconsistencies.

Solution: Implement data quality processes, utilize data integration tools, and leverage alternative data sources to enhance data quality and availability.

Cybersecurity Risks

Challenge: Adverse manipulations and cyberattacks targeting AI systems in the finance industry could threaten data security and integrity.

Solution: Implement strong cybersecurity services measures, including encryption, authentication procedures, and ongoing monitoring, to reduce the danger of cyberattacks and protect sensitive financial data.

Connecting to Legacy Systems

Challenge: Integrating AI technologies with financial organizations’ current legacy systems and infrastructure can be challenging and expensive.

Solution: Use middleware and APIs for smooth integration, use modular and scalable AI architectures, and progressively move to AI-enabled systems while maintaining backward compatibility with legacy systems.

The Future of AI in Financial Services

The future of AI in FinTech services holds an immense potential for transformative innovation. As AI technologies advance, financial institutions increasingly leverage AI-driven solutions for enhanced customer experiences, personalized wealth management, and more accurate risk assessment.

AI algorithms will streamline operations, automate routine tasks, and optimize decision-making processes, driving efficiency and profitability. Additionally, AI-powered predictive analytics will enable proactive risk management and identify new business opportunities. With ongoing advancements in AI capabilities, the financial services industry is poised to undergo a paradigm shift, revolutionizing how financial institutions operate, engage with customers, and deliver value in the digital age.

How Appinventiv Can Help You Leverage the Power of AI in Finance

Appinventiv is your trusted partner in leveraging the latest AI trends in finance. With our expertise as an artificial intelligence services company and deep understanding of the finance industry, we can help you unlock the transformative potential of AI for your financial operations. With our exceptional fintech software development services, we can assist you in developing AI-powered solutions tailored to your specific needs, whether it’s automating routine tasks, enhancing fraud detection, or optimizing investment strategies. Through our collaborative approach and cutting-edge AI solutions, we ensure that you stay ahead in the dynamic landscape of finance and harness the full power of AI to drive growth and efficiency in your organization.

FAQs

Q. What is artificial intelligence (AI) in finance?

A. Artificial intelligence (AI) in finance refers to using sophisticated algorithms and machine learning methods to evaluate enormous volumes of financial data, automate procedures, and provide predictions based on that data. Financial organizations can use it to make better decisions, run their businesses more efficiently, and provide clients individualized services.

Q. What are the top benefits of AI in finance?

A. Here are some of the top benefits of implementing AI in finance:

- Seamless customer interactions

- Task automation

- Fraud detection enhancement

- Cost savings

- Enhanced decision-making

- Personalized financial guidance

- Improved risk management

- Efficient data processing

- Scalability and flexibility

Q. How is AI used in finance?

A. AI is used in finance to automate routine tasks, analyze data for insights, improve fraud detection, optimize investment strategies, personalize customer experiences, and enhance risk assessment and management. It enables financial institutions to streamline operations, make data-driven decisions, improve efficiency, and deliver better services to customers.

Q. Why is AI the future of finance?

A. AI is considered the future of finance because it has the potential to revolutionize the industry. With its advanced capabilities, AI can process and analyze vast amounts of financial data faster and more accurately than humans, leading to improved efficiency and accuracy in decision-making.

CRM in Banking Industry– Benefits, Challenges, Features and Integrations

A misconception is prevalent about CRM (Customer relationship management) that only certain kinds of businesses need one. But in reality, a CRM system is a must if you have customers who rely on your products or services. Unarguably, CRM is an integral aspect of every industry, and the banking sector is no exception. CRM in…

How Much Does It Cost to Build a Bill Payments App Like My Optus?

In today’s fast-paced digital landscape, convenience is king. From ordering food and buying groceries to booking medical appointments and managing finances, the demand for user-friendly applications is skyrocketing. Among this wide array of applications, digital payment apps emerge as a transformative force, offering unparalleled convenience to access financial services and manage transactions on the go.…