- The Lags in Centralized KYC Systems

- Steps for Using Blockchain Technology for KYC Process

- Step 1: The user builds a profile on the KYC DLT system

- Step 2: User performs transactions with FI1

- Step 3: Users perform a transaction with FI2

- Benefits of Using Blockchain in KYC/AML Process

- Data Quality

- Lowered Turnaround Time

- Reduced Manual Labor

- Distributed Data Collection

- Better Operational Efficiency

- Validation of Information Accuracy

- Real-Time Updated User Data

- Enhanced Risk Management

- Trust and Transparency

- Can Blockchain Development Solutions Resolve KYC Challenges? Concluding Thoughts

- Explore the Potential of Blockchain Technology for KYC with Appinventiv

- FAQs

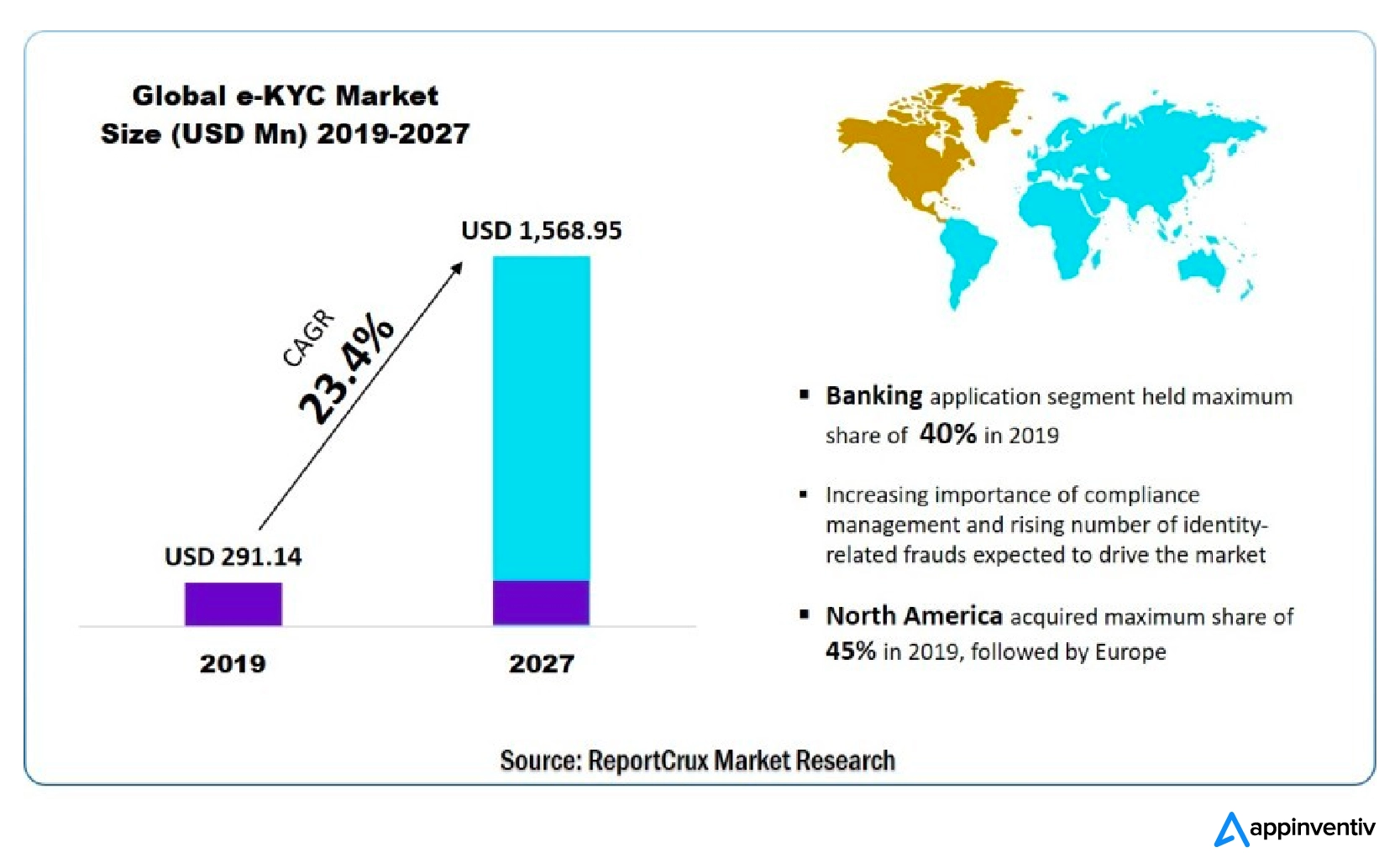

Know Your Customer or KYC processes are the backbones of a financial institution’s anti-money laundering efforts. According to current estimates, the global e-KYC market is growing exponentially and is expected to reach $1,568.95 million by 2027 from $291.14 million in 2019, growing at a CAGR of 23.4% from 2020-2027.

With unprecedented KYC market growth and a whopping amount spent on making KYC processes better, one can easily assume that the process would be unhackable and issues-free. However, despite these remarkable efforts, traditional KYC processes are often inefficient, costly, labor-intensive, and time-consuming.

To address these challenges, new-gen technologies like AI and blockchain have emerged as promising solutions. By leveraging blockchain technology for KYC verification, the processes can be made more efficient, secure, and cost-effective, redefining the regulatory compliance landscape.

Let’s delve deeper to understand the importance of using blockchain for KYC, eliminating inefficiencies and duplication in KYC processes.

The Lags in Centralized KYC Systems

In order to truly understand the changes that blockchain technology can bring to the counterproductive KYC process, let’s first throw light on the problem areas of the present system. The problems will help us realize how blockchain technology for KYC has become an unavoidable necessity.

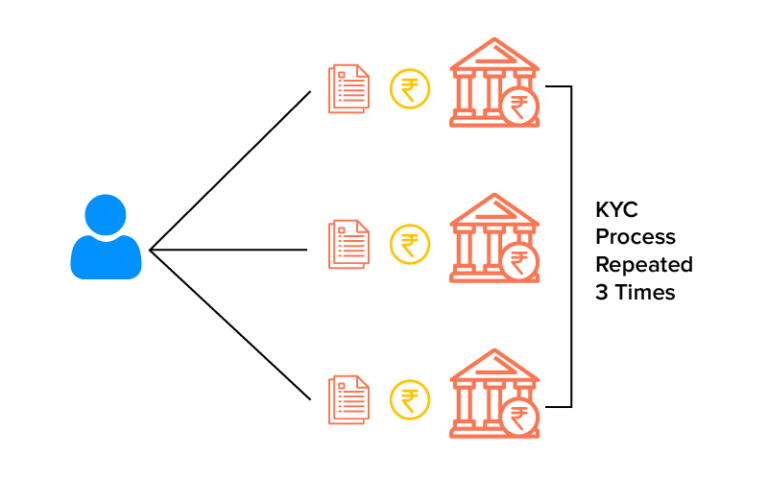

Every bank or financial service provider comes with its own set of specifications with no standardization. This often results in users performing the KYC process with every bank and provider they use. Moreover, a tight, siloed system like this limits Financial Institutions (FIs) from tracking consumers’ expenses on other platforms, leading to every institution having its specific set of incomplete data. This centralization of data in silos combines to cause an inefficient KYC process and creates issues like:

- Misidentification of fraudulent data

- The inability to track customers

- Customers entering fake data

- Delayed processing time

The result of these challenges is the increasing amount we spend on KYC processes and a constant rise in money laundering instances. As a resolution to the above challenges, the KYC process is gradually being shifted to blockchain.

Let’s dive deep into the process of using Blockchain for KYC verification and the benefits that this synergy offers to the FinTech sector.

Steps for Using Blockchain Technology for KYC Process

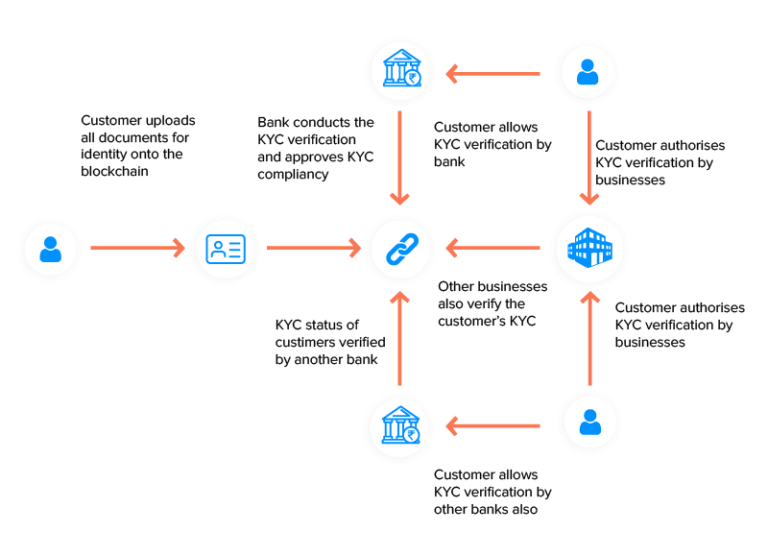

The process of using Blockchain for KYC happens through multiple stages in a Distributed Ledger Technology. Here is an illustrative example: Consider a scenario of blockchain-based KYC verification between two FIs. In this hypothetical case, the initial FI (FI-1) carries out KYC verification for a client, and subsequently, the second FI (FI-2) is required to perform the same KYC transaction.

In a traditional KYC system, this would necessitate repeating the KYC verification process. However, in a blockchain-powered KYC system, the procedure unfolds in a markedly different manner. Let us gain an in-depth understanding of the steps involved in KYC blockchain implementation.

Step 1: The user builds a profile on the KYC DLT system

FI deploys a Blockchain-based KYC platform, which users complete as a one-time setup using their identity documents. Once uploaded, the data becomes accessible to the FI1 for verification purposes.

There are multiple options when it comes to storing the users’ data:

- A centralized, encrypted server

- On the F1 private server

- DLT platform.

Step 2: User performs transactions with FI1

When the user performs a transaction with FI1, they give them the right to access the user’s profile. The FI1 then verifies the KYC data and saves a copy on their server. Next, they upload a ‘Hash function’ on the DLT platform.

Finally, FI1 transfers KYC digital copies to the user’s profile embedded with a Hash Function that matches the Hash Function uploaded on the DLT platform.

Now, if the KYC data is altered, the Hash Function of the KYC data won’t match the one posted on the DLT platform, alerting the other financial institutions on the blockchain of such change.

Step 3: Users perform a transaction with FI2

When FI2 asks the user to perform KYC, the user grants access to their user profile to FI2. FI1 then reviews the KYC data (and its Hash Function) with the Hash function uploaded by FI1. If the two match, FI2 would know that the KYC is the same as the one received by FI1. In case the Hash Functions don’t match, FI2 would have to validate KYC documents manually.

But what happens when the user obtains a new passport or driver’s license and their original document in the DLT user profile changes? In such cases, FI leverages smart contracts to update their systems automatically when the user provides new documents. Here, too, the user submits the new document to F1, who then broadcasts the change across the blockchain (through the new Hash Function), which then becomes accessible to other FI participants.

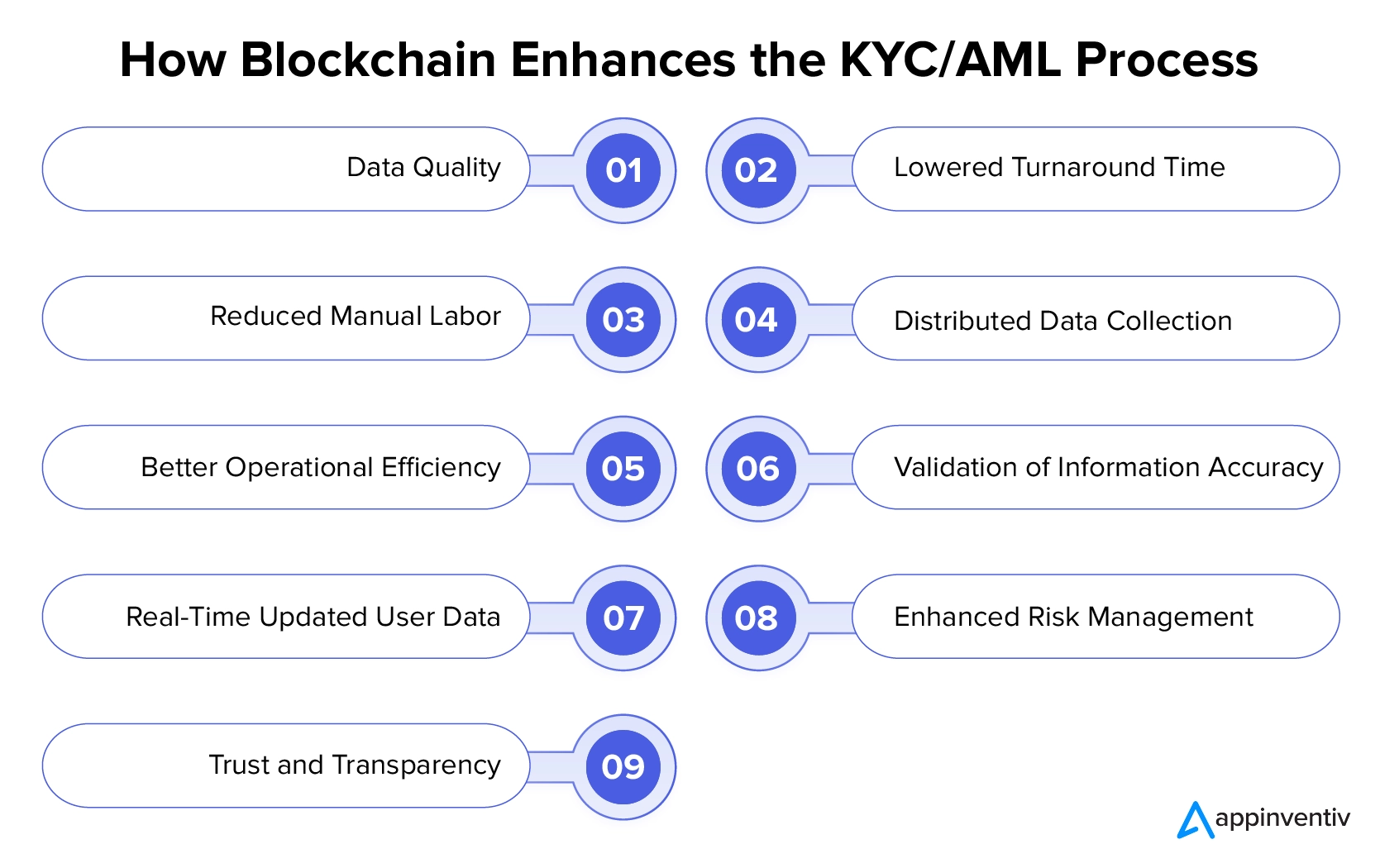

Benefits of Using Blockchain in KYC/AML Process

Leveraging blockchain technology in the KYC and AML (Anti-Money Laundering) process offers numerous advantages, revolutionizing the methods through which customer identification and verification take place. Let’s dig deeper to understand the myriad advantages of blockchain-based KYC systems.

Data Quality

In a KYC process powered by blockchain technology, data quality is significantly enhanced through real-time tracking and monitoring of all alterations, creating an immutable and transparent ledger. This ensures that any changes made to the data are traceable and verifiable, thereby enhancing the accuracy and reliability of the information.

Lowered Turnaround Time

Through KYC Blockchain software solutions, FIs get direct access to the data, which saves data gathering and processing time. The direct access to comprehensive and verified information allows FIs to expedite their decision-making processes, enhancing efficiency and reducing the overall time required for customer onboarding and compliance checks.

Reduced Manual Labor

With KYC on Blockchain, the need for physical documentation is minimized as all customer data is securely stored and managed on the blockchain. This reduction in manual labor not only expedites the KYC process but also lowers the risk of errors, enhancing the accuracy and reliability of compliance procedures.

Distributed Data Collection

The introduction of blockchain in KYC brings data to a decentralized network that only parties with permissions can access. Moreover, since the data can be accessed only by permissioned users, the system offers efficient data security, thus eliminating instances of unauthorized access.

Better Operational Efficiency

Features like an unhackable digital process and sharing user information on a permissioned blockchain network can massively lower the effort and time needed in the KYC process. This, in turn, expedites the customer onboarding time and lowers the regulatory compliance expenses.

Validation of Information Accuracy

KYC Blockchain systems enable transparency and immutability that, in turn, allows financial institutions to validate the trustworthiness of data present in the DLT platform. The decentralized KYC process acts as a streamlined way to gain secure and swift access to up-to-date user data. This lowers the labor-intensive efforts that an institution puts into gathering information.

Real-Time Updated User Data

Every time a KYC transaction is performed at a financial institution, the information is shared within a distributed ledger. This blockchain technology KYC systems enable other participating institutions to access updated information in real-time with a guarantee that they will be notified every time there is a new addition or any modifications to the documents.

Enhanced Risk Management

Blockchain offers real-time visibility into customer data and transaction history, enabling better risk management. It empowers FIs to efficiently identify high-risk customers and implement the best risk mitigation measures.

Trust and Transparency

The decentralized and transparent characteristics of blockchain foster trust among customers, financial institutions, and regulators by offering a shared source of truth. This, in turn, minimizes disputes and enhances transparency throughout the KYC/AML process.

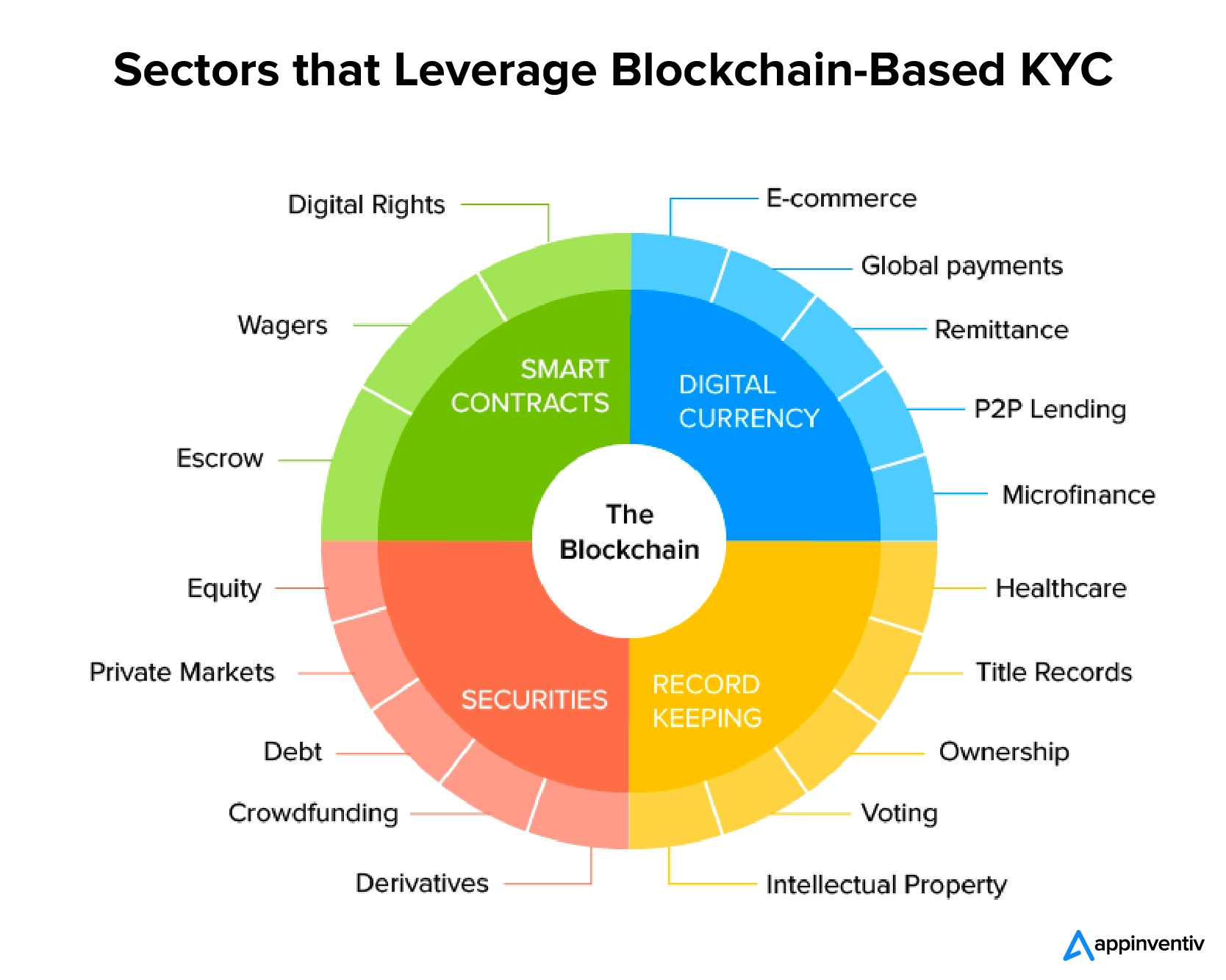

The benefits of blockchain are not merely limited to KYC and the FinTech industry. There are many other sectors that partner with a blockchain development company to explore the advantages of blockchain applications.

Also Read: How Adoption of Blockchain in Real Estate Changing the Scenario

Here is a visual presentation of the industries that leverage blockchain-based KYC:

Can Blockchain Development Solutions Resolve KYC Challenges? Concluding Thoughts

Gathering information and processing in the traditional KYC process takes up a great amount of time, money, and effort, leaving very few resources available for monitoring and assessing user behavior for anomalies. By offering speedy access to up-to-date data, blockchain technology in KYC can lower the time needed for laborious tasks, which, in turn, can be employed to find solutions to more complex KYC challenges.

However, blockchain cannot solve all the issues faced in the KYC process. After the data is acquired, financial institutions still have to validate the information. For this, technologies like AI and cognitive analytics have to be employed for greater efficiency.

In its present state, blockchain, when used in combination with other technologies, can showcase high potential to help institutions lower the cost and time linked with the KYC process.

Explore the Potential of Blockchain Technology for KYC with Appinventiv

KYC verification is essential for businesses in various industries, particularly FinTech, where compliance with industry regulations is indispensable. The utilization of blockchain technology for KYC verification offers a transformative approach, providing a paradigm shift in the KYC verification process.

So, if you want to explore this side of blockchain development services or wish to validate your decentralized KYC-based idea, get in touch with us. We are one of the leading blockchain development companies in the US, offering cutting-edge blockchain technology KYC solutions for your specific needs.

FAQs

Q. How can Blockchain help KYC?

A. Blockchain can enhance KYC processes by providing a decentralized and secure method for storing and verifying customer information. It allows for a transparent and tamper-resistant ledger, reducing fraud risks and ensuring a more efficient, accurate, and reliable KYC process. The decentralized nature of blockchain also enables the sharing and updating of customer data across multiple FIs in a secure and permissioned manner, streamlining compliance efforts and enhancing trust in the KYC process.

Q. What are the best practices to optimize KYC using blockchain technology?

A. Mentioned below are some of the best practices to optimize KYC using blockchain technology:

Comply with Industry Regulations: While leveraging blockchain for KYC verification can elevate the entire process, you must ensure that the implemented solutions align with pertinent regulations, such as GDPR and AML/KYC laws.

Utilize Smart Contracts: Integration of smart contracts can automate specific aspects of the KYC process, reducing the risk of human error and ensuring adherence to pre-established rules.

Partner with Industry Peers: Collaborating with fellow industry stakeholders can standardize blockchain KYC solutions, fostering widespread adoption. Such collaborative efforts also facilitate the exchange of knowledge and resources, enhancing the effectiveness of the KYC process.

Enhance User Experience: While improving the security and efficiency of the KYC process is critical, it is equally essential to ensure a user-friendly experience. Implementing an intuitive user interface increases adoption rates and enhances customer satisfaction.

Prioritize Data Security: Data security is paramount when deploying a blockchain-based KYC platform. Thus, encryption, private key management, and other security measures are essential to protect sensitive customer information.

You may like reading: FinTech Cybersecurity – How to Build a Financial App with Proactive Security Measures?

Q. Can blockchain-based KYC solutions integrate with existing legacy systems?

A. Yes, at Appinventiv, we design custom blockchain solutions for KYC processes that can seamlessly integrate with existing systems. However, the level of integration depends on the specific technology and infrastructure in place.

Q. What is the cost of deploying blockchain technology for KYC?

A. The cost to deploy blockchain technology for KYC can vary widely based on several factors, including the blockchain platform, scope of implementation, scalability requirements, location of blockchain app developers, and so on.

Providing an exact cost without specific project details is challenging. Businesses interested in deploying blockchain technology for KYC should thoroughly analyze their requirements, consult with blockchain experts, and obtain detailed project proposals to estimate the associated costs and timeline.

Get in touch with our blockchain app developers to know the exact cost of developing blockchain KYC solutions for your business.

The Rise of Blockchain in Digital Marketing - Benefits, Use Cases and Challenges

Blockchain technology is revolutionizing digital marketing by transforming strategies through its decentralized and secure framework. It provides marketers with unparalleled transparency in campaign tracking and data management, guaranteeing increased security and privacy for users. As the digital landscape is advancing at a fast pace, blockchain in marketing offers the digital marketers with the means to…

Blockchain Interoperability: The Key to Connect Siloed Blockchain Networks

Blockchain has been a revolutionary response for industries facing the growing pressure of centralized operations’ limitations. By building an ecosystem which runs on zero trust, the technology introduced the world with processes that were incredibly neutral, change-proof, and 100% transparent when compared to their predecessors - traditional computing environment. Having reached a stage where blockchain…