- Understanding Tokenization of Assets on Blockchain

- Tokenization vs Securitization

- Tokenization vs Fractional Ownership

- Types of Tokens Circulated and Used in Blockchain World

- 1. Based on Nature

- 2. Based on Speculation

- Benefits of Asset Tokenization on Blockchain

- 1. Enhanced Liquidity

- 2. Global Accessibility

- 3. Lower Barrier to Entry

- 4. Improved Transparency and Security

- 5. Immutability

- 6. Cost Effective Transactions

- 7. Enhanced Market Efficiency

- 8. No Intermediaries

- Use Cases and Examples of Digital Assets Tokenization Across Industries

- 1. Finance

- 2. Real Estate

- 3. Healthcare

- 4. Sports

- 5. Enterprise

- 6. Art and Collectibles

- Risk and Challenges to Adoption of Tokenization

- 1. Not Immune from Attacks

- 2. Regulatory Compliances

- 3. Security Concerns

- How to Tokenize an Asset?

- Select an Asset to Tokenize

- Define the Right Token Type

- Establish Compliance Requirements

- Formulate Tokenomics

- Choose the Blockchain Platform

- Develop Smart Contracts

- Build Asset Management Solutions

- Integrate Asset Management Solution to the Required System

- Issue the tokens

- Release the Token Listing

- Partner with Appinventiv for Asset Tokenization Platform Development

- FAQs

Blockchain has brought a transformative difference in the finance world for over a decade. With its characteristics like decentralization, immutability, transparency, and distributed structure, the technology has added new forms of benefits and applications to the ecosystem. One of which is asset tokenization on blockchain.

Asset tokenization is an extended use case of blockchain technology that facilitates the buying, selling, and transferring of digital assets on a decentralized ledger. Tokenized assets aim to assist enterprises in leveraging secure and transparent transfer of asset ownership, enhancing asset liquidity, and facilitating rapid, cost-efficient asset trading. This concept has emerged as one of the top blockchain technology trends by opening new doors for the tokenization of assets.

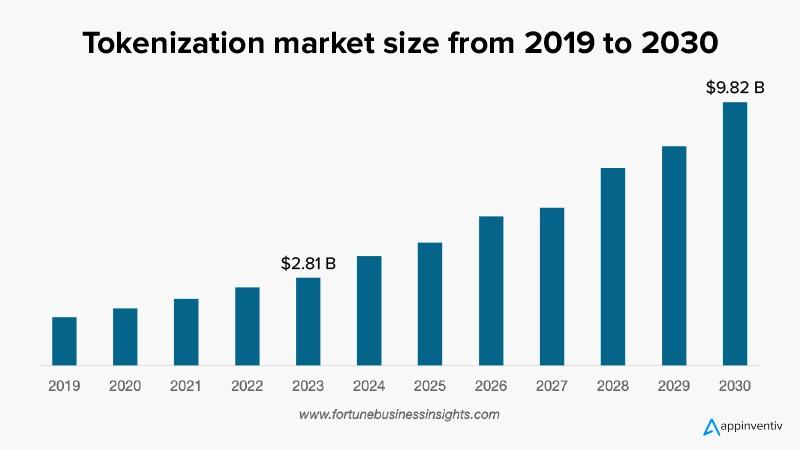

The global tokenization market is expected to grow from $2.81 billion in 2023 to $9.82 billion by 2030 at a CAGR of 19.6% during the forecast period. This signifies that the global tokenization market is rapidly growing with no signs of slowing down in the near future; thus, introducing this concept into your business vertical will be a profitable idea.

But how far will blockchain take the market? Will it become a revolutionary addition to every business in every sector? Let’s delve deeper to understand the many benefits and use cases of asset tokenization on blockchain in various industries.

Understanding Tokenization of Assets on Blockchain

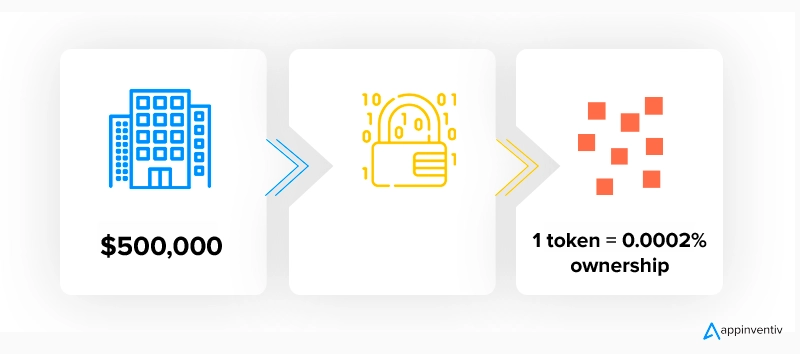

Asset tokenization on blockchain is a process of converting the rights of a physical or digital asset into a digital token on a blockchain or distributed ledger system. This enables fractional ownership, trading, and transfer of assets in a secure and transparent manner.

For example, consider the scenario of an individual needing $50,000 from a condo valued at $500,000. By tokenizing the condo into 500,000 security tokens, each representing 0.0002% ownership, they could opt to sell 50,000 tokens instead of relinquishing the entire property, preserving its function as a livable space while enhancing asset liquidity.

The asset tokenization process sounds much like securitization and fractional ownership but it holds some key differences. Let us look at them in detail below:

Tokenization vs Securitization

Tokenization turns all real-world assets into high-liquidity digital tokens. In contrast, securitization converts low-liquidity assets into higher-liquidity security instruments that could be traded in markets and over the counter.

Tokenization vs Fractional Ownership

Fractional ownership, unlike tokenization, provides an opportunity to bring unrelated parties together and enjoy trading in a digital world.

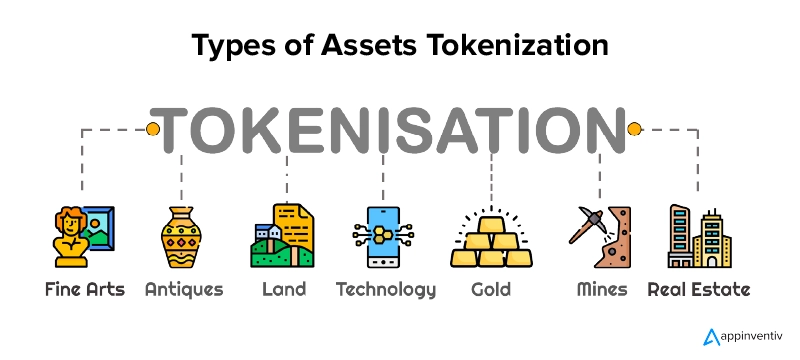

In essence, any asset with tangible or intangible value can potentially be tokenized to facilitate ownership, transfer, and trading on blockchain networks. It includes but is not limited to real estate properties, stocks and bonds, commodities, precious metals, artwork and collectibles, intellectual property rights, securities, fiat currencies, digital assets (such as cryptocurrencies), renewable energy projects, and so on.

Financial organizations are actively tokenizing cash. According to McKinsey & Company, an estimated $120 billion worth of tokenized cash is presently circulating in the form of fully reserved stablecoins.

Types of Tokens Circulated and Used in Blockchain World

In the realm of asset tokenization blockchain, various types of tokens are circulated and utilized. To maximize the advantages of investing efforts into developing tokenized assets, tokens are typically classified into two primary categories:

1. Based on Nature

- Tangible Assets – Tangible tokens represent a set of assets that hold some monetary value and are available usually in a physical form.

- Fungible Assets – These types of assets are created in a way that makes each token identical to the next. For instance, one bitcoin is equivalent to another bitcoin and can be traded interchangeably.

- Non-Fungible Assets – NFTs are uniquely designed tokens that cannot be exchanged or replaced with another, often representing distinct items or properties.

2. Based on Speculation

- Currency Tokens – These tokens represent traditional currencies in digital form.

- Utility Tokens – Digital tokens issued to raise funds for cryptocurrency development and can be later employed to purchase a particular product or service offered by the issuer of the cryptocurrency.

- Security Tokens – Security tokens, one of the cryptocurrency currency trends, are basically the digital representation of traditional securities.

Now that we are familiar with the types of tokenization of assets via distributed ledger blockchain technology, let’s look into what are the benefits of this process.

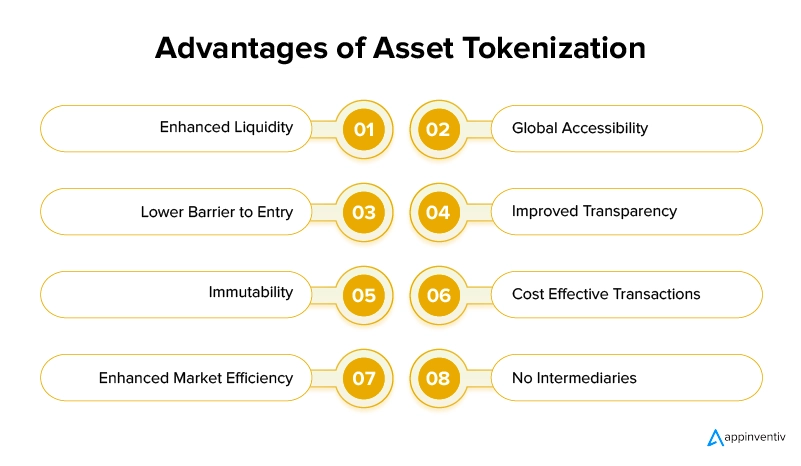

Benefits of Asset Tokenization on Blockchain

Tokenization of assets offers a transformative approach to investment by digitizing ownership rights and facilitating the trade of assets on blockchain networks. Embracing asset tokenization offers a myriad of benefits, from increased liquidity and accessibility to enhanced transparency and market efficiency. Let’s talk about these benefits in detail:

1. Enhanced Liquidity

One of the prime benefits of asset tokenization is enhanced liquidity. Presently, the market for privately held firms is illiquid. Because of this, it takes more time for buyers and sellers to know about each other and the services they offer. They also have to spend considerable time deciding the factors for doing business together and hiring lawyers and other service providers to build a contract for executing the transaction.

But, with the adoption of asset tokenization, this process becomes smoother and streamlined. It introduces a blockchain platform where tokens represent private company securities and are sold to participants who are pre-vetted in such areas as authorized investors with adequate capital to take the risk.

These investors can exit the platform anytime by selling their tokens on a secondary market easily and efficiently. They won’t have to suffer from the hassle of early redemption, which is an expensive affair. This enables more investors to participate, leading to increased liquidity as assets can be bought and sold more easily.

2. Global Accessibility

Accessibility is also one of the prime benefits of asset tokenization on the blockchain surface. Blockchain-based tokenization allows assets to be traded on a global scale without the need for intermediaries or geographical restrictions. This opens up investment opportunities to a global audience and facilitates cross-border transactions.

3. Lower Barrier to Entry

Asset tokenization reduces the minimum investment required to access certain assets, encouraging investors to get a small fraction of shares and making them more accessible to a wider range of investors. This democratization of investment opportunities can attract new participants to the market.

4. Improved Transparency and Security

In blockchain asset tokenization, transactions are transparent and traceable, providing a higher level of security and reducing the risk of fraud or manipulation. This gives you an idea of whom you are dealing with, what power they have, and whom they have purchased this token from. Something that adds transparency to the whole process. Additionally, smart contracts can automate processes and ensure compliance with regulatory requirements.

5. Immutability

The data stored on the blockchain cannot be changed, deleted, or corrected. So anyone interested in buying or selling tokens can be assured that the asset information and transaction records are accurate, as they are verified and cannot be changed once recorded onto the blockchain.

6. Cost Effective Transactions

Asset tokenization on blockchain can reduce transaction costs by eliminating intermediaries and streamlining processes. This will eventually result in lower fees for investors and issuers, making investment opportunities more attractive.

7. Enhanced Market Efficiency

Digital assets tokenization can increase market efficiency by reducing inefficiencies such as long settlement times and manual paperwork. This can lead to faster and more streamlined transactions, benefiting both investors and issuers.

8. No Intermediaries

Asset tokenization enables direct peer-to-peer transactions on blockchain networks, eliminating the need for traditional intermediaries such as brokers, custodians, or clearinghouses. It reduces transaction costs, and the process becomes more efficient, transparent, and secure. This direct ownership structure also minimizes counterparty risk and ensures investors have full control over their assets.

Now that we know the major benefits of asset tokenization blockchain in general, let’s dive into multiple use cases of the same across different sectors.

Use Cases and Examples of Digital Assets Tokenization Across Industries

There are several industries embracing the concept of asset tokenization, each with its own unique applications and advantages. With that said, let’s explore the various use cases of asset tokenization in different sectors.

1. Finance

Tokenization, one of the top applications of blockchain in the fintech industry, is changing the landscape in different ways – be it margin lending, product structuring, investment, or payments. It also enables the creation of decentralized finance (DeFi) platforms, allowing users to access financial services such as lending, borrowing, and trading without the need for traditional intermediaries.

Tokenization of assets allows finance organizations to turn all assets into digital crypto-currencies that can be exchanged seamlessly. It gives merchants an escape from storing the actual credit card numbers in POS machines and other systems. This, as a whole, introduces liquidity in the market and reduces the risk of data breaches.

Likewise, the tokenization of equity shares offers users multiple tokens generated for a single credit card. This implies that in the event of a security breach on an online platform where a token is used, it becomes challenging to reverse engineer the code and obtain the original credit card number.

A real-world example of this emerging trend in investment strategies is the partnership between AlgoZ, a leading liquidity provider, and OmiseGo, a blockchain platform facilitating peer-to-peer transactions. Through this collaboration, AlgoZ aims to enhance liquidity and trading efficiency on the OmiseGo network, showcasing the application of asset tokenization to optimize trading experiences and access to decentralized finance opportunities.

2. Real Estate

Real estate is one of the most prominent industries that leverages the benefits of asset tokenization platform development. By tokenizing real estate assets, property owners can divide ownership into smaller, tradable units, making it easier for investors to participate in the market. Tokenization also reduces barriers to entry for investors, increases liquidity in the real estate market, and enables fractional ownership of high-value properties.

Additionally, tokenized real estate can facilitate cross-border investments and streamline property transactions by automating processes such as title transfers and rental payments. It also lets anyone invest any amount, which further results in a better marketplace for all.

When talking about real estate tokenization, platforms like Harbor, Slice, and Meridio stand out, offering innovative solutions for fractional ownership, increased liquidity, and streamlined transactions. These platforms leverage blockchain technology to tokenize real estate assets, allowing investors to access the market more easily and diversify their portfolios with fractional ownership of high-value properties.

You may like reading: Benefits, Use Cases, and Examples of AI in Real Estate

3. Healthcare

The healthcare sector is also turning towards the idea of tokenization of assets to settle some major challenges prevailing these days. In healthcare, blockchain asset tokenization offers opportunities to digitize and streamline various aspects of the industry, including patient data management, medical supply chain management, and healthcare financing.

Tokenization replaces sensitive patient data like PANs, NPPI, and ePHI with unique and non-sensitive values, which reduces data breach cases. It also transfers the power to create, access, and share sensitive data from intermediaries like insurance companies to patients and medical organizations. This form of healthcare tokenization enables patients to verify the precision of their data, thereby reducing the substantial costs typically incurred by engaging third-party services.

Clincoin is a perfect example of understanding the scope of tokenization and token economy in the healthcare domain. This blockchain-powered platform not only facilitates connections among users, providers, and developers but also incentivizes users to participate in healthy activities by rewarding them. Users can then use these tokens to buy digital tools, products, and services in a decentralized marketplace.

Also read: How is AI Transforming the Healthcare Industry

4. Sports

Asset tokenization is also making inroads into the sports industry, particularly in areas such as player contracts, team ownership, and fan engagement. Tokenizing sports assets allows for the fractional ownership of sports teams, enabling fans to invest in their favorite teams and share in their success.

Additionally, player contracts can be tokenized to provide athletes with alternative sources of income and greater financial security. Moreover, sports memorabilia and collectibles can be tokenized as non-fungible tokens (NFTs), allowing fans to buy, sell, and trade digital representations of iconic moments in sports history. Overall, asset tokenization in the sports industry has the potential to democratize access to sports investments, enhance fan participation, and create new revenue streams for athletes and teams.

Various sports clubs and firms have already started looking into this direction, while others are planning to embrace the concept. One notable example of asset tokenization in the sports industry is the recent partnership between Manchester City Football Club and Superbloke. This collaboration aims to tokenize Manchester City’s fan engagement activities, allowing fans to access exclusive content, experiences, and merchandise through blockchain-based tokens. By leveraging asset tokenization, Manchester City seeks to enhance fan participation, drive engagement, and create new revenue streams in the rapidly evolving sports market.

5. Enterprise

Enterprises also harness the potential of tokenized blockchain to unlock the value of corporate assets, increase liquidity, and streamline business operations. They consider this concept to extend their approach to new markets, evaluate employee performance, ensure proper resource allocation, introduce better incentive models, and add transparency to all internal processes.

Using digital asset tokenization services, enterprises can tokenize a wide range of assets, including intellectual property rights, equipment, and inventory. By digitizing assets on blockchain networks, enterprises can increase transparency, reduce administrative costs, and improve access to capital markets.

One real-world example of asset tokenization in the enterprise sector is the tokenization of corporate bonds. Companies can tokenize their debt obligations into digital tokens, allowing investors to buy and trade fractional ownership of the bonds on blockchain platforms. It provides companies with an alternative financing option while offering investors greater flexibility and liquidity in their investment portfolios.

6. Art and Collectibles

Tokenization is revolutionizing the art and collectibles industry by digitizing ownership of artwork, collectible items, and other valuable assets. Tokenized blockchain can make art more accessible to art lovers and artists, as they can now tokenize their works and sell them worldwide without intermediaries while also ensuring transparency and provenance.

One of the recent examples that made headlines was the successful tokenization of the first multi-million dollar work of art. It was a painting by Andy Warhol named “14 Small Electric Chairs (1980)”. The main purpose of the beta auction was to test the Dutch auction process and generally check how the artwork tokenization and blockchain technology work.

Also Read: What is Blockchain Beyond Cryptocurrencies: 22 Use Cases

Risk and Challenges to Adoption of Tokenization

While asset tokenization offers numerous benefits to businesses across industries, there are also some risks and challenges to its successful adoption:

1. Not Immune from Attacks

Challenge: Despite the robust security measures implemented in tokenization systems, they are not immune to cyberattacks. Blockchain hackers may target tokenized assets through various means, including phishing attacks, malware, and social engineering.

Solution: Businesses should continuously monitor and update their security protocols to defend against evolving cyber threats in the digital landscape. Additionally, implementing insurance policies and contingency plans can help mitigate the impact of potential security breaches on tokenized assets and investors.

Related Article: Digital Immune System – How It Shields Your Business Against Cyberattacks

2. Regulatory Compliances

Challenge: Most of the obstacles in asset tokenization are related to regulatory compliances and current technology constraints. Regulatory uncertainty and compliance requirements vary across jurisdictions, posing difficulties for tokenization projects. Different regions have different regulations regarding securities, taxes, and data privacy, which can complicate tokenization efforts.

Solution: Governments and regulatory bodies can provide clearer guidance and regulations for tokenization projects. Regulators, politicians, and even developers need to begin work on defining the legal framework and drafting global laws and regulations regarding tokenized assets and the activities associated with them.

3. Security Concerns

Challenge: Security vulnerabilities in smart contracts, exchanges, and digital wallets pose risks to tokenized assets. Hackers can exploit vulnerabilities to steal tokens or manipulate transactions, leading to financial losses and reputational damage.

Solution: Implementing robust security measures, such as multi-factor authentication, encryption, and audit trails, can mitigate security risks associated with tokenization. Regular security audits and penetration testing can help identify and address vulnerabilities proactively.

How to Tokenize an Asset?

Tokenization of assets is a series of multiple steps, including formulating the tokenomics for the chosen asset category, developing smart contracts for token issuance, setting up a specialized infrastructure to manage and trade the tokenized assets, and so on. An asset tokenization process with Appinventiv looks as follows:

Select an Asset to Tokenize

We assess your business requirements, the preferences of your target audience, and market dynamics to identify the assets suitable for tokenization and verify the financial viability of the tokenization process.

Define the Right Token Type

Based on the nature of the asset being tokenized, we release utility tokens, security tokens, governance tokens, or NFTs.

Establish Compliance Requirements

Our compliance specialists conduct a thorough analysis of global, country-specific, and industry-specific legal regulations relevant to the asset, such as GDPR for data protection, SEC regulations for financial securities, or HIPAA for healthcare assets.

Formulate Tokenomics

In this phase, we provide a comprehensive tokenomics model for the tokenized asset, defining characteristics of token supply and demand, outlining token value, and specifying associated rights related to the assets.

Choose the Blockchain Platform

Considering the specific needs of every project, we identify the most suitable blockchain platform for tokenizing your assets. Additionally, we offer the option to construct an asset tokenization platform atop your existing blockchain network.

Develop Smart Contracts

We design and develop smart contracts tailored to tokenize assets, program the asset’s functionalities, and automate compliance checks with relevant industry regulations.

Build Asset Management Solutions

We build a custom blockchain-based asset management application for token issuers and investors. Also, we integrate the blockchain app with a chosen third-party crypto wallet to facilitate efficient management of tokenized assets.

Integrate Asset Management Solution to the Required System

We link the solution to payment gateways, accounting software, trading platforms, KYC/AML verification services, and other pertinent systems.

Issue the tokens

We execute token issuance, such as IDO, ITO, STO, etc., either on your own or a third-party blockchain platform to facilitate token distribution or primary acquisition of the tokenized asset by investors.

Release the Token Listing

We enlist your tokens on chosen token exchanges to enable the trading of tokenized assets on secondary markets as per user specifications.

Partner with Appinventiv for Asset Tokenization Platform Development

Asset tokenization presents a transformative opportunity for businesses seeking to enhance liquidity, accessibility, and efficiency in asset management and investment. By partnering with Appinventiv, a custom blockchain development company, organizations can unlock the full potential of this innovative technology.

Our proven expertise in blockchain development, coupled with our comprehensive suite of services, ensures a seamless and efficient tokenization process. From asset identification to token issuance and beyond, we empower businesses to navigate the complexities of blockchain technology with confidence and ease.

Whether you want to tokenize real estate, financial assets, or digital collectibles, our blockchain experts are committed to delivering tailored solutions that meet your unique business needs. Our comprehensive suite of asset tokenization solutions and services includes:

- Tokenization consulting to help businesses identify assets suitable for tokenization.

- Development of decentralized platforms for secure issuance of asset tokenization.

- Design and implementation of smart contracts to automate the execution of tokenization processes.

- Development of digital wallets and integration with blockchain networks for transparent asset tracking.

- Regular audits and assessments to ensure adherence to industry standards and best practices.

- Ongoing technical support and maintenance services to ensure the smooth operation of tokenization platforms.

Embrace the future of asset tokenization on blockchain with Appinventiv and embark on a journey toward greater efficiency, security, and innovation.

FAQs

Q. What is the cost of blockchain-based asset tokenization platform development?

A. The cost of developing a blockchain-based asset tokenization platform varies depending on various factors, such as the project’s complexity, features, development team expertise, and regulatory compliance requirements.

On average, the cost of building a blockchain-based asset tokenization platform ranges between $30,000 to $300,000 or more. For a more accurate estimate, discuss your project requirements with our experienced blockchain developers.

Q. How does asset tokenization work?

A. Asset tokenization converts real-world assets, such as gold, property, or money, into digital tokens on a blockchain. These tokens represent ownership or rights to the underlying asset, allowing individuals to buy, sell, or trade fractions of the asset. Through tokenization, investors can access previously illiquid markets, increase liquidity, and diversify their portfolios by investing in fractional ownership of high-value assets.

Q. How to tokenize an existing business?

A. Tokenizing an existing business involves a step-by-step process, which is as follows:-

- Understanding the existing business and revenue generation model.

- The next step is to look ahead towards tokenization. It includes determining what type of tokens to introduce and how to establish a token business model.

- The next step includes integrating the token into your existing business model and launching it publicly.

Q. What is the future of asset tokenization?

A. The future of asset tokenization is promising, with continued growth and adoption expected across various industries. As technology evolves and regulatory frameworks mature, asset tokenization will enable greater liquidity, accessibility, and efficiency in asset management and trading. This innovative approach has the potential to democratize access to investment opportunities, unlock previously illiquid markets, and streamline transactions on a global scale.

With advancements in blockchain technology and increased acceptance by businesses and investors, asset tokenization is poised to revolutionize the way assets are owned, traded, and managed in the coming years.

The Rise of Blockchain in Digital Marketing - Benefits, Use Cases and Challenges

Blockchain technology is revolutionizing digital marketing by transforming strategies through its decentralized and secure framework. It provides marketers with unparalleled transparency in campaign tracking and data management, guaranteeing increased security and privacy for users. As the digital landscape is advancing at a fast pace, blockchain in marketing offers the digital marketers with the means to…

Blockchain Interoperability: The Key to Connect Siloed Blockchain Networks

Blockchain has been a revolutionary response for industries facing the growing pressure of centralized operations’ limitations. By building an ecosystem which runs on zero trust, the technology introduced the world with processes that were incredibly neutral, change-proof, and 100% transparent when compared to their predecessors - traditional computing environment. Having reached a stage where blockchain…