- Why Should Financial Organizations Invest in RPA Tools?

- What are Some Common Use Cases of RPA in Finance?

- PO Processing

- Invoice Processing

- Accounts Reconciliation

- Travel & Expenses

- Tax Calculations

- Financial Reporting

- Budget Planning & Forecasting

- RPA in KYC

- Payroll Processing

- Real-World RPA in Finance Examples

- Keybank

- Radius Financial Group

- Societe Generale Bank, Brazil

- Zurich Insurance

- Benefits of RPA for finance

- A Step-by-Step Process of Successful RPA Deployment in Finance

- Determine the Goals and Purpose

- Evaluate Procedures for Automation

- Develop a Business Case

- Design and Plan

- Develop and Test Bots

- Implement and Deploy

- Monitor and Optimize

- Strategies for Overcoming RPA Challenges in Financial Operations

- Integration with Legacy Systems

- Regulatory Compliance

- Data Quality and Management

- Process Complexity

- Maximize RPA Benefits in Finance with Appinventiv

- FAQs

In the finance industry, manual data processing, especially numerical information, has a higher risk of human errors. Surprisingly, these errors can result in more than 25,000 hours of avoidable rework, amounting to approx $878,000 in annual costs. Understandably, financial firms want to reverse this trend and stay safe from the risk of human errors. Thankfully, RPA in finance emerges as a potential savior in this regard.

Robotic process automation in financial services helps improve operations’ speed, accuracy, and efficiency. This technology is evolving quickly and can handle data more efficiently than humans while saving huge costs.

Financial institutions have been using RPA for finance and accounting processes for quite some time. A recent Gartner research shows that about 80% of financial firms have either implemented or are planning to implement robotic process automation in their business processes. Hyperautomation will not be an exaggeration to describe RPA for accounting and finance as it can perform up to 30 times more work than a human.

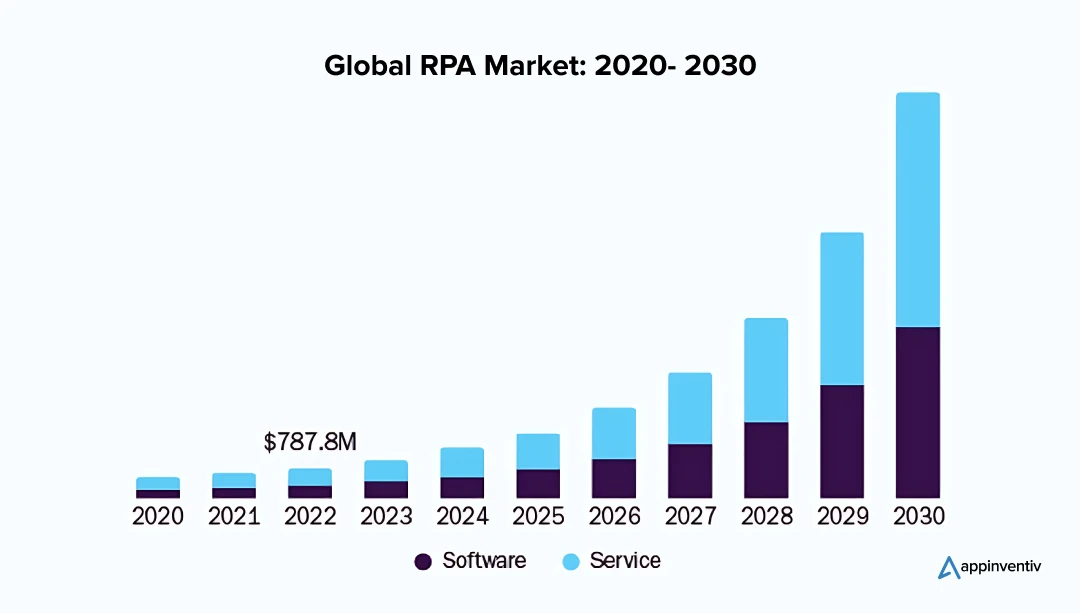

The technology has evolved from performing simple individual tasks of automation to processing full-fledged automated reports, data analysis, and forecasting while interacting with other technologies. According to Grand View Research, the global RPA market size is expected to reach a valuation of $30,850.0 million by 2030, growing at a CAGR of 39.9% from 2023 to 2030.

The above figure proves the effectiveness of implementing RPA in the financial sector. As against manual processes, automated processes run smoothly. So, which tasks can you automate at your financial institution? And what is the best way to implement RPA in banking and financial firms? Let’s discover some of the most remarkable RPA use cases in finance and accounting that are worth looking at. But before that, let’s have a look at the use of RPA in finance and why financial organizations should invest in the same.

Why Should Financial Organizations Invest in RPA Tools?

Financial organizations should prioritize investing in Robotic Process Automation (RPA) tools to drive transformative improvements in their operations. RPA finance streamlines repetitive tasks such as data entry, transaction management, and compliance reporting, resulting in faster, more accurate processes. By automating these routine functions, organizations can reduce costs, minimize errors, and free up valuable human resources for higher-value work.

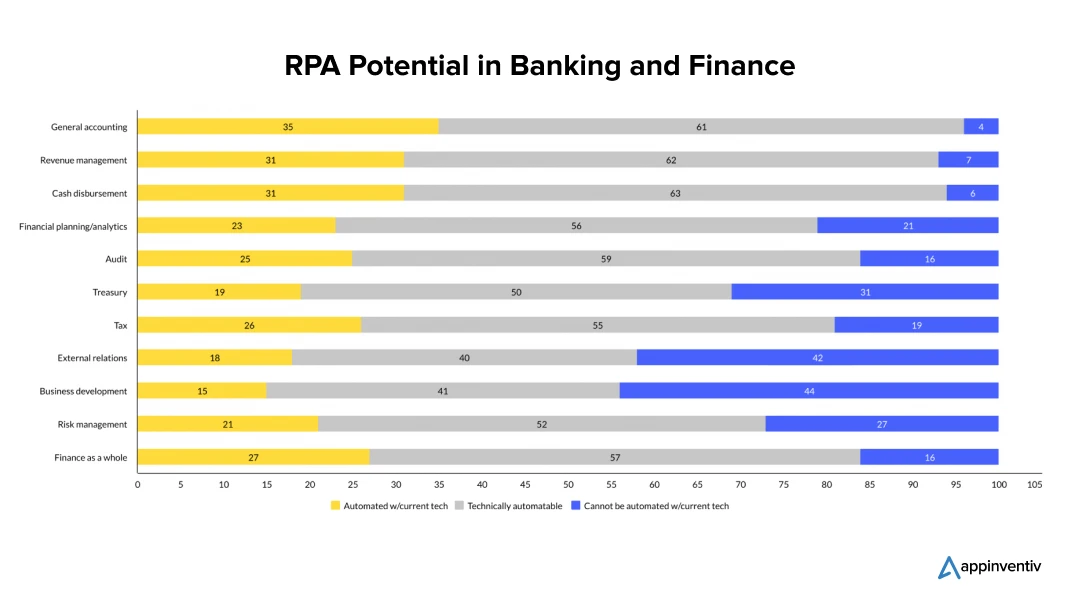

According to McKinsey, general accounting operations hold the highest potential for automation in the finance sector. Currently, 56% of FinTech businesses utilize RPA accounting automation for business development functions, highlighting the significant yet limited scope of automation in this area. As technology evolves, there is a substantial opportunity to increase automation across both general accounting and business development, enhancing overall operational efficiency.

Additionally, RPA provides the flexibility to adapt to changing regulations and market dynamics swiftly. Embracing RPA not only enhances efficiency but also positions financial institutions for significant cost savings and a stronger competitive edge.

What are Some Common Use Cases of RPA in Finance?

RPA in financial services has several different applications that help free up human resources and allow them to focus on more critical tasks. Here are some of the significant use cases of RPA in finance and accounting that are worth your investment.

PO Processing

FinTech organizations are often heavily involved in cash inflows and outflows. The repeated task of creating purchase orders for different clients, forwarding them, and getting approval is not only monotonous but also prone to mistakes if done manually.

Processing the same through RPA integrated with AI will eliminate the possibility of errors and smartly capture the data. With the automated system in place, an automated approval matrix can be created and forwarded for approvals without human intervention. Simple, effective, quick, and cost-saving are some of the most apparent benefits of RPA in finance and accounting for PO processing.

Invoice Processing

Invoice processing is also repetitive and tedious, especially if the invoices are received or generated in varied formats. As a customer-centric organization, financial organizations struggle to raise correct invoices in client-required formats on time.

On top of that, the approval matrix and process may lead to a lot of rework in terms of correcting the formats and data. RPA in finance operations can take up this tedious, repetitive task while ensuring the correctness and forwarding the invoices to the aligned approving authority in no time.

Overall accounts payables and receivables can be completely automated with automated invoicing software and RPA in the finance industry. The maker and checker process can be almost eliminated as the machine can match the invoices with the relevant POs.

Accounts Reconciliation

It is a critical business process that can take up a significant number of business hours for the account team to ensure accurate balance comparisons. Back-and-forth references and logins required into different systems need a hawk’s eye to ensure no errors were made, and the numbers are compared accurately.

To understand it better, an organization with other functions and sub-companies follows different structures and processes in maintaining its accounts. Based on the business requirements and client needs, bringing all of them into a standard processing format might not be possible. The central team faces challenges in reconciling the accounts of all the departments/sub-companies. The process is tedious, error-prone, and repetitive.

This is where finance robotics process automation can bring relief to the central team. In fact, it is the primary benefit of RPA for accounting. RPA bots make the task quick and consistent by auditing and reconciling the data at every step and process with minimal human intervention in incorporating the essential elements of these tasks. Human intervention is only needed when the data reflects misalignments.

Travel & Expenses

Raising travel requests, checking the expense category, obtaining required approval, obtaining essential supporting documents, etc., takes a lot of time for the accounts team and may even delay their processing.

However, with the implementation of RPA in corporate finance, creating expense reports and ensuring that the expense records are as per the company policies have become a lot easier and faster. Also, reimbursement management can be done on time with a finance automation solution. Policy violations and data discrepancies can also be intimated to the concerned individuals/departments with the help of automated alerts.

Tax Calculations

When collating data for tax calculations, creating tax basis, preparing reports, etc., are automated and performed using RPA bots, it reduces repeated task redundancies and inaccuracies that might happen while performing the same manually. Digits and figures must be accurate to the decimal places to eliminate mismatches in the reconciliation and data processing.

Although most businesses run their process through tax processing software, there is still a significant amount of manual work involved. Most of this manual work can be done using RPA bots to reduce time and costs while ensuring better accuracy and adherence to compliance parameters.

Also read- How can automation be used to ensure security and compliance in business?

Financial Reporting

Keeping track of business transactions and profit and loss on a daily basis helps you plan ahead of time and warns you of issues even before they arise. Being proactive in managing and handling these issues saves you from losses. Changes can be implemented to correct and improve the existing methods and business processes.

Banks and financial institutions are required to generate extensive reports that reflect performance, statistics, and trends that involve huge data. The data extracted manually will be tedious and unreliable.

However, robotic process automation in finance and accounting facilitates gathering data from different sources and data present in different formats. Collating, reporting, and analyzing this data leads to better forecasting and planning.

Budget Planning & Forecasting

Budget planning and forecasting is one of the main RPA in financial services use cases. Utilizing RPA bots to gather data from various reports and systems accurately enhances the creation of detailed variance reports, offering multiple perspectives for analysis.

By integrating historical data with current information, RPA allows for precise comparisons and trend analysis, leading to more accurate forecasts and effective strategic planning. This capability supports better decision-making and optimizes financial management processes.

Our team at Appinventiv created Mudra, a cutting-edge chatbot-based budget management platform that effectively tackles personal budgeting challenges. After six months of dedicated design and development, Mudra is now poised for launch in over 12 countries.

This innovative application features interactive elements designed to enhance user engagement and drive a transformation in the FinTech industry.

RPA in KYC

KYC is a necessary and time-consuming process that the BFSI market has to perform for every customer. According to a report by Infosys, a bank spends around $52 million every year on KYC compliance, and for some banks, the spending surges approx $384 million. In addition to the enormous costs, compliance divisions across the financial industry have grown in size, with 150 to 1,000+ full-time equivalents (FTEs) compliance teams.

Incorporating RPA in finance to automate the KYC process reduces costly errors while saving time and resources. Accordingly, RPA in financial services of KYC will help accelerate customer onboarding and improve the overall customer experience.

Payroll Processing

Payroll processing is one of the most critical processes for any business. Timely and accurate processing leads to a happier workforce, which in turn builds a satisfied customer base and a successful business.

With financial institutions’ presence in multiple locations worldwide, capturing productivity, attendance, and tax regimes according to geographical location becomes tedious and time-consuming. Collecting such data and performing calculations is prone to errors that might lead to dissatisfied employees.

Robotic process automation for finance provides you with a breath of fresh air by automating the whole process. Timely and correct calculations lead to employee satisfaction. Performing the tedious tasks of timesheet validations, deductions calculations, tax calculations, overtime payouts, etc., can be managed by RPA bots with zero errors and delays. Also, bots can do tasks for hours in just a matter of minutes without getting tired.

Applications of RPA in banking and finance are a continuous process. You can’t envision the automation of an entire process all at once. So, it is a good practice to carefully determine your starting point and partner with a reputed financial software development company like Appinventiv to embrace RPA trends in finance.

Real-World RPA in Finance Examples

Robotic process automation in finance has gained immense popularity in the finance sector due to its ability to automate repetitive and mundane tasks, resulting in reduced human errors and increased operational efficiency. This is why the BFSI market has embraced RPA trends with open arms over the past few years. Here are some real-world RPA examples in financial services:

Keybank

One of the leading commercial banks, Keybank, adapted RPA in finance processes at an early stage to improve efficiency in a highly realistic manner. Account receivables that involve multiple steps of repetitive tasks, such as generating invoices and POs, have been automated. Although the bank’s key focus is typically the payments, the automation of accounts receivable makes the payment process smooth and error-free from the first step to the last stage.

Radius Financial Group

Radius Financial Group, a prominent mortgage lender, implemented RPA to streamline the complex and time-consuming mortgage application process. Traditionally, coordinating with clients for necessary documentation and verifying paperwork involved lengthy manual steps, which were prone to errors and delays. By adopting RPA, the company automated the process of gathering and verifying information from multiple data sources.

This automation reduced processing time by 80%, significantly speeding up the mortgage approval process. As a result, Radius Financial Group was able to maintain operational efficiency and productivity, even during challenging periods like the pandemic, ensuring continued profitability and customer satisfaction.

Societe Generale Bank, Brazil

Societe Generale Bank, Brazil has been the leader in financial services, and it could become possible by automating tedious, repetitive tasks through robotic process automation. The data used in the financial industry is huge and complex, but the regular automated reports prepared by RPA bots help the employees to be better informed and provide par-excellence customer service. The positive value added to enhance the customer experience has significantly transformed the business model.

Zurich Insurance

With a widespread presence in different countries across the globe, the major challenge before Zurich Insurance was to follow geography-specific regulations. By utilizing RPA and AI in finance processes, they segregated the standard and general policies; and saved a vast amount of time. The underwriters could now get ample time to review more complex procedures. The outcome was surprising as they could save approximately 50% of the processing cost and time.

Benefits of RPA for finance

To overcome workflow bottlenecks, challenges of repeated tasks, and possible human errors in the BFSI market, businesses need to get started with AI, ML-enabled robotic process automation. It will also help eliminate the operational inefficiencies that lead to unproductive instances and poor customer service. In brief, with the implementation of RPA in finance, a notable change can be observed in the following areas of financial firms:

- The potential of AI and Ml-enabled RPA helps keep customers informed about various new features of financial products and services, resulting in enhanced customer experience.

- Data and reports created by RPA bots help organizations analyze customer behavior regularly, which helps drive sustainable growth.

- By automating repetitive and monotonous tasks, RPA bots help get real-time data analysis and improve the team’s operational efficiency.

- RPA in banking and finance will also reduce monetary fraud and proactively flag instances of potential theft.

- Lastly, robotic process automation in finance ensures data compliance throughout the process.

A Step-by-Step Process of Successful RPA Deployment in Finance

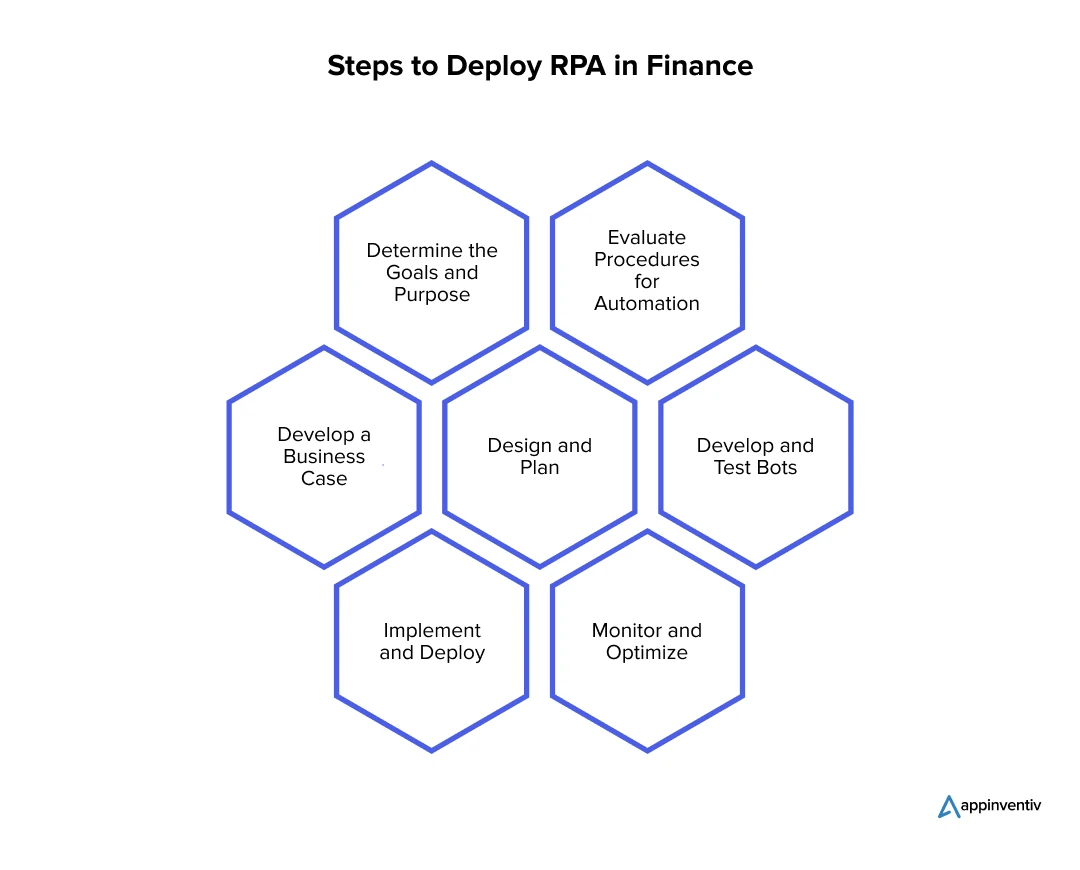

Integrating robotic process automation in finance industry can transform operations and drive significant efficiency gains. From identifying suitable processes for automation to scaling and optimizing the implementation, RPA in finance can ensure maximized efficiency. Let’s explore the process step-by-step.

Determine the Goals and Purpose

Establishing precise goals for the application of robotic process automation is the first step in integrating it. Ascertain whether reducing expenses, improving accuracy, or increasing overall operating efficiency are the main objectives. Determine which particular organizational operations or processes stand to gain the most from automation.

To determine where RPA can have the biggest influence, the workflows must be assessed. You may guarantee that RPA is in line with the strategic priorities of your company and yields quantifiable benefits by establishing clear objectives and comprehending the extent of automation.

Evaluate Procedures for Automation

A thorough audit of current processes is essential for the effective application of RPA. Start by determining which routine and rule-based tasks are most suited for automation. While evaluating each process, consider its level of complexity, transaction volume, and possible operational impact.

Concentrating on the tasks that have the highest return on investment helps select which ones to automate first. Sophisticated process mapping and a grasp of the subtleties of every workflow are necessary to guarantee that RPA is used efficiently, reducing errors and increasing productivity.

Develop a Business Case

Creating a robust business case is essential for securing the resources and support needed to implement RPA. Clearly outline the expected benefits of RPA, such as cost reductions, improved productivity, and greater accuracy. Include a detailed ROI analysis to demonstrate the financial viability and sustainability of the investment.

Highlight key performance indicators, such as reduced processing times and decreased error rates, to showcase the potential improvements. Additionally, address the potential challenges and risks associated with the implementation, building strategies for mitigating these issues.

Design and Plan

A comprehensive implementation plan is crucial for ensuring a smooth RPA deployment. Develop a strategy that outlines project timelines, resource allocation, and risk management. Design automation workflows to detail how the RPA tool will integrate with existing systems and processes.

This planning phase should also identify potential integration challenges and outline strategies for mitigating risks. A thorough plan covers all aspects of RPA deployment, setting the stage for a successful rollout.

Develop and Test Bots

With the design finalized, move on to developing RPA bots based on the defined workflows. Conduct extensive testing in a controlled environment to ensure the bots operate as intended. Testing should address all scenarios and potential edge cases to verify reliability and accuracy. Resolve any issues identified during testing before proceeding. Thorough validation minimizes the risk of disruptions during live operation and confirms that the bots are ready for full deployment.

Implement and Deploy

Initiate the deployment of RPA bots in the live environment, beginning with a pilot phase. This approach allows for close monitoring of bot performance and resolution of any issues before full-scale deployment. Observe how the bots interact with existing systems and collect user feedback to address operational challenges. A phased rollout ensures a smooth implementation process and enables adjustments based on real-world performance.

Monitor and Optimize

Ongoing monitoring is essential to ensure RPA bots continue to achieve their objectives and deliver expected benefits. Regularly track performance metrics, solicit user feedback, and identify areas for improvement. Make necessary adjustments to optimize bot functionality and resolve emerging issues. Continuous optimization ensures that RPA solutions remain effective and continue to provide value as business needs evolve.

Strategies for Overcoming RPA Challenges in Financial Operations

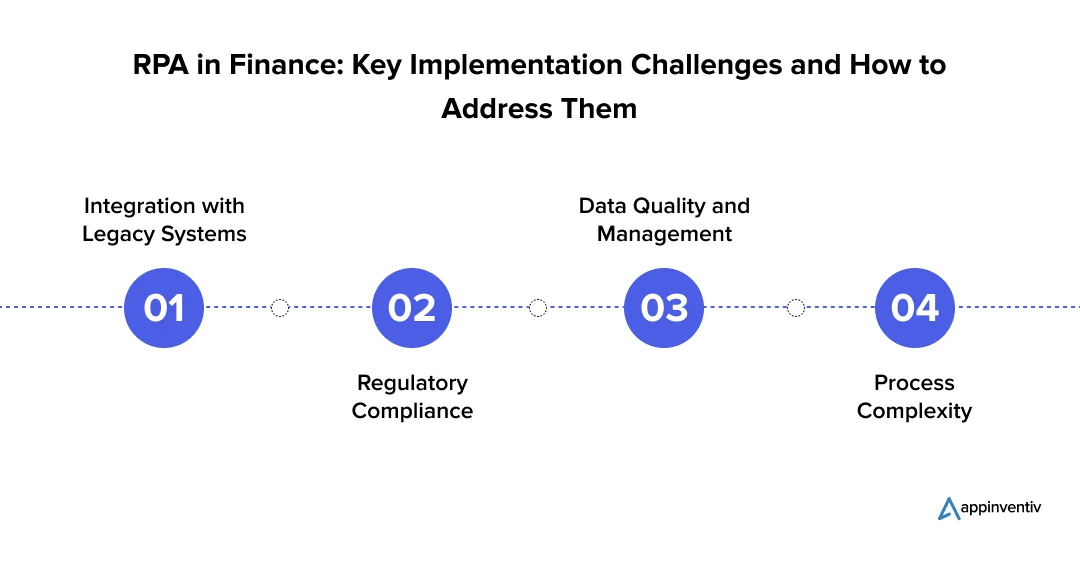

Implementing RPA in finance offers the potential to significantly enhance efficiency and accuracy in financial operations. However, there are several RPA in finance challenges when it comes to implementation. Let’s have a look at some of those.

Integration with Legacy Systems

Financial institutions often depend on outdated legacy systems that may not integrate well with modern RPA tools, leading to compatibility issues. These older systems may also lack the necessary flexibility for effective automation, resulting in operational inefficiencies.

Solution: Deploy RPA solutions that are compatible with legacy systems or use middleware to address integration challenges. Gradually upgrade legacy systems to enhance their compatibility with new technologies. Additionally, explore system modernization or hybrid solutions to facilitate smoother integration and future scalability.

Regulatory Compliance

Financial operations are tightly regulated, and automating these processes must meet various compliance standards. This can be difficult due to the frequent changes in regulations and varying requirements across different regions, which can complicate the automation process. Additionally, maintaining a clear and accurate audit trail for compliance purposes can be challenging.

Solution: Design RPA implementations with compliance requirements in mind from the beginning. Work closely with legal and compliance teams to incorporate necessary controls and audit features into RPA solutions. Continuously monitor and update RPA systems to keep up with evolving regulations and ensure ongoing adherence.

Data Quality and Management

RPA systems require precise and consistent data to operate effectively, but financial data is often inconsistent and of poor quality. These data issues can lead to errors in automated processes, compromising accuracy and reliability. Additionally, integrating RPA with existing data management systems can be complicated when dealing with varied data sources and formats.

Solution: Invest in thorough data cleansing and validation procedures to ensure high data quality before deploying RPA. Establish strong data governance practices to uphold data integrity and address inconsistencies. Conduct regular data audits and updates to maintain accuracy and support reliable RPA operations.

Process Complexity

Financial processes can be highly complex and vary widely between organizations, making it challenging to standardize and automate. Furthermore, the presence of numerous exceptions and variations within these processes can complicate automation efforts, potentially leading to extended implementation timelines and a higher risk of errors.

Solution: Focus initially on automating simpler, high-volume tasks to achieve early gains and build confidence. Thoroughly map and analyze existing processes to streamline and understand them before applying RPA. Collaborate with RPA specialists to pinpoint the best processes for automation and create a detailed plan to manage complexity effectively.

Maximize RPA Benefits in Finance with Appinventiv

By leveraging Artificial Intelligence and Machine Learning, automation tools can interact with a wide range of internal applications such as enterprise resource planning (ERP) and customer relationship management (CRM). This integration helps reduce the processing time by providing accurate data analysis, triggering automated customer responses, and interacting with other internal systems.

Consequently, a streamlined and cost-efficient team can focus on delivering better customer service and enhancing the overall customer experience. By leveraging the best RPA tools in finance, FinTech companies can improve their capabilities and ensure smooth operations.

Furthermore, the ability to fetch detailed reports, detect patterns, analyze historical and current data, and provide valuable information helps stakeholders make informed decisions more efficiently and accurately.

Overall, the combination of AI and ML with RPA enhances the potential of RPA in financial services, leading to improved efficiency, reduced errors, enhanced customer experiences, and data-driven decision-making.

Appinventiv is one of the fastest-growing global FinTech app development services providers, widely known for its exceptional RPA solutions for the finance industry. Backed by a dedicated team of 1600+ tech experts, we provide best-in-class RPA solutions for finance that can automate your FinTech business processes seamlessly. Right from conceptualization to deployment, our team stands by you at every step, with unwavering dedication and passion, while ensuring to delivery of innovative solutions that exceed your expectations.

To transform your business with a robust RPA solution in finance, get in touch with our skilled tech experts now!

FAQs

Q. What is RPA in finance?

A. RPA in finance is a user-friendly software that helps automate various repetitive and monotonous tasks by just accessing user interfaces without disturbing underlying programs.

Q. What are the benefits of implementing RPA in finance industry?

A. The benefits of RPA in finance industry are growing rapidly as it can effectively automate tasks of repetitive nature that are prone to cause errors and are time-consuming when performed manually. Accordingly, you can have a lean, cost-efficient team by reducing operational costs while ensuring high compliance standards and minimal human errors.

By automating most of the mundane tasks of inventory management, regular account payables and receivables, record keeping, payroll processing, and report generation, the finance automation solution allows human resources to focus on more strategic roles of planning and client relations. It is much easier to manage the data and systems with the steep and substantial growth of the company.

Q. What is the impact of RPA in finance account payables?

A. Account payable is a critical component of finance and accounting. The repetitive tasks involved are time-consuming and error-prone. RPA integrated with ML and AI can take over the tedious task of generating invoices and POs. This will allow us to compare the raised invoices against POs and keep the audit in place on a real-time basis.

Q. How can RPA be leveraged to automate finance tasks?

A. Financial institutions can leverage the power of robot process automation by deploying RPA bots into the system that mimic human interactions with various financial processes. These bots can automate mundane and repetitive tasks such as data entry, report generation, invoice processing, reconciliation, etc., with great accuracy and speed.

Furthermore, RPA can interact with internal systems, such as ERP and CRM, enabling seamless data exchange and facilitating end-to-end automation. Through RPA applications in finance, businesses can focus on more value-added tasks while RPA bots efficiently manage time-consuming tasks.

Q. How much does RPA implementation cost?

A. The cost of RPA implementation typically ranges from $40,000 to $300,000 or more, depending on the complexity and scale of the project. This includes software licensing, development, integration, training, and ongoing maintenance. Initial costs can be high, but long-term savings from increased efficiency and accuracy often justify the investment.

CRM in Banking Industry– Benefits, Challenges, Features and Integrations

A misconception is prevalent about CRM (Customer relationship management) that only certain kinds of businesses need one. But in reality, a CRM system is a must if you have customers who rely on your products or services. Unarguably, CRM is an integral aspect of every industry, and the banking sector is no exception. CRM in…

How Much Does It Cost to Build a Bill Payments App Like My Optus?

In today’s fast-paced digital landscape, convenience is king. From ordering food and buying groceries to booking medical appointments and managing finances, the demand for user-friendly applications is skyrocketing. Among this wide array of applications, digital payment apps emerge as a transformative force, offering unparalleled convenience to access financial services and manage transactions on the go.…