- Types of yield farming DeFi

- Interest on the lending deposits

- Transaction fees for offering liquidity

- Token incentives from protocol operators

- Token incentives from pool operators

- The working of a yield farming app

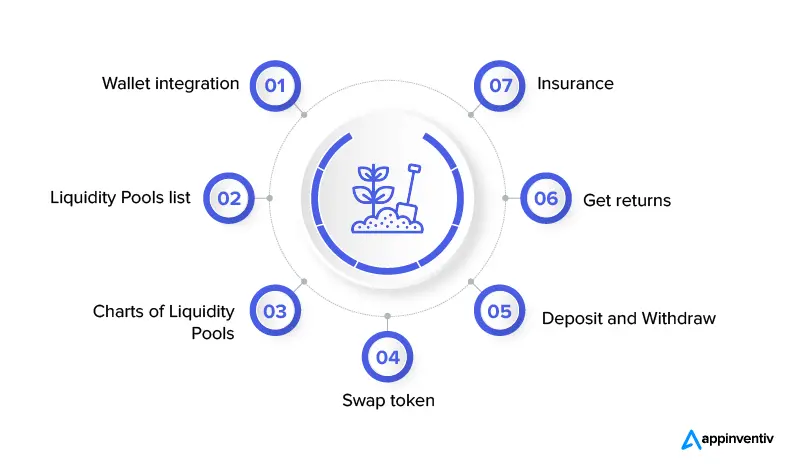

- The list of DeFi yield farming app features

- 1. Wallet integration

- 2. Liquidity Pools list

- 3. Charts of Liquidity Pools

- 4. Swap token

- 5. Deposit and Withdraw

- 6. Get returns

- 7. Insurance

- Smart Contracts

- Mechanism to allocate lenders tokens

- Security

- How does Appinventiv manage yield farming DeFi development?

- Product discovery

- Blockchain integrated solution designing

- How much does it cost to develop a DeFi yield farming app?

Over time, blockchain, especially the crypto space, has been creating a bridge between traditional financial models with its own decentralized versions. Right from using cryptocurrencies to making payments to having DeFi and decentralized exchange platforms to enable trading, the crypto domain is closing the gap with the traditional financial ecosystem at a lightning speed.

The latest offering in the vision to come at par with centralized finance is DeFi yield farming – a process that allows lenders to give money to borrowers on a DeFi yield farming app in turn of interest.

The interest which DeFi yield farming applications have garnered over time can be seen by statistics like DeFi Pulse estimating 95% of the USD 41.5 billion total value locked (TVL) in the DeFi space being linked to yield farming. This meteoric rise in interest has pushed a number of entrepreneurs towards DeFi yield farming development.

While theoretically the concept is fairly straightforward, there are a number of complexities and deciding factors that work behind it. The primary one of which is choosing how your platform would support yield farming.

[It might also interest you to read – How DeFi lending works]

Types of yield farming DeFi

There are a number of different ways lenders can get returns on the tokens they put in the liquidity pool. Deciding the one which the platform will be based on is a critical part of starting the journey to create a DeFi yield farming app.

Interest on the lending deposits

Earning an interest on deposits is the most direct way to earn DeFi yields. In this case, the lenders deposit cryptocurrencies in pools governed by the smart contracts and in return, get an interest-earning token. The interest is typically generated by the borrowers who take loans from the liquidity pool.

Transaction fees for offering liquidity

Another way to farm DeFi yield is by supplying cryptocurrencies as liquidity to ton pools on the decentralized exchanges (DEXs). The exchange usually charges the users somewhere around 0.3 per cent for swapping their tokens and the fee is then distributed in the pool’s liquidity providers.

Token incentives from protocol operators

The concept popularized by Compound Finance and Uniswap works in a way that a token allocation is made to the past and current users of the protocol. It acts as a reward for the users to participate in the protocol and being its loyal user.

Token incentives from pool operators

Imagine an event where a new blockchain launches its token. Now because it’s new, the liquidity in the pool is very low. For such blockchain project owners, it has become a common practice to engage in “liquidity bootstrapping”. In this model, they attract the liquidity providers with the assurance of additional token incentives.

Once you have fixed the types you will build a DeFi yield farming app on, the next part lies in understanding how your investors/lenders will move inside the application.

But before that, if you are new to the world of decentralized finance and are still contemplating its benefits, here’s a go-to DeFi business guide for you, explaining to you all about the concept.

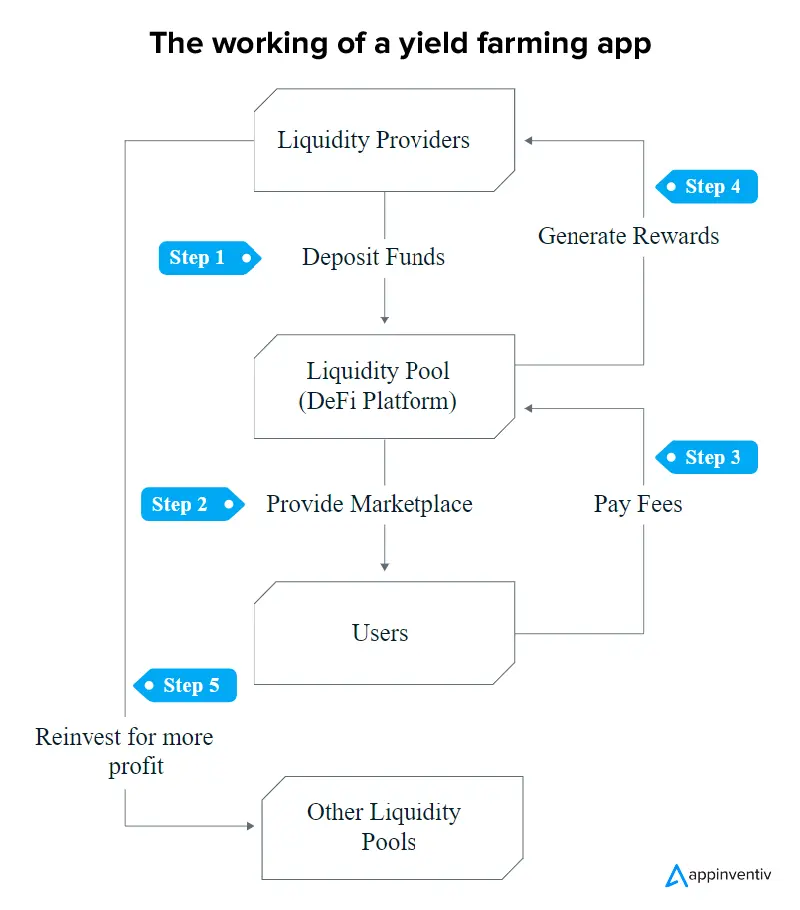

The working of a yield farming app

Everyone who knows what a DeFi yield app is, knows how it works on a high level. However, a crucial part of DeFi yield farming development is getting a good grasp of the users’ movement and then creating features that would support the journey.

- Stage 1. At the beginning of the DeFi yield farming journey, multiple smart contracts are made that act as liquidity pools or the smart contracts are written to interact with the existing LPs. The providers put their money in these pools in the form of stablecoins and other standard cryptocurrencies.

- Stage 2. Here, the users are given a marketplace in which they can invest, trade, or borrow yield farming tokens.

- Stage 3. At this stage the users or borrowers pay fees to the yield farming DeFi platform in turn of the tokens they borrow.

- Stage 4. The DeFi yield farming application then gives rewards or returns to the liquidity providers, investors, or users based on the stake they have put in the liquidity pools.

- Stage 5. Once the lenders get interest on their invested amount, they are given the option to reinvest them in other liquidity pools with higher APRs – Annual Percentage Rate.

Now that we have looked into the working mechanism of DeFi yield farming applications, let us get down to the features that make them work and answer what are the benefits of DeFi yield farming?

The list of DeFi yield farming app features

Intuitive features lie at the core when you build a DeFi yield farming app. Creating a mechanism where the platform is able to allocate liquidity providers’ tokens across different liquidity pools is complex. Let us look into some of the must-have DeFi yield farming app features.

1. Wallet integration

The key part of DeFi yield farming development is integration with existing wallets. Right from getting the token to the platform to getting the returns from the liquidity pools, the cryptocurrency gets saved in a wallet.

Here’s an ultimate guide to blockchain wallets for all your queries regarding crypto wallets.

2. Liquidity Pools list

The next must-have part of a yield farming DeFi interface is a list of Liquidity Pools in which the lenders put in their tokens. This part of the interface carries current value details around –

- TVL (Total Value Locked) – It highlights the total amount of crypto locked in a pool

- APY (Annual Percentage Yield) – The annual rate of return imposed on the borrowers and then paid to the providers.

- APR (Annual Percentage Rate) – The annual rate of return imposed on the capital borrowers and then paid to the capital providers.

3. Charts of Liquidity Pools

This part of the platform should enable the liquidity providers and borrowers a time-range based growth of the pools, attached risks, and estimated returns. This will help the users make a better decision in terms of where to put their tokens.

4. Swap token

With the number of cryptocurrencies across the globe being close to 10,000 now, it is impossible to have all the tokens in your DeFi yield farming application. The solution to this lies in creating a swapping mechanism where the lenders can swap their token with the one that works on the platform.

5. Deposit and Withdraw

Next part of the application feature lies in having a secure deposit and withdrawal functionality. Using the functionality, the lenders will be able to put their money in the platform and withdraw the returns when it reaches their expected rate.

6. Get returns

The reason why users work with a yield farming DeFi is because of the returns they are able to generate as passive income. It is critical to have a well-planned architecture for withdrawal, one that comes with the option of either getting the amount after the platform’s fees is paid or re-invest the amount back into the liquidity pools.

7. Insurance

In many ways, insurance is not exactly a must-have part of DeFi yield farming platforms. However, noting the rising cases of security breaches and hacks, it can be beneficial to give your users insurance cover, one that can be charged every week on the deposited number of tokens.

[Also Read: What is DeFi Insurance? Identifying Business Opportunities and Use Cases]

Now that we have answered the features part of the answer to How do you build a DeFi yield farming dApp, let us briefly touch upon other crucial elements that would define the success of your yield farming DeFi platform .

Smart Contracts

Smart contracts are the foundation of DeFi yield farming platforms. The mechanism of liquidity pools in terms of deposits, returns, and withdrawals are coded in the smart contract, which then handles the working of the platform. In a high returning yield farming protocol, the strategies are coded to move funds from one LP to other on the basis of different parameters to generate maximum yield from the DeFi ecosystem.

Mechanism to allocate lenders tokens

DeFi yield farming development deals with taking lenders tokens and allocating them across different liquidity pools in a way to get them maximum returns. Creating this mechanism from scratch can be complex and time-taking – a reason why dApps development service providers tend to integrate the product with existing DeFi yield farming protocols and platforms.

Security

The process to create a DeFi yield farming app and maintain it is complex. There are a number of risks associated with the architecture – loopholes in smart contracts, unsecure mechanisms for withdrawing funds from liquidity pools, high fees, etc. It is critical to have a secure architecture which is hack-proof and immutable.

A blend of all these features and the architecture together goes on to develop DeFi yield farming app. Next to these, there’s one other factor that decides the success of the platform – the approach DeFi yield farming development companies follow.

Here’s how we, at Appinventiv, approach the process.

How does Appinventiv manage yield farming DeFi development?

At Appinventiv, we have built two DeFi yield farming platforms – one where we integrated it with an existing protocol and the other one built from scratch. In both the projects, we followed a similar methodology that started from conceptualization to delivery. Here is what the different aspects were –

Product discovery

- We provide value-add by giving product-building ideas by analyzing risks and providing solutions to mitigate them.

- Create the milestone of the deliverables.

Blockchain integrated solution designing

Smart contracts

The decentralized interactions are identified and coded into smart contracts for storing assets, funds and their retrieval. Smart contracts architecture is defined by choice of design pattern to follow and modularity. Based on the architecture designed, smart contracts are coded. Smart contracts are written for :

- Smart contracts for the creation of liquidity pools or interacting with existing LPs.

- Smart contracts to configure the platform, timing of the events like harvest rewards and open pools.

- Smart contracts for strategies to move funds to increase yield.

- Smart contracts for asset management.

- Smart contracts to interact with other yield farming protocols like Yearn.

Middleware architecture

Building a DeFi platform which has multiple features apart from core yield farming associated with user like social features or DAO or crypto news embedded etc. we design a secure, robust and scalable middleware to wrap smart contracts and create a restful API model for frontend and admin to interact with.

System architecture for component interaction

We ensure to model the interaction of various layers i.e. smart contracts, middleware, frontend, and admin (if needed). Additionally, the inter and intra component interactions are designed to formulate the system design.

Technical documentation

- The technical aspect of the system design.

- Building of documents with the program blocks communication.

- Creation of logic for payments and rewards.

User Interface and Admin Interface development

For user interface:

- Creation of transaction on the users side

- Connection of the web wallets

- Transact message to the chains

- Get data from the chain and contract information

For admin:

Based on the requirements and use cases, there might be attributes that need to be added to admin interface like –

- Analytics of transactions and volume

- Managing platform/protocol fee

- User management, and more

Component integration

We follow component integration as an iterative cycle where the components are integrated to create a complete workflow and unit/module testing.

UAT and QA on testnets and custom environments

Production level deployment

Delivery

With all the changes addressed, we deliver the platform along with a demo of the admin and user flow. Share your project requirements with our team of experts now.

How much does it cost to develop a DeFi yield farming app?

The cost of creating a DeFi yield farming platform is impossible to answer without looking at the scope of the work. However, on the basis of the features we covered in the article added to the average hourly development range of $60-80, the process completion can reach anywhere between $150,000 to $250,000.

The factors that will play a role in deciding this range is number of smart contracts, intuitiveness of the platform in terms of asset allocation, features of the user profile and interactions, analytics, and whether you are looking to integrate the app with an existing protocol or build DeFi yield farming app from scratch with its own tokenomics and architecture – something that would increase the development cost.

As you must have gathered, the benefits of DeFi Yield Farming are equally high for the users and the platform entrepreneurs. While the users get a passive income stream, the platform owners get high revenue with respect to the transaction fees. We hope that the information you gathered here would help you come on the path of successful yield farming DeFi development.

Choosing Polygon over Ethereum to Build Efficient dApps

Polygon aims to give people numerous choices when they create dApp on Polygon. Some developers keep security over speed while others compromise on security for lowered fees and speed - the technology is building multiple Ethereum-centric scaling solutions to address all these different features. Ethereum has remained a pillar in the cryptocurrency space. Right from…

How to build a DeFi staking platform?

Every investment related research you do irrespective of whether it is in stocks, mutual funds, or even gold, you will likely come across one common advice - profit lies in holding the investment. Now with 1 out 10 investors putting their money in cryptocurrency, the old adage around holding assets for long-term is getting extended…