- What is a payment gateway, and how does it work?

- How to create a payment gateway system?

- How creating a payment gateway can benefit your business

- Solutions to the biggest challenge of creating a payment gateway - Security

- Types of payment gateways

- Essential Compliance Requirements for Payment Gateway Systems

- GDPR (General Data Protection Regulation)

- PCI DSS (Payment Card Industry Data Security Standard)

- AML (Anti-Money Laundering) Regulations

- SOX (Sarbanes-Oxley Act)

- PSD2 (Payment Services Directive 2)

- KYC (Know Your Customer) Requirements

- The features you would want in your payment gateway, and how much will it cost?

- How can Appinventiv help in your endeavor to create a payment gateway?

- FAQs

A report published by Deloitte in March 2022 estimated that the total worldwide transaction value of digital payments is expected to reach $11.3 trillion by the year 2026, growing at a CAGR of 13%. By creating a payment gateway, entrepreneurs can grab the opportunity of being part of this monumental shift. The online payment system, which consists of several key stakeholders, such as the merchant and the consumer, is proving to be the backbone of the globalized world.

By becoming a part of the online payment ecosystem, startups and enterprises can benefit from this increasing digitization of payments. A crucially important cog in this near-flawless digital payments system, payment gateways are digital point of sale (POS) terminals that serve several vital functions facilitating the digital payment ecosystem. Before diving deep to know how to create a payment gateway system, let us first understand how payment gateways work.

What is a payment gateway, and how does it work?

When we walk into a brick-and-mortar store, completing a (non-cash) transaction involves swiping a card on the POS terminal, which captures our card information while sharing it with the relevant parties for authorization and completing the transaction.

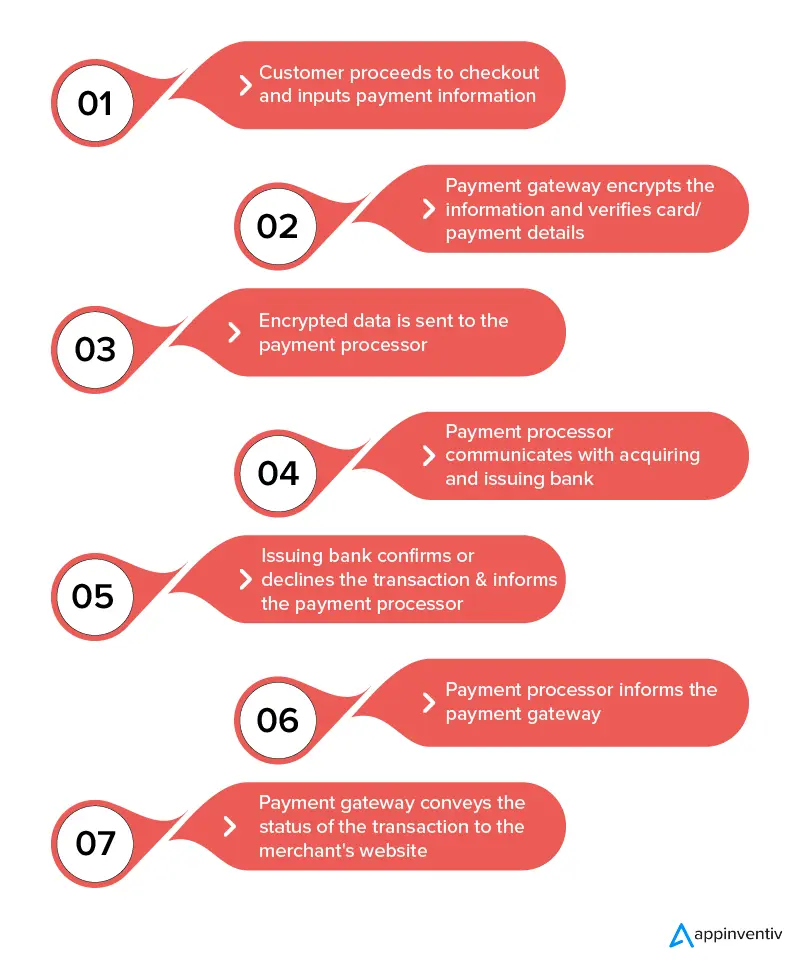

When we replicate this on a digital storefront, the payment gateway acts as the POS terminal capturing the consumer’s card information. However, other vital functions are happening simultaneously. Let us examine in a step-by-step process how digital transactions take place.

Step 1: After the consumer adds the product (or service) to their cart and proceeds to checkout, they are then taken to the payment gateway either on the merchant’s server or on third-party servers (the difference is explained below in the article). The consumer selects the preferred mode of payment (taking a credit card as an example). After entering the card details, the consumer clicks on something like ‘make payment.’

Step 2: Once the consumer submits their card details, the payment gateway first tags the transaction as card-not-present (CNP) and encrypts and secures the information to be transmitted to multiple parties. Simultaneously the payment gateway also verifies the card details and authenticates the card.

Step 3: The encrypted data is sent to the payment processor. The payment processor is a tech that communicates with the banks to settle the payment.

Step 4: The payment processor communicates with the acquiring bank (merchant’s bank) and the issuing bank (customer’s bank), which evaluate the transaction.

Step 5: The issuing bank and the appropriate card network (Visa or Mastercard, in most cases) approve or decline the transaction. This approval or denial is communicated to the payment processor, which sends the status to the payment gateway.

Step 6: The payment gateway communicates the transaction’s status to the merchant’s website, which is then displayed on the screen to the consumer. And this is where the transaction is completed.

And all of this happens within three seconds!

How to create a payment gateway system?

A snapshot of a payment gateway development process, let us examine in a step-by-step guide how to approach the development of a custom payment gateway.

- Research and ideate: Before embarking on getting your payment gateway developed, you should first ascertain the business objective you want to accomplish with your payment gateway. You should also define your target audience and conduct thorough due diligence before creating the gateway. Once this is completed, you can move on to building the product.

- Develop the infrastructure: This includes building the systems and networks required to process, authorize, and settle payments securely. These are the main nuts and bolts of your payment gateway and should be developed by a reputed payment gateway software development company like Appinventiv.

- Implement fraud detection measures: As already mentioned, fraud detection is something that the users of your payment gateway will expect. So implementing this mechanism is as crucial as creating the gateway itself. Implement measures to detect and prevent fraudulent transactions.

- Obtain licenses and certifications: Creating a payment gateway involves a lot of compliance, as discussed above. So before you launch your product into the market, you’ll have to obtain all the necessary compliance certificates, which you can get with the help of a payment gateway development services company.

- Integrate with the payment processing network: Your gateway will need to communicate with the payment processing network to authorize and settle transactions.

- Test and launch your payment gateway: Carefully test your gateway to ensure it functions properly and securely before launching it to the public.

When you create your payment gateway, it can be built on various programming languages, such as PHP, Java, Ruby on Rails, Python, and .NET, depending on the gateway’s requirements and the payment gateway developer’s expertise. As a general rule, however, if building a website or web application, PHP or Ruby on Rails might be a good choice. Java or Swift might be a better-suited alternative for a mobile application.

![]()

How creating a payment gateway can benefit your business

Digital transactions are synonymous with the globalized world. By creating a payment gateway, enterprises and startups can take advantage of the payment gateway development benefits, some of which are listed below.

- One-time development cost: While using third-party payment gateways, such as PayPal and Stripe, you pay a fee on each transaction which can accrue to a large amount over thousands of transactions. Whereas, when you create a payment gateway system, you invest once and never have to pay a single penny for payment gateway service.

- Save up to 3% on every transaction: As mentioned above, with your custom payment gateway, you don’t have to pay the gateway fee you usually would. This means you will be saving up to 3% on every transaction.

- Easy refund & query management: One thing businesses need help with while using third-party payment gateways is refund processing because the claim-settlement time gets delayed when refunds are involved. But with your payment gateway, you can keep track of refunds and get real-time updates about the same.

- Your foray into the payment collection business: With your custom payment gateway development, you not only save money on the fee but can also generate passive income by allowing other merchants to use your payment gateway. You can charge merchants as much as 2-3% on every transaction by letting them use your payment gateway.

However, the digital payment industry is mire with particular deep-rooted challenges proving to be a bottleneck in the mass adoption of such systems.

Solutions to the biggest challenge of creating a payment gateway – Security

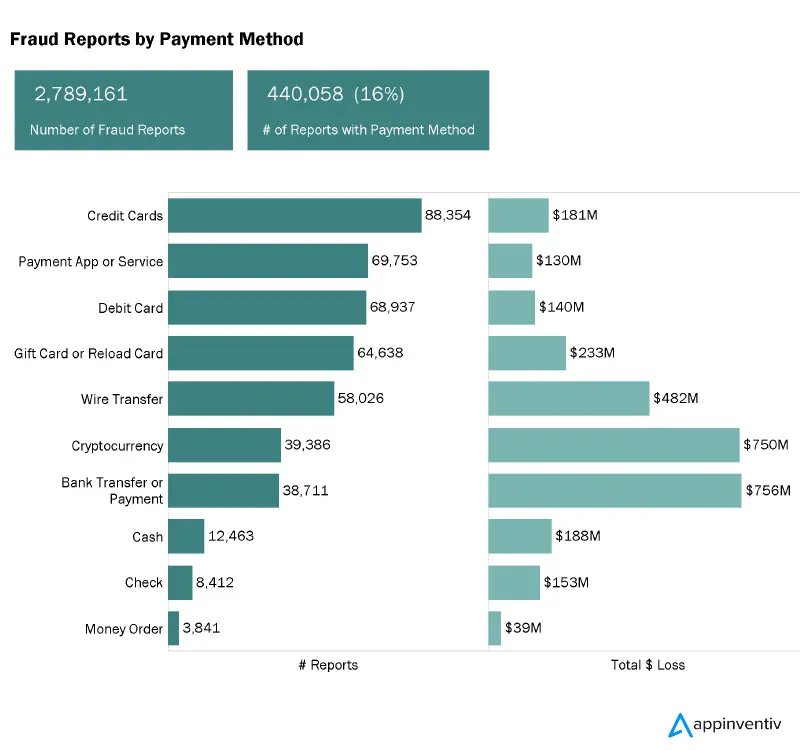

The United State Government’s Federal Trade Commission, in its report published in February 2022, noted that most of the frauds reported in the United States during 2021 involved digital transactions. The graph above shows that cash, check, and money orders accounted for a minuscule percentage of fraud reported in 2021.

The prevalence of such frauds and malpractices highlights that the digital payment landscape is tricky and needs comprehensive security measures to protect consumer and merchant data.

That is why governments worldwide have mandated payment gateways with robust security measures. One of these measures is the ‘Payment Card Industry Data Security Standard,’ known as ‘PCI DSS.’ To meet the necessary security standards, every payment gateway provider must comply with PCI data security requirements.

PCI Security Standards Council is the nodal agency that checks this compliance and, as an effect, keeps our digital transactions secure throughout platforms, devices, and interfaces.

Another security measure protecting our data is ‘3-D Secure’. Referring to Three-domain secure protocol, 3DS adds an extra layer of security with two-factor authentication for every transaction. Services like Visa and Mastercard already use 3DS in most transactions, and the one-time passwords (OTP) we receive on our mobile numbers every time we make an online purchase is a live example of 3DS in play. (Also read other ways to secure user’s data with Multifactor Authentication System)

In its July 2022 circular, the Reserve Bank of India restricted payment providers throughout the country from keeping customers’ card data, commonly known as Card-on-File data. The circular meant that all card details would be tokenized, and the actual card details stored with the entities (except card issuers and card networks) would be purged. By doing this, India became the latest example of tokenization happening in the digital payment landscape.

Tokenization refers to replacing card details with tokens to secure the customer from fraudulent activities or data breaches. The western world, namely the US and European markets, have already adopted tokenization on a large scale, especially on the blockchain.

Types of payment gateways

Based on the positioning of the payment gateways, these can be classified into three categories which are explained below.

- Hosted gateways: Hosted payment gateways are when a customer is redirected to the payment processing website away from the merchant’s website. This hosted gateway is where the transaction will take place. Hosted gateways are appropriate for merchants who do not have the resources to meet the necessary security standards to host the payment gateway on their server. But this also results in the merchant having little control over the consumer’s payment experience. Additionally, it redirects the consumer from the merchant website adding in the time it takes to complete the transaction. But these sacrifices are necessary to secure the transaction and the consumer data.

- Self-hosted payment gateways: Self-hosted payment gateways are placed on the merchant servers but send the information to a third-party payment gateway URL for processing and authentication. This gives the merchant more control over the payment experience of the customer.

- API-hosted payment gateways: API-hosted payment gateways are the most sought-after by merchants of all sizes because it gives the merchant complete control of the buying and payment experience. But this requires merchants to be PCI DSS compliant as their servers will store every customer’s payment information.

Essential Compliance Requirements for Payment Gateway Systems

When developing a payment gateway system, it’s essential to follow these compliance requirements:

GDPR (General Data Protection Regulation)

GDPR compliance regulates the handling of personal data for individuals in the EU, mandating transparency and strict data protection practices.

PCI DSS (Payment Card Industry Data Security Standard)

PCI DSS ensures secure management of credit card information through encryption, secure storage, and regular security assessments.

AML (Anti-Money Laundering) Regulations

AML requires monitoring and reporting suspicious activities to prevent money laundering and terrorist financing.

SOX (Sarbanes-Oxley Act)

For U.S. organizations, ensures financial accuracy and transparency in reporting, impacting payment gateway transactions and auditing.

PSD2 (Payment Services Directive 2)

Governs payment services across the EU, focusing on secure customer authentication and enhanced consumer protection.

KYC (Know Your Customer) Requirements

KYC mandates verifying customer identities to prevent fraud and ensure transaction legitimacy.

The features you would want in your payment gateway, and how much will it cost?

A payment gateway must be quick, efficient, and secure enough to carry out hundreds of thousands of transactions. Building a payment gateway, or an MVP of it will cost you in the range of $150,000-$250,000. But that range is to get a primary gateway developed. Payment gateway development costs will increase to create the one that is preferred and used by the masses.

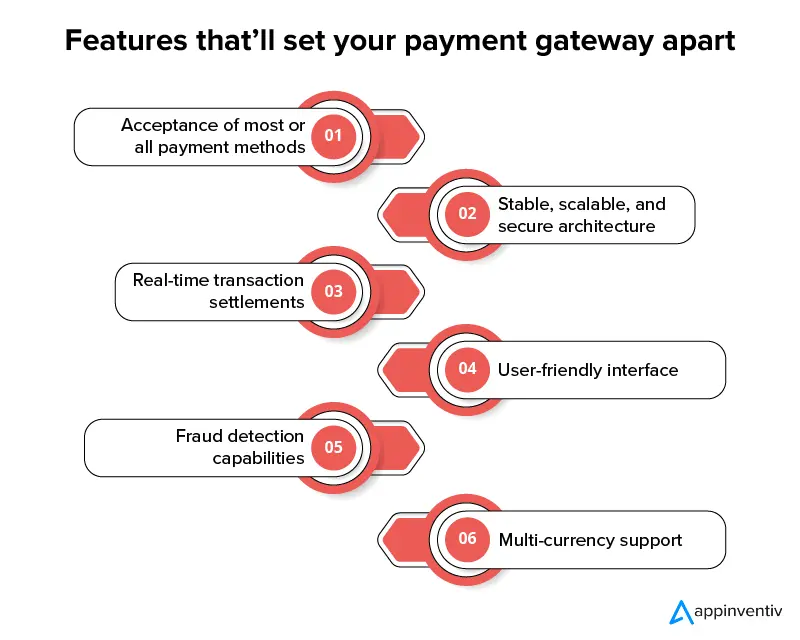

There are numerous payment gateway features you would want to discuss with a payment gateway development services company, which are listed below.

- Payment methods: Gone are the days when credit and debit cards were the only modes of digital payment available. With the rise of mobile wallets and other digital payment methods, customers expect merchants to provide most, if not all, of these payment methods. Therefore, while developing a payment gateway or a mobile wallet app, ensure it can accept most digital payment methods.

- Stability: Payment gateways need to operate 24 hours of 365 days, and thus any amount of downtime is looked down upon. While developing your payment gateway, make sure that the application is stable and can be scaled quickly to handle the surge in usage. A paper published by the Asian Bureau of Finance and Economic Research in May 2022 found that “payment via PayPal decreases by approximately 10% during PayPal outages,” which translates to a monumental loss of revenue.

- Real-time transactions: Increasingly, merchants and entrepreneurs are looking for options that offer real-time claims settlement. When you create a payment gateway system, try to find the best approach to providing real-time payments without compromising security.

- User-friendly UI/UX: While developing your payment gateway, ensure that the navigation is user-friendly and accessible by all of the anticipated consumers.

- Fraud detection mechanism: A crucially important feature, fraud detection systems employ a combination of rule-based systems, machine learning algorithms, and behavioral analytics to identify patterns and anomalies that are indicative of fraud. Overall, fraud detection systems in payment gateways are designed to protect merchants and consumers from financial loss and safeguard the integrity of the payment ecosystem.

- Scalable solution: Online shopping is not linear, and merchants often witness spikes in transactions on certain occasions, such as Black Friday. Therefore, when you create a payment gateway, you should keep these spikes in mind and should be able to scale up as and when required.

- Support for multiple currencies: Digital transactions are not constrained by geographies; hence, consumers in multiple countries might use your payment gateway. That is why you should look at multi-currency payment gateway development to make the gateway as inclusive as possible.

How can Appinventiv help in your endeavor to create a payment gateway?

A complicated piece of technology, such as a payment gateway, requires technical expertise and business intelligence to deliver the best product. At Appinventiv, as a leading FinTech software development company with nearly a decade of experience, we have helped thousands of our clients unlock their digital potential.

From building a P2P Payment App to integrating a payment gateway, our team has the technical know-how and the mastery of the concepts that can enable you to take your business to the next level. If you are interested in creating a payment gateway, our team will be happy to assist you with any queries. Get in touch today.

FAQs

Q. How to create a payment gateway system?

A. When building a payment gateway, the first step is to zero in on business objectives. Then after creating a rough plan and selecting a development agency, discuss the features and add-ons you want. You’ll also have to take care of compliance and security, and after careful testing and debugging, you can start accepting payments from your customers.

Q. How much does it cost to build a payment gateway?

A. The average cost of getting a payment gateway MVP is in the range of $150,000-$250,000. However, with advanced features, and capabilities, the cost will go up.

Q. How long does it take to build a payment gateway?

A. On average, it can take anywhere from several weeks to several months to build a payment gateway, depending on multiple factors. Still, some more complex systems can take longer to develop.

CRM in Banking Industry– Benefits, Challenges, Features and Integrations

A misconception is prevalent about CRM (Customer relationship management) that only certain kinds of businesses need one. But in reality, a CRM system is a must if you have customers who rely on your products or services. Unarguably, CRM is an integral aspect of every industry, and the banking sector is no exception. CRM in…

How Much Does It Cost to Build a Bill Payments App Like My Optus?

In today’s fast-paced digital landscape, convenience is king. From ordering food and buying groceries to booking medical appointments and managing finances, the demand for user-friendly applications is skyrocketing. Among this wide array of applications, digital payment apps emerge as a transformative force, offering unparalleled convenience to access financial services and manage transactions on the go.…