- Fintech Business Models That Investors are Betting on for Their Fintech revenue model

- 1. Insurtech

- 2. Digital Share Broker

- 3. Cross-border Payments

- 4. RegTech

- 5. Digital Operating Platform

- 6. Online Payment Processing

- 7. Savings and Budgeting Apps

- 8. Peer-to-peer lending Solutions

- 9. Fraud Analysis Software

- Reasons That Make Fintech a Good Investment Avenue

- 1. Fiat currency is becoming digital

- 2. Data has become the new oil

- 3. Your mobile is your wallet

- 4. The social impact

- 5. Fintech industry acquirers tend to have deep pockets

- Fintech Investments Trends 2022

- 1. Bigger and bolder deals

- 2. Deals happening in diverse locations

- 3. Inclusion of Big Tech Giants

- 4. Big Fintechs Will Invest in New/Early-stage Startups

- 5. Continued Partnerships

- 6. Financial Services’ Re-bundling

- 7. Greater Focus on Cybersecurity Products

- What does 2022 hold for Fintech?

- 1. Embedded finance will continues to grow

- 2. Web3 will become more mainstream

- 3. It is the year of blockchain

- 4. Cross-border e-commerce is accelerating

- 5. The fusion of artificial intelligence and machine learning starts.

- How can Appinventiv Help you with Successful Fintech App Development?

- Final Note

- FAQs

In all the different lists of the most lucrative and profitable investment sectors, the one name that would be common is Fintech.

Going by the simple formula that monetary transactions are something that customers would need irrespective of the economic condition, the sector has made itself recession-proof and, in turn, investment friendly. It continues to become an inevitable part of the economy with the involvement of next-gen technologies in its offering set and the customer experience it offers, acting as the benefits in Fintech through digital technologies.

In this article, we are going to look into the important Fintech sectors for investment.

Fintech Business Models That Investors are Betting on for Their Fintech revenue model

1. Insurtech

According to a PWC report, insurance companies are aware of the Fintech era. There are enough reasons to believe that the insurance sector is heading towards digitalization through mobile apps.

Venture capitalists who feel that the insurance industry is ripe for disruption and to be a part of the future of fintech have started exploring investment opportunities in avenues like social insurance, ultra customizable policies, and dynamic pricing based on the new streams of data coming in from the internet-based devices. Going by the trend which is placing Insurtech in the forefront of the positive impact of Fintech on startups, it is one of the best Fintech sectors for investors.

2. Digital Share Broker

An increased volatility in the share prices have brought a number of new investors in the market. This newfound interest that the share market is getting is a sign of a new culture which needs a platform to understand the basics and perform stock trading in a less risky manner.

This is the reason why brands like Freetrade and Robinhood stock trading app are constantly getting attention from the investors, while similar brands like Numbrs are getting funded and becoming unicorns.

3. Cross-border Payments

Although there has been a slight decline in the amount of foreign exchange payments because of cross-border trade limitations that have come into existence because of the COVID-19 rise, it would return.

Meaning, future-centric investors will start backing promising foreign exchange payment companies today. This rise will also bring a demand for greater adoption of cryptocurrencies specific solutions that further eliminates the issues attached with cross-border payments.

4. RegTech

The one factor that has been keeping the Fintech domain from achieving mass adoption is the presence of a number of regulations and compliances. By the time you understand how to develop a PCI compliant app, you will be asked to follow multiple other policies.

To solve this issue, the sector is constantly finding new ways for improving regulatory compliances. Here are some of the offerings:

- KYC & AML solutions

- Data management solutions

- Tax management solutions

- Trade monitoring solutions

- Portfolio risk management solutions

- Regulatory change management solutions, etc.

5. Digital Operating Platform

There is a continuous need for operating platforms which would help bring down the cost and better the efficiency of wealth management, banking, and insurance. In an ode to faster digital transformation, these sectors are looking for ready-made solutions which they can incorporate in their existing systems. Investors too will like to back such solution providers who have a deep inclination towards cloud based operating ecosystems.

[Also Read: How much does it cost to build a Neobank]

6. Online Payment Processing

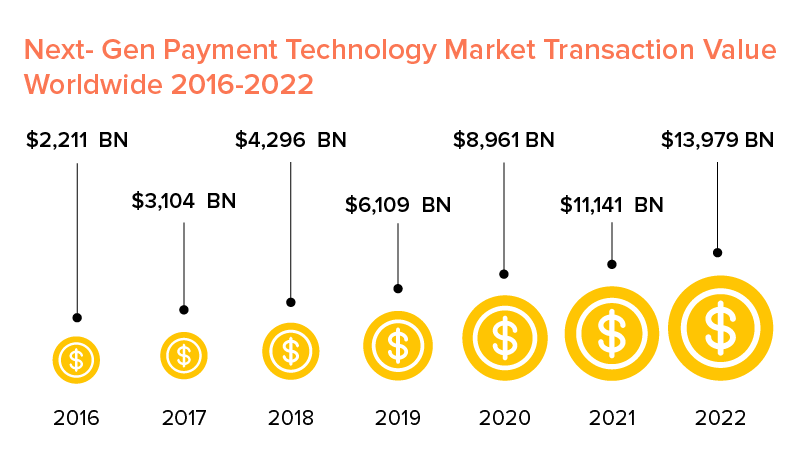

When we talk about online payment processing solutions, we talk about companies that give the infrastructure needed for processing payments and transferring money from one consumer to another.

The domain is so lucrative that four out of eight renowned Fintech companies fall in this category – Ant Official, Stripe, Klarna, and Adyen.

7. Savings and Budgeting Apps

The current crisis has redefined how we calculated savings, investments, and buying amounts. It has become extremely important to stack emergency funds while allocating funds in other important spending areas.

Customers, for acing this changed formula of budget management have started using applications like Cleo. And the industry has started seeing it as one of the best Fintech sectors for Fintech investors.

8. Peer-to-peer lending Solutions

One of those sectors directly hits the big financial institutions by targeting their most profitable domain – loans. Peer-to-peer lending, as they are commonly called, is an alternate form of finance that connects individuals or entrepreneurs with potential investors.

The chances of getting approved is much higher than banks while the interest rate is also much less. The solutions are aimed at fueling innovation and growth by giving the small businesses the funding they need to get projects off the ground.

Some of the popular names in this sector include – LendingClub, Lufax, ComonBond, Jimubox, Prosper, Funding Circle, etc.

9. Fraud Analysis Software

Fintech businesses focus on anti-fraud and security with the help of Machine Learning and Artificial Intelligence for finding patterns in financial transactions, which indicates high fraud risk is what the investors are also paying attention to.

Investors have started putting their money behind Fintech companies that offer fraud and security analysis as their service suite.

Two companies that are offering the service impeccably are Featurespace and Brighterion.

Reasons That Make Fintech a Good Investment Avenue

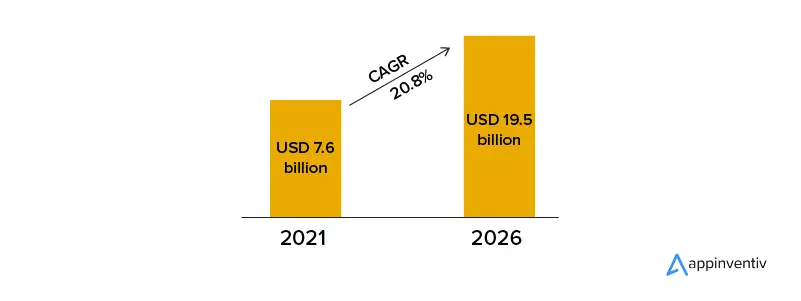

The fintech industry would continue its march to be valued at an estimated $332.5 billion by 2028.

Since FinTech industry is becoming popular every passing day, investors are now being more attracted to the sector. More and more companies are seeking interest into the decentralized finance space, offering different innovative solutions such as payments and settlements. Here are some of the reasons why FinTech is a good investment avenue.

1. Fiat currency is becoming digital

If you look back at how your spendings has changed in the last decade, you will notice the shift in how you conduct transactions and how the majority of your transactions have become cashless through the mode of digital payments in Fintech. Whether it is using PayPass for paying for coffee or using online banking for sending money to friends and family, cash has slowly started becoming a thing of the past.

While on one hand, Fintech companies rely on this shift to keep their platforms in demand, on the other hand, users and investors love the conveniences that this shift offers. And both the reasons are enough for digital payments to become one of the best Fintech sectors to invest in.

2. Data has become the new oil

Fintech brands tend to gather a huge amount of data related to consumers’ spending habits. When used strategically, this data can be applied for filling all the different loopholes present in the traditional financial services.

The one area where it can be most used is bettering the customer experience. It can be used to guide customers on the amount they should spend, save, and invest.

3. Your mobile is your wallet

The time when you had to carry a physical wallet for storing your money is long gone. You can now save your card and bank details on your phone and make payments for goods and services in almost every retail house and service-based agencies.

Fintech companies have been at the forefront of this drastic shift towards a wallet-less and cashless world. The mobile wallet applications brands use have all the right technologies needed to make payments efficient and give a great experience to the users – something that innovation is designed for.

4. The social impact

Fintech app development companies hold the power to serve millions of people around the globe – even in unbanked locations. They offer services that change the way businesses are conducted. By bringing transactions on a non-fiat mode, they have the ability to eliminate black money circulation. These fintech application development companies also help governments gather taxes and facilitate credit to individuals and businesses in developing nations. This is also the number one reason why investment in Fintech is on the rise by socially conscious brands.

5. Fintech industry acquirers tend to have deep pockets

A prime characteristic of the Fintech domain is that the Fintech companies’ competitors tend to have deep pockets. The competitors are mainly companies like Mastercard or Visa or banking institutions looking for acquisition opportunities to maintain their fintech investment market share or expand their reach.

The availability of readily-accessible capital in the Fintech domain from such competitors also makes it an industry that is favorable for M&A activity.

The pointers above are a definite sign of why it is the right time to invest in Fintech mobile app development and why to partner with a fintech software development company. But having this intention is not enough. It is also mandatory that you know the best fintech sector investment strategies. There are a number of models that have emerged in financial services consulting, but only a few limited ones have emerged as the most profitable Fintech sectors to invest in.

Now that we peeked into the Fintech landscape in 2022 and beyond and which factors are contributing to the maturing of the Fintech sector on investment grounds, let us, on a concluding note, look into the Fintech investment trends in the Fintech industry that will be active this year and for some time to come.

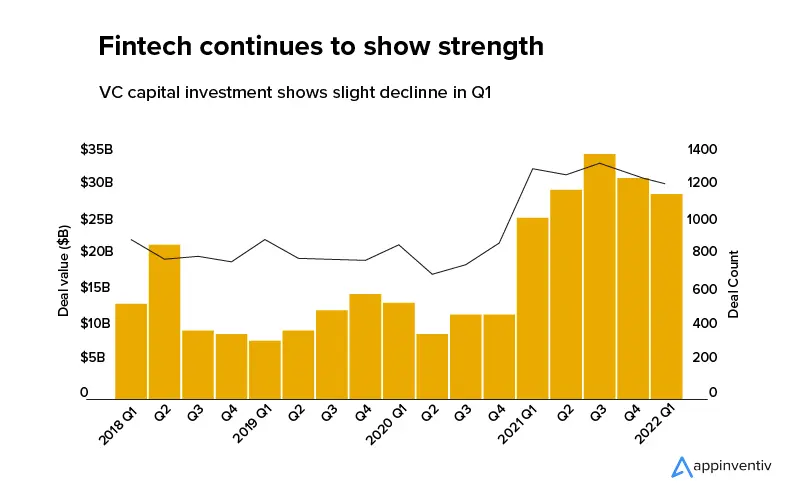

Fintech Investments Trends 2022

1. Bigger and bolder deals

With investors focusing on late-stage Fintechs, the deal sizes are bound to grow manifold. In the coming, high conviction deals focused on companies backed by proven business models will be on the rise. We are also bound to see investors attention shifting to companies with expertise in multiple sub-domains.

2. Deals happening in diverse locations

In the coming, we will see Fintech deals happening in locations that are different from the jurisdictions that fall outside of the traditional markets like the US or Australia and the UK. The locations where high investment activity is expected are Latin America, Southeast Asia, and Africa.

3. Inclusion of Big Tech Giants

Through the mode of Google Pay and Apple Card, tech giants like Google and Apple have already started establishing their foothold in the Fintech space. These tech giants, in addition to brands like Tencent, Ant, and Alibaba, will continue to target developing nations – by directly entering the segment or forming strategic alliances.

4. Big Fintechs Will Invest in New/Early-stage Startups

In order to extend their reach in the future of Finance, established Fintech software development companies will start investing in emerging Fintech brands and Fintech software development services. This would vary from augmenting their capabilities to getting access to skilled talents quickly.

5. Continued Partnerships

The formation of partnerships would continue to grow between new Fintech companies and big tech players and between traditional companies and Fintechs. These will likely be heavily customer focused and geared towards the creation of more value and greater scalability.

6. Financial Services’ Re-bundling

We could only imagine interacting with 1 to 2 financial products in the last decade. But today, the number has increased to 5-10. Managing these unrelated services has fallen upon the customers, and we are not taking it well. This has led to a demand for platforms that would address almost all our financial needs in one place.

7. Greater Focus on Cybersecurity Products

The attention on cybersecurity-focused Fintech companies would increase as the traditional financial institutes will shift their focus from building the services from the ground up to buying them.

What does 2022 hold for Fintech?

These top five fintech trends help make the lives of consumers and businesses easier and more accessible. The adoption of these trends at scale, in the long run, will redefine your relationship with finance.

1. Embedded finance will continues to grow

Embedded finance for enterprises is all about empowering businesses to provide customers credit without having to leave their platform.

Embedded finance focuses mainly on the large sectors, including payments, card payments, lending, investments, and banking. Investing will be more accessible, easy, and less costly when it comes to funds and stocks in embedded finance.

According to a Bloomberg report, 72%of buy now pay later app users said using the services caused their credit scores to drop. The rise in popularity of buy now pay later cause the BNPL industry to accumulate $680 billion in transactions by 2025.

2. Web3 will become more mainstream

The Web3 buzz will continue to build consumers and businesses to more ownership over their digital goods. It decentralizes the internet and rebuilds it on the blockchain. DeFi facilitates peer-to-peer transactions and does not completely rely on banks.

In the coming year, Web3 space will start delivering solutions to meet consumer protection, accessibility, and usability challenges.

3. It is the year of blockchain

Deloitte’s 2021 Global Blockchain Survey found that 76% of surveyed executives “believe digital assets will serve as a strong alternative to, or outright replacement for, fiat currencies in the next 5–10 years.”

With its high-security applications, Blockchain technology offers to both ends of the transaction, specifically in identifying management.

The advantages of blockchain and the rapidly increasing growth of the cryptocurrency will lead to a growing demand for blockchain-as-a-service (BaaS). Companies are now looking forward to finding innovative ways to digitize and streamline their business operations.

4. Cross-border e-commerce is accelerating

The pandemic continued to create drastic changes in 2021. You will be going to feel these changes in the year 2022. It will change the way how people shop. A recent Accenture study found the total cross-border payment flow worldwide is growing about 5% per year and is slated to top $156 trillion by 2022.

International transactions offer enormous growth to small and medium-sized businesses that used to only cater to their “hometowns.”

Demand for payment settlement is skyrocketing these days, providing businesses a great advantage in eliminating the risk of payment failure. With this trend, you can expect real-time payment capabilities in 2022.

5. The fusion of artificial intelligence and machine learning starts.

The advanced algorithms and breathtaking technologies urge businesses to expand their AI and machine learning use in 2022.

AI helps predict consumer behavior and enables the targeted products to enhance the customer journey and upsell customers automatically.

AI also saves business time and effort by handling customer FAQs through chatbots, which frees up your employees’ time to focus on higher-level tasks and customer service needs.

How can Appinventiv Help you with Successful Fintech App Development?

Appinventiv is one of the most acknowledged and popular fintech app development company that has 600+ technocrats who work passionately to turn mere products into front-page headlines.

We have done everything from investment solutions and dynamic KYC platforms to creating wealth management software and end-to-end banking solutions. You can also check out how Appinventiv scaled merchant onboarding for the nation’s leading Fintech enterprise, Bajaj Finserv.

We help them build easy and affordable finance options through low-interest rates and

flexible repayment options. And ultimately, the team delivers the best results by making 300+ merchants onboard and 3 lacs+ transactions per day.

This is not where our success tales end.

You must also quickly check how Appinventiv experts helped Asian Bank in their transaction processing system.

Our team of experts helped Asian Bank in building a core banking platform that offers functionalities such as wire transactions with cryptocurrency, buying and selling of cryptocurrencies, and wallet recharge. The diligent efforts of our experts led to over 50K crypto transactions for the bank.

Final Note

The Fintech sector has great potential, which is why investors are attracted to it. One of this sector’s greatest benefits is that it allows small players to compete in the same field as traditional banks and financial institutions. If you are looking for a reliable fintech app development company in USA, then you can contact us here, and our experts and fintech app developers will gladly help you with the solutions.

FAQs

Q. Which fintech domain receives the largest investments?

A. Payment is the biggest domain that receives the largest investments. The payment fintech domain is all about payment services, including payment back-end infrastructure, card issuing, merchant acquiring, mobile payment, seamless solutions, and point of sales solutions.

Q. Is now a good time to invest in fintech app development?

A. The best answer is that any time is good to invest in fintech app development. With this technology, your payments can be processed faster with lower online payments and limited access to financial services. Fintech app development has proven to be a lucrative and profitable investment sector.

Q. Which fintech sectors are attracting the most startup funding?

A. Fintech firms attracted about 26 percent of the total investments made during the quarter, followed by media and entertainment with 19% share, enterprise tech with 16 % share, retail tech with 9% share, edtech with 8 % share, and health tech with 5% share.

CRM in Banking Industry– Benefits, Challenges, Features and Integrations

A misconception is prevalent about CRM (Customer relationship management) that only certain kinds of businesses need one. But in reality, a CRM system is a must if you have customers who rely on your products or services. Unarguably, CRM is an integral aspect of every industry, and the banking sector is no exception. CRM in…

How Much Does It Cost to Build a Bill Payments App Like My Optus?

In today’s fast-paced digital landscape, convenience is king. From ordering food and buying groceries to booking medical appointments and managing finances, the demand for user-friendly applications is skyrocketing. Among this wide array of applications, digital payment apps emerge as a transformative force, offering unparalleled convenience to access financial services and manage transactions on the go.…