- What is Robotic Process Automation (RPA)?

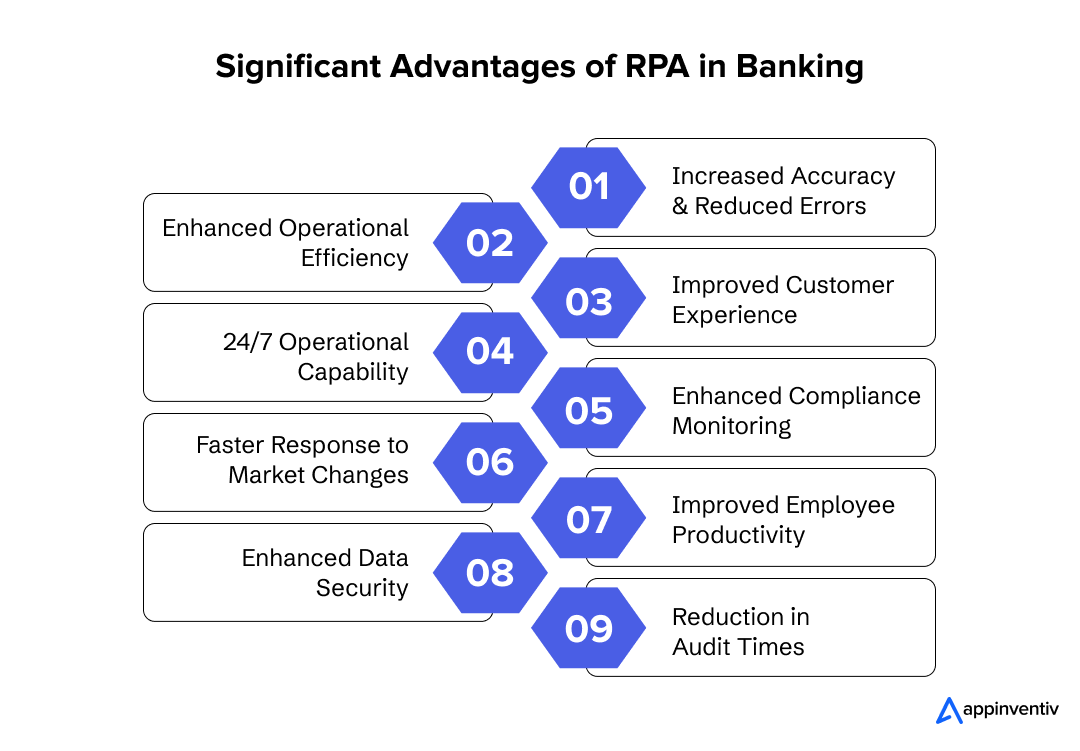

- Transformative Benefits of RPA in the Banking Sector

- Increased Accuracy and Reduced Errors

- Enhanced Operational Efficiency

- Improved Customer Experience

- 24/7 Operational Capability

- Enhanced Compliance Monitoring

- Faster Response to Market Changes

- Improved Employee Productivity

- Enhanced Data Security

- Reduction in Audit Times

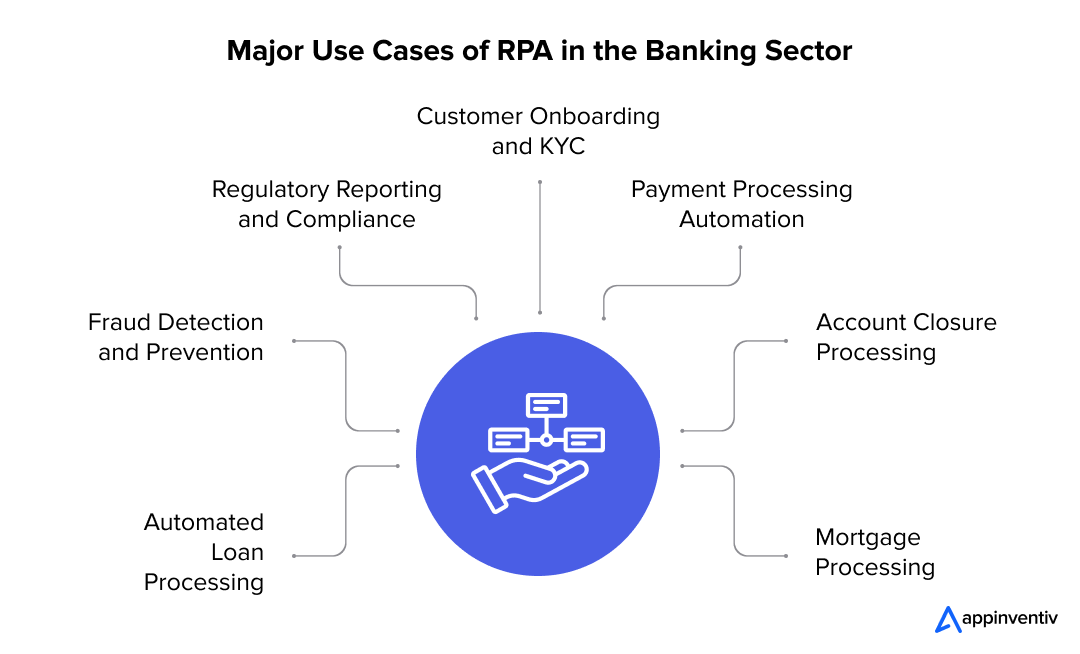

- Prominent RPA Use Cases in the Banking Sector

- Automated Loan Processing

- Fraud Detection and Prevention

- Regulatory Reporting and Compliance

- Customer Onboarding and KYC

- Payment Processing Automation

- Account Closure Processing

- Mortgage Processing

- Real-World RPA Case Studies Highlighting Its Game-Changing Potential

- Challenges of Implementing RPA in Banks

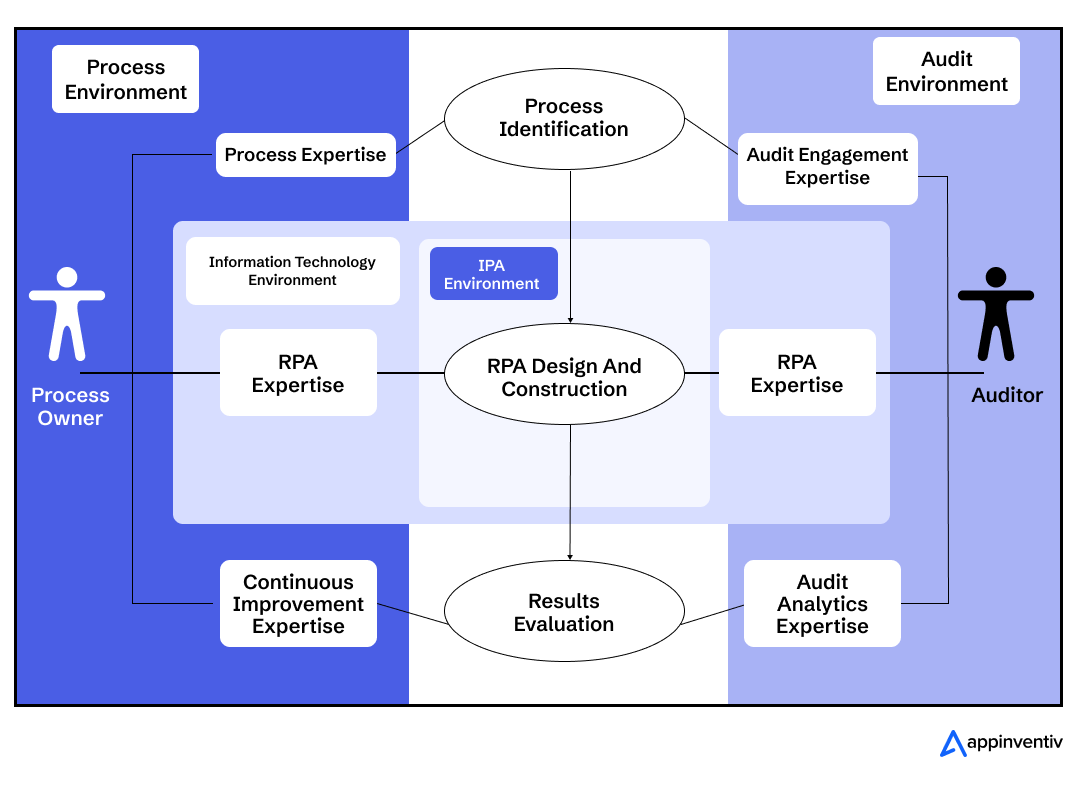

- Step-by-Step Guide to Leveraging RPA in the Banking Industry

- Identify High-Impact Processes for Automation

- Conduct a Thorough Feasibility Assessment

- Set Clear and Measurable Objectives

- Choose the Right RPA Platform for Banking Needs

- Design Optimized, Automated Workflows

- Pilot the RPA Implementation with Care

- Implement Rigorous Security and Compliance Measures

- Deploy RPA at Scale Across Key Functions

- Continuously Monitor and Optimize Performance

- Expand RPA to Transform Additional Banking Functions

- Future Trends in RPA for Banking

- How Appinventiv Delivers Comprehensive, Cutting-Edge RPA Solutions

- FAQ

Have you ever wondered how banks handle increasingly complex tasks while keeping services smooth and responsive?

It’s no coincidence—many financial institutions are adopting technologies like Robotic Process Automation (RPA). By automating repetitive processes such as loan approvals, customer onboarding, and fraud detection, Robotic process automation in banking empowers the sector to operate faster and more accurately.

This isn’t just about cutting costs—it’s about enabling banks to deliver better services and respond to market changes more effectively. Globally, businesses leverage RPA to reduce human error, improve compliance, and create personalized customer interactions.

In summary, robotic process automation in banking goes beyond task automation, enabling banks to be more agile and responsive to evolving customer needs and market dynamics, all while seamlessly integrating into existing systems.

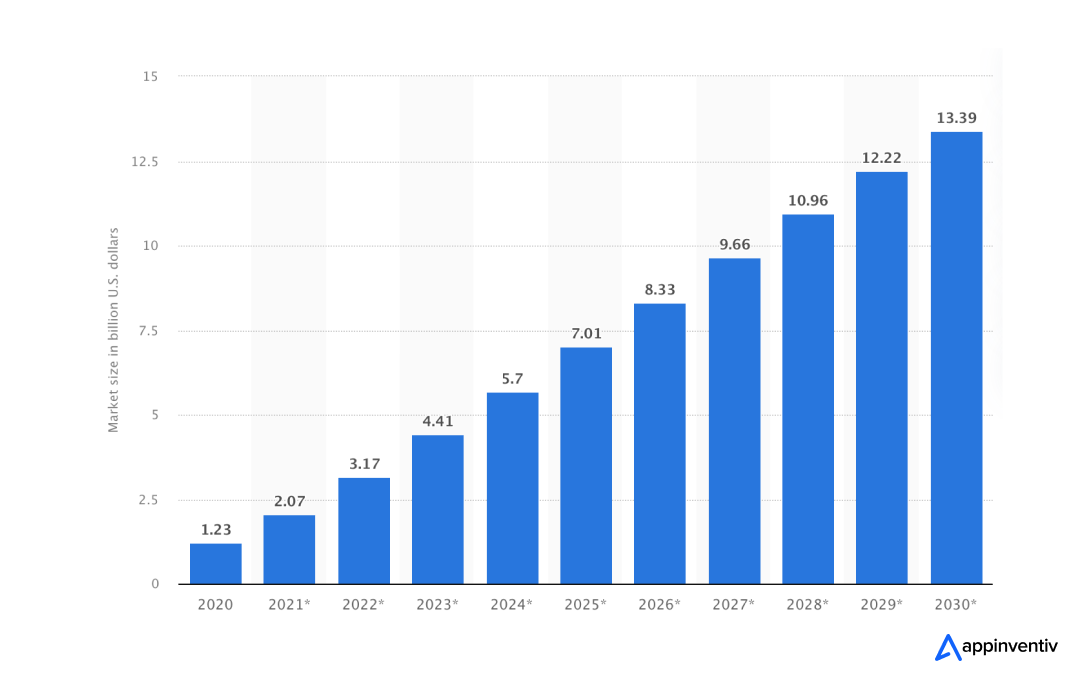

Marketing Analysis of RPA

According to Statista, the global Robotic Process Automation (RPA) market is expected to surpass $13 billion by 2030, an increase of more than $12 billion from 2020.

This growth reflects the rising demand for RPA, demonstrating that it’s the right time for businesses to consider investing in this technology. With RPA becoming more integral to streamlining operations and improving efficiency, early adopters can gain a significant competitive edge in the evolving market landscape.

So, without further delay, let’s dive into the growth of RPA, exploring its impact, development process, and much more.

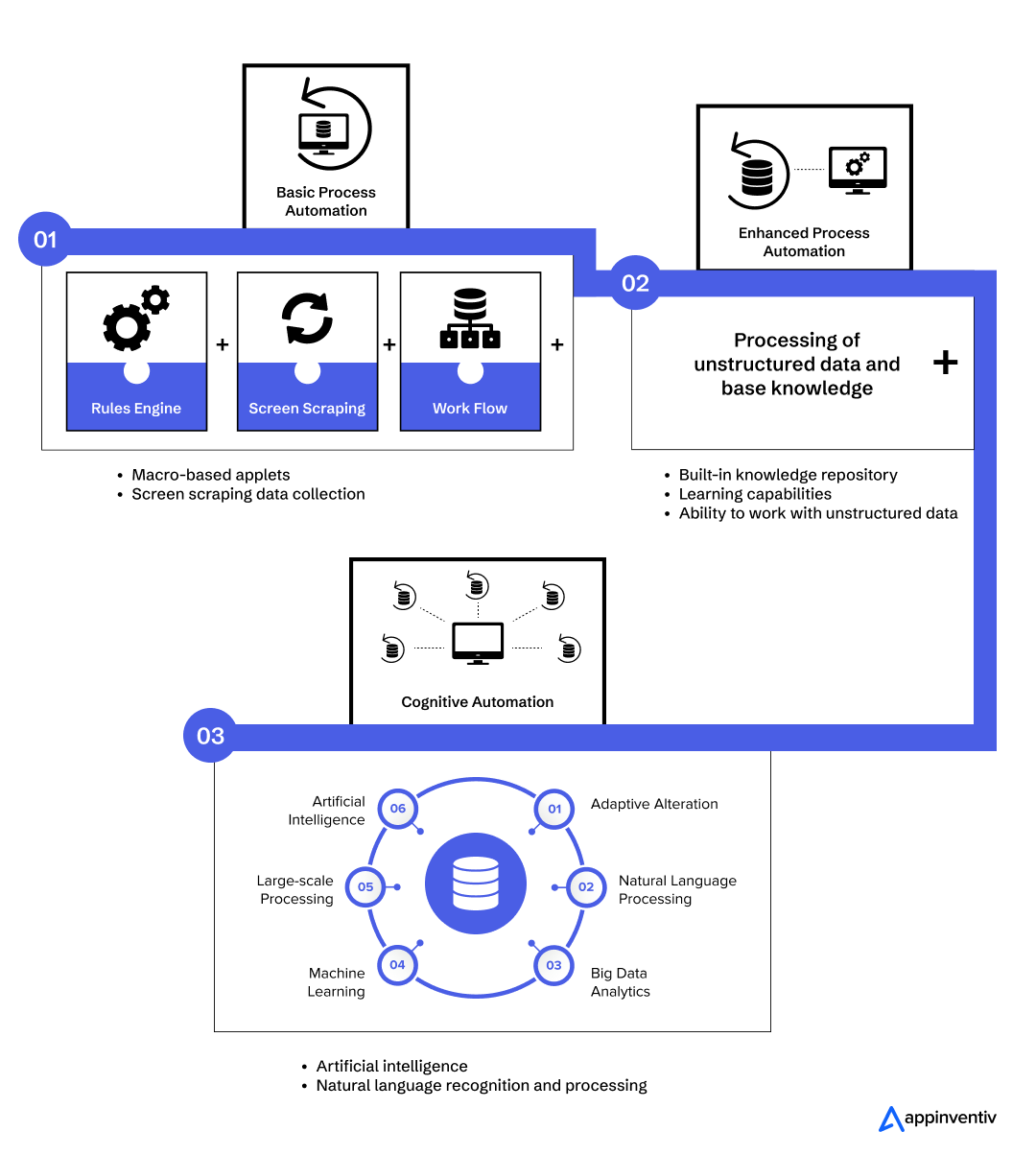

What is Robotic Process Automation (RPA)?

Robotic Process Automation (RPA) in banking is a technology that uses software robots, or “bots,” to automate repetitive, rule-based tasks typically performed by humans in digital systems. These bots are trained thoroughly through algorithms to mimic human actions, such as entering data, processing transactions, responding to emails, and interacting with other software applications.

Robotic process automation in banking is widely used to improve efficiency, reduce errors, and free up human employees for more complex, strategic tasks. It’s especially valuable in finance, healthcare, and customer service, where many processes are repetitive and time-consuming. Unlike traditional automation, RPA doesn’t require changes to underlying systems, making it easy to implement in existing infrastructures.

Here’s an overview of how RPA technically works in banks and financial firms.

Bot Execution Engine

The bot execution engine runs automation scripts, handling tasks through attended, unattended, or hybrid bots. These bots automate banking operations like loan processing and compliance checks, interacting seamlessly with core banking systems. The engine ensures high efficiency and precision without manual intervention.

Development Studio

The development studio provides a low-code interface to design RPA workflows, with pre-built modules for automating tasks such as KYC verification and transaction validation. It supports API integration and allows the creation of custom workflows, enabling banks to streamline complex processes like fraud monitoring.

Control Room/Orchestrator

The control room manages bot operations, scheduling tasks, scaling bot deployment, and monitoring real-time performance. Banking automates high-volume activities like regulatory reporting and transaction reconciliation, ensuring efficiency and compliance with audit trails and real-time tracking.

User Interface (UI) Integration

RPA banking processes mimic human interactions with banking applications through UI-level integration, enabling bots to automate tasks like data entry and form submissions. It allows bots to interact with legacy systems via screen scraping, ensuring seamless data flow without modifying existing infrastructure.

Optical Character Recognition (OCR)

Optical Character Recognition (OCR) allows RPA bots to extract data from scanned documents and PDFs, automating document-heavy processes like loan applications and invoice processing. This technology converts unstructured data into machine-readable formats, enabling the automation of compliance checks and customer onboarding.

Artificial Intelligence (AI) and Machine Learning (ML) Integration

AI and ML integration with Robotic Process Automation in banking enhances automation by adding intelligent decision-making capabilities, such as fraud detection and credit scoring. Bots can learn from historical data to improve accuracy and efficiency, automating complex tasks like risk assessments

Transformative Benefits of RPA in the Banking Sector

RPA banking processes have automated repetitive tasks that not only cut the manual intervention but also augment the employees’ operational capabilities and productivity level.

This transformation facilitates quick ticket resolution and enhances the customer experience. You can now focus on your strategic initiatives and let RPA capabilities handle other mundane tasks. Let’s delve into the different benefits of RPA adoption in banking.

Increased Accuracy and Reduced Errors

Robotic process automation in banking significantly reduces human error by automating repetitive tasks like data entry, account reconciliation, and transaction processing. This leads to precise and consistent results, ensuring tasks are executed flawlessly every time. Using bots eliminates the risk of manual errors, ultimately enhancing the quality of work and reducing the need for rework. This improvement aligns seamlessly with the goals of RPA and digital transformation, enabling banking institutions to achieve greater accuracy and efficiency in their operations.

Enhanced Operational Efficiency

RPA streamlines recurring operations by automating time-consuming processes like loan application processing, customer onboarding, and fraud detection. By removing bottlenecks in these workflows, banks can reduce processing times, enabling employees to focus on more complex tasks. This automation boosts the overall productivity of banking operations, resulting in faster, more efficient services.

Improved Customer Experience

One of the key benefits of RPA in banking is enhanced customer experience. With RPA, banks can offer faster and more accurate responses to customer queries. Automating back-office operations, such as transaction processing and account updates, helps you to resolve queries quickly and improves Average Waiting Time (AWT). Additionally, chatbots powered by RPA can handle customer queries 24/7, offering immediate assistance and resolving common issues, greatly enhancing customer satisfaction.

24/7 Operational Capability

RPA enables round-the-clock operations without requiring a human workforce. Whether processing transactions or updating customer data, bots can work non-stop, ensuring critical banking functions continue seamlessly. This continuous operation helps banks meet the increasing demand for real-time services while improving service delivery during off-peak or weekends.

Enhanced Compliance Monitoring

Robotic process automation in banking ensures that regulatory compliance is maintained by automatically checking and verifying compliance-related data. It can track every action in real-time and generate audit trails for regulators. By constantly monitoring regulation changes and updating workflows accordingly, RPA reduces non-compliance risk while ensuring that the bank adheres to the latest industry standards.

Faster Response to Market Changes

The banking industry is constantly evolving, and RPA allows financial institutions to adapt to new market demands or regulatory changes quickly. By automating tasks such as data collection, reporting, and leveraging predictive analytics, banks can quickly adjust their strategies and implement necessary changes with minimal disruption to operations. This agility enables banks to stay competitive in a fast-paced market.

Improved Employee Productivity

RPA frees employees from repetitive and mundane tasks, allowing them to focus on more valuable, strategic initiatives. Employees can spend more time on tasks that require critical thinking, problem-solving, and customer engagement, leading to higher job satisfaction and increased overall productivity. This shift towards more meaningful work drives innovation within the bank.

Enhanced Data Security

RPA enhances data security by automating sensitive processes such as customer data verification and transaction monitoring. Automating these tasks reduces human involvement, minimizing the risk of data breaches or unauthorized access. Furthermore, RPA tools are designed with advanced encryption and access control mechanisms, ensuring that confidential information remains secure.

Reduction in Audit Times

With RPA, audit processes become more streamlined and efficient. Automated systems can gather, organize, and present data required for audits in a fraction of the time it would take manually. This automation also ensures that the data is accurate and readily accessible. It enables auditors to complete their work faster and with fewer discrepancies, leading to faster compliance checks and regulatory approvals.

Prominent RPA Use Cases in the Banking Sector

Let’s explore the RPA use cases in banking and how it helps institutions elevate their operations, enhance productivity, and drive innovation.

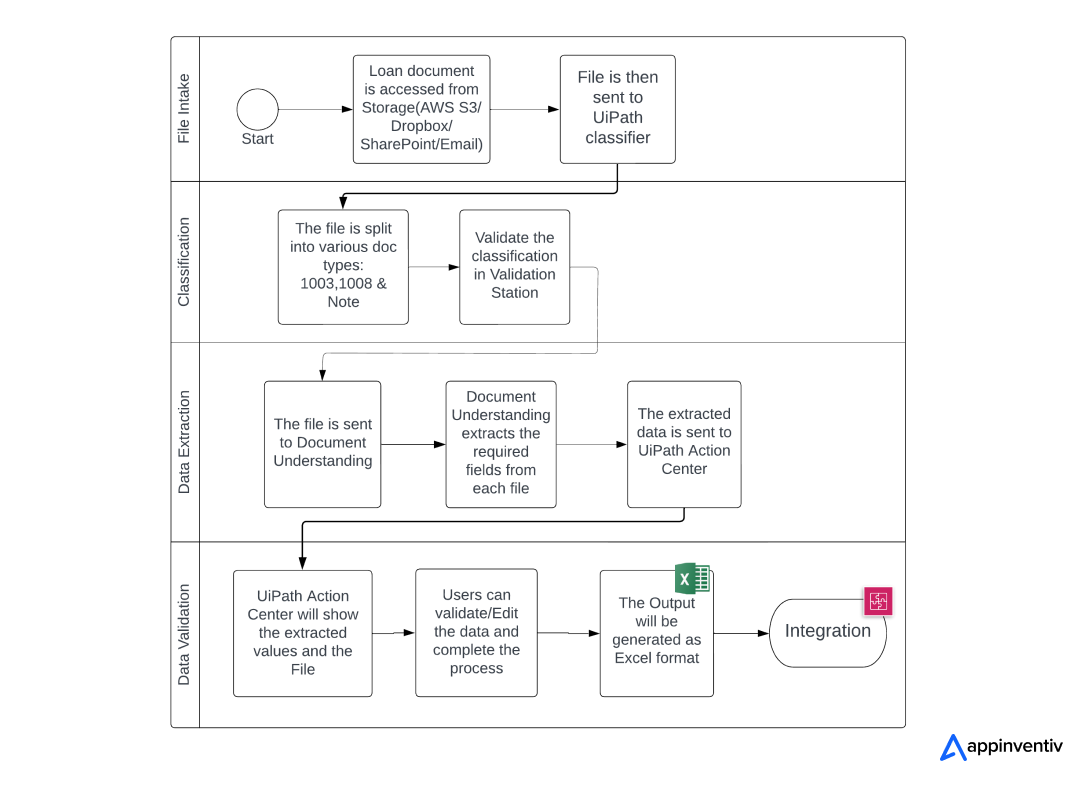

Automated Loan Processing

The role of RPA in the banking industry is immense. RPA in banking processes streamlines loan processing by automating time-consuming manual tasks. Traditionally, loan processing involves a lot of paperwork, document verification, credit checks, and approvals. RPA bots can handle data entry, retrieve customer data, and validate documents from various sources, eliminating human errors and reducing turnaround times.

By automating processes such as loan eligibility checks, credit scoring, and approval workflows, banks can accelerate loan approval times from days to hours. Furthermore, RPA ensures adherence to regulatory guidelines, reducing compliance risks and providing consistent, high-quality loan assessments.

How Robotic Process Automation Processes Automated Loan Processes?

RPA automates loan processing by extracting data, verifying documents, fetching credit scores, and checking compliance. It accelerates approvals by handling eligibility validation, populating loan systems, and notifying applicants, all while reducing errors and manual effort. Advanced AI integration further enhances decision-making for risk and credit assessments.

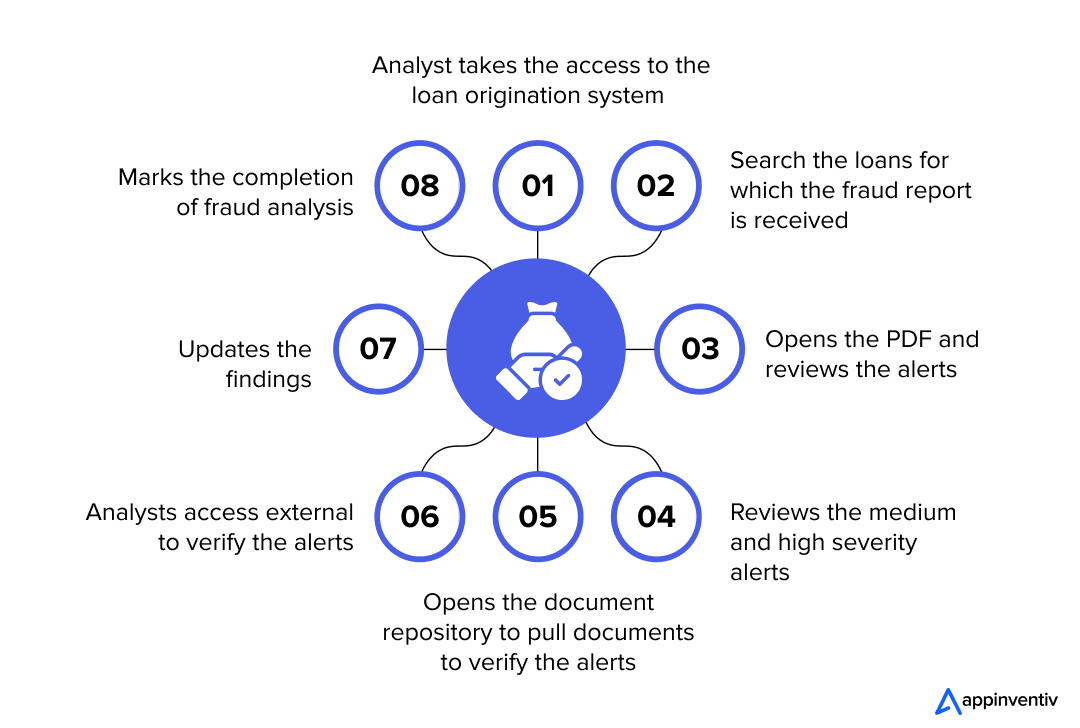

Fraud Detection and Prevention

Fraud detection in banking requires real-time monitoring of vast amounts of transactional data to identify suspicious activities. RPA enhances fraud detection by automating the process of data monitoring and anomaly detection. It enables banks to flag unusual transactions based on predefined rules, such as abnormal transaction amounts, frequency, or location changes.

RPA bots can quickly scan through thousands of transactions, alert the fraud prevention team to suspicious activities, and even halt fraudulent transactions automatically. By integrating with artificial intelligence (AI), RPA can also improve its ability to predict and prevent fraud patterns, making the entire system more secure and efficient.

How does RPA work in fraud operations?

Robotic Process Automation (RPA) revolutionizes fraud operations as a vigilant watchdog. It continuously scans transactions in real-time, swiftly identifying unusual patterns and discrepancies using advanced algorithms.

By pulling data from multiple sources, RPA uncovers potential fraud risks and flags them for review. When suspicious activities arise, it can instantly alert the team, generate compliance reports, and even automate immediate responses, like freezing accounts.

This proactive approach enhances security and streamlines operations, allowing fraud teams to focus on more strategic investigations and strengthening overall defenses against fraud.

Regulatory Reporting and Compliance

Banks operate under strict regulations and must produce regular reports for regulatory bodies such as Basel III, GDPR, and FATCA. RPA can significantly improve compliance reporting by automating the collection, validation, and submission of required data. RPA ensures that reports are generated accurately and in a timely manner, reducing the risk of human errors that can lead to hefty fines. Bots can also maintain an audit trail, documenting every action for future review, thus making regulatory audits smoother and more transparent. Additionally, robotic process automation in banking enables banks to update compliance procedures automatically as new regulations emerge, keeping them in line with changing regulatory landscapes.

How RPA Works in Risk and Compliance?

RPA bots perform tasks like data extraction, monitoring transactions, flagging anomalies, and generating compliance reports automatically, ensuring that processes are more accurate and consistent. RPA bots work 24/7, allowing organizations to stay ahead of deadlines and compliance checks. Furthermore, RPA is designed to adhere to strict rules and regulations.

Customer Onboarding and KYC

Robotic Process Automation use cases in banking, particularly in customer onboarding and KYC (Know Your Customer) processes, streamline data collection, automate document verification, and enhance compliance checks, resulting in faster onboarding times and improved customer experience. Robotics process automation in the banking sector helps banks automate these processes by pulling customer data from multiple sources, conducting background checks, and filling in forms—all without manual intervention.

RPA bots can ensure customer data is validated, verified, and updated across all systems in real-time. The process is faster, with less room for error, enhancing the customer experience while ensuring compliance with regulatory standards.

How do Robotic Process Automation Processes work in Customer Onboarding and KYC?

During customer onboarding, RPA gathers and verifies data from databases and multiple sources, such as forms, ensuring precision without human intervention. By leveraging Optical Character Recognition, RPA extracts data from documents like identification cards and utility bills, comparing them against set criteria for discrepancies. It also automates background checks by retrieving information from external sources, such as credit bureaus and government watchlists.

Payment Processing Automation

Payment processing involves multiple steps, including validating payment details, checking for funds, updating internal records, and ensuring regulatory compliance. RPA streamlines this process by automating tasks such as initiating payments, verifying payment information, and updating payment statuses in the bank’s systems.

By automating payment workflows, RPA eliminates delays caused by manual intervention and reduces errors. For example, RPA can verify account numbers, transfer funds, and confirm the payment with the payer and the payee. Moreover, RPA can be integrated with anti-fraud systems to identify suspicious payments, adding an extra layer of security while ensuring the seamless execution of payment operations.

Account Closure Processing

Account closure is a repetitive process often involving multiple steps, such as verifying the account holder’s details, checking for any pending transactions or balances, retrieving account history, and ensuring compliance with the bank’s policies. RPA bots can automate these tasks, ensuring that accounts are closed accurately and promptly.

RPA can handle large volumes of account closure requests simultaneously, significantly reducing processing time while ensuring that all necessary steps, including compliance checks, are completed. It can also automatically generate reports or notifications to inform customers about the successful closure of their accounts, providing a seamless experience.

Mortgage Processing

Mortgage processing is traditionally a labor-intensive process that involves collecting and verifying vast amounts of customer data, reviewing loan applications, assessing credit scores, and ensuring compliance with underwriting standards. Robotic process automation in banking can streamline mortgage processing by automating data entry, verification, and compliance checks.

RPA bots can automatically pull information from multiple sources, analyze loan applications, check creditworthiness, and ensure that all regulatory requirements are met before approval. This reduces the chances of human error, speeds up the approval process, and improves customer satisfaction by providing quicker turnaround times for mortgage decisions.

How RPA Streamlines Mortgage Process?

First, RPA optimizes application interactions and integrations, ensuring seamless data flow between systems like loan origination platforms and underwriting tools. Next, RPA automates data entry and extraction from mortgage applications and documents, speeding up processing. Finally, RPA handles email and FTP automation, automatically retrieving, sending, and organizing crucial documents. Together, these automations significantly enhance efficiency and mortgage workflow.

After delving into the various use cases of RPA, let’s shift our focus to some compelling real-world examples that showcase its transformative impact.

Real-World RPA Case Studies Highlighting Its Game-Changing Potential

Here are some real-life examples of RPA in banking that empower institutions to improve customer experiences, boost accuracy, and drive innovation in their services. Let’s explore!

Bank of America

To tackle long wait times and customer dissatisfaction due to high volumes of inquiries, Bank of America leveraged RPA to automate customer service tasks. This included responding to frequently asked questions and processing simple transactions. As a result, the bank greatly reduced response times, significantly improving customer satisfaction and allowing human agents to focus on more complex issues.

Wells Fargo

Wells Fargo is one of the prominent examples of robotic process automation in banking. Wells Fargo recognized the need to enhance its fraud detection processes to protect customers better. By integrating RPA into its fraud monitoring system, the bank automated the analysis of transaction patterns and flagged suspicious activities more efficiently. This led to improved fraud detection rates, enabling quicker responses to potential incidents and enhancing customer trust in the bank.

HSBC

HSBC was stuck with manual, slow regulatory reporting that consumed much time and was prone to errors. As a solution, they embedded RPA in their banking operations to automate data collection, initiate data-driven forecasting, and crack out reports. Subsequently, this big move towards robotics ensured timely submissions and augmented efficiency and accuracy.

Challenges of Implementing RPA in Banks

Let’s explore the challenges businesses encounter while adopting robotic process automation (RPA) in banking, including data security, compliance, and workforce adaptation issues. . Addressing these challenges is crucial for ensuring a successful and responsible implementation of Robotics Process Automation in the banking sector.

Challenge: Integration with Legacy Systems

Many banks still rely on outdated legacy systems that can be challenging to integrate with Robotic Process Automation (RPA). These older systems may not support modern technologies, making seamless communication with RPA difficult.

Solution: Banks should invest in middleware tools or APIs that bridge the gap between legacy systems and RPA, ensuring smoother integration while upgrading outdated infrastructures over time.

Challenge: Data Security and Privacy Concerns

Robotic process automation in banking systems handles sensitive customer and financial data, which increases the risk of data breaches or non-compliance with privacy regulations like GDPR.

Solution: Implement strong encryption protocols, conduct regular security audits, and ensure compliance with data protection regulations to safeguard sensitive information throughout the automation process.

Challenge: Skill Gaps and Workforce Management

Introducing RPA can lead to skill gaps in the workforce, where employees may lack the expertise to effectively manage and operate automated systems.

Solution: Invest in employee training programs to upskill staff in RPA management and work with automation specialists to fill any immediate skill gaps.

Challenge: Change Management and Resistance to Automation

Employees may resist RPA implementation due to concerns about job loss or unfamiliarity with the technology. This can slow down the automation process.

Solution: Focus on change management strategies by clearly communicating the benefits of RPA, such as reducing repetitive tasks and offering training to help employees adapt to new roles and technologies.

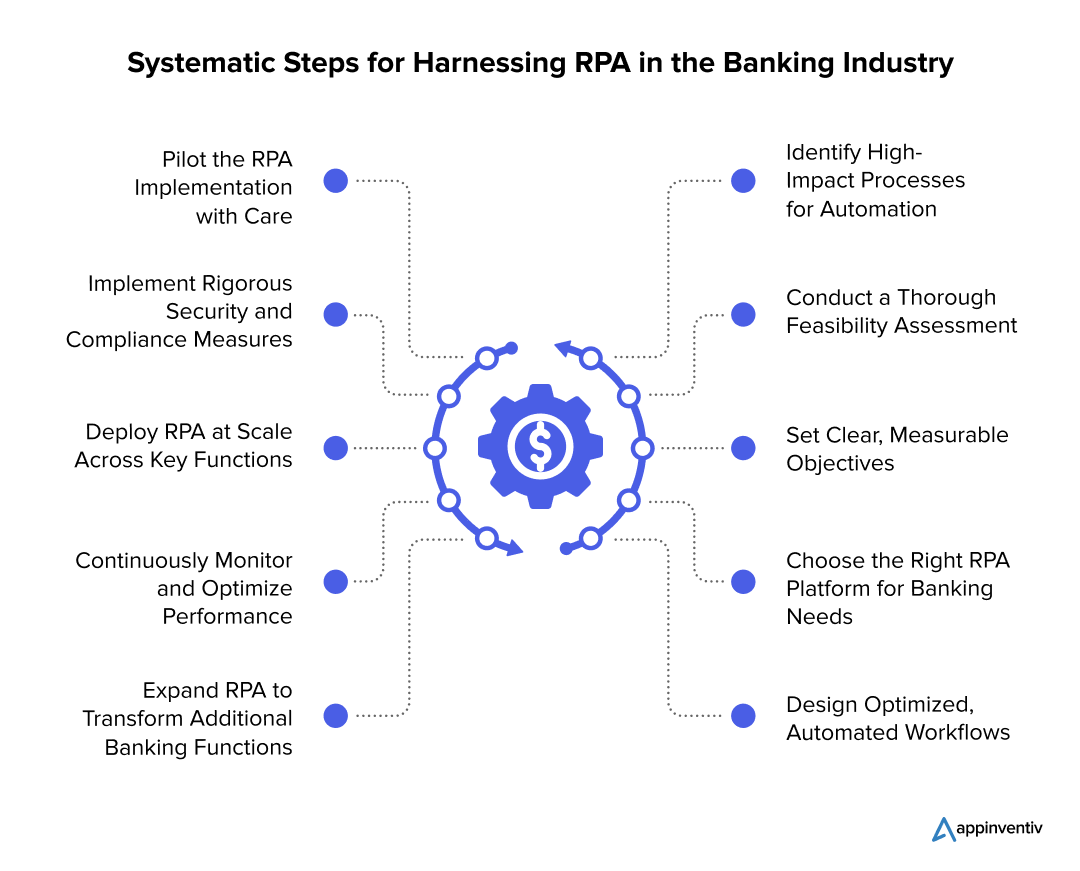

Step-by-Step Guide to Leveraging RPA in the Banking Industry

Implementing robotic process automation in the banking industry involves a comprehensive methodology, thorough analysis, and various key elements that enable institutions to create impactful and results-oriented solutions.

Let’s explore how RPA and digital transformation can drive efficiency and innovation in the banking sector!

Identify High-Impact Processes for Automation

RPA meticulously analyzes banking workflows to pinpoint repetitive, rule-based, and labor-intensive tasks. Focus on processes like loan applications, account onboarding, KYC verification, and transaction monitoring, which are ripe for automation and can yield significant operational efficiencies. Prioritize processes directly affecting customer satisfaction and regulatory compliance, ensuring that automation has operational and strategic benefits. Look for bottlenecks that can be removed entirely through RPA, increasing speed and accuracy.

Conduct a Thorough Feasibility Assessment

Undertake a comprehensive feasibility study to evaluate both the technical and financial aspects of automating each identified process. Assess the potential of RPA digital transformation to drive down operational costs, enhance productivity, and significantly reduce manual errors, all while maintaining process integrity.

Consider long-term scalability when choosing RPA tools and processes to ensure they can grow with your bank’s needs. Also, check if your current systems are compatible or if new integrations are needed to avoid technical issues during implementation.

Set Clear and Measurable Objectives

Define precise, measurable goals for your RPA digital transformation initiatives, such as reducing processing times, increasing customer satisfaction, and minimizing human intervention. Ensure these objectives align with the bank’s digital transformation strategy to maximize long-term benefits. Establish key performance indicators (KPIs) to measure the impact of RPA on operational efficiency and customer experience. In addition, set milestones for implementation so that progress can be tracked and adjusted as necessary.

Choose the Right RPA Platform for Banking Needs

Select an RPA platform that integrates seamlessly with your bank’s legacy systems while offering robust features tailored to the financial sector. Top platforms like UiPath, Automation Anywhere, and Blue Prism provide specialized banking tools, including compliance management and advanced security protocols.

Evaluate the platform’s ability to scale and handle increasing process volumes without compromising performance. It’s also important to ensure the platform offers robust analytics tools, enabling you to track the performance of your bots in real-time.

Design Optimized, Automated Workflows

Collaborate closely with process experts and IT teams to design RPA workflows that replicate and streamline existing manual processes. This involves carefully mapping out steps to ensure accuracy and efficiency, making automation a powerful enhancement rather than a simple replication.

Consider adding error-handling mechanisms within the automated workflows to avoid costly delays. Additionally, ensure workflows are flexible enough to adapt to future regulatory changes or process adjustments.

Pilot the RPA Implementation with Care

Launch the RPA solution in a controlled pilot environment by targeting a specific process for automation. This phase is crucial for identifying potential issues, gathering feedback, and making necessary adjustments before full-scale implementation.

Keep stakeholders involved throughout the pilot phase to ensure organizational alignment and buy-in. It’s also a good time to assess the RPA’s integration with other technologies like AI or machine learning, which can further enhance the automation’s effectiveness.

Implement Rigorous Security and Compliance Measures

Given the highly sensitive nature of banking data, ensure that your RPA implementation adheres to stringent industry standards for data security, privacy, and regulatory compliance. Implement robust encryption, user access controls, and audit trails to safeguard customer information and maintain trust. Conduct regular security audits to ensure the RPA system complies with evolving regulatory requirements. Also, consider including real-time monitoring capabilities to detect and mitigate potential threats.

Deploy RPA at Scale Across Key Functions

Once the pilot proves successful, the robotics will be rolled out in banking operations across additional departments and processes. Develop a strategic deployment plan that includes comprehensive change management initiatives to ease the transition for employees and ensure the new workflows are adopted smoothly. Training and upskilling employees to manage and work alongside RPA bots is critical for long-term success. Also, ensure the deployment plan includes continuous feedback loops to identify operational challenges early.

Continuously Monitor and Optimize Performance

Establish a monitoring framework to track the performance of RPA bots and measure their impact on efficiency, accuracy, and cost savings. Regularly review and optimize automated processes as banking operations evolve, ensuring that the RPA continues to deliver sustained improvements. Use advanced analytics to identify potential areas of improvement, allowing the system to evolve with minimal downtime. Additionally, consider setting up alerts for critical issues, ensuring swift action in case of system malfunctions.

Expand RPA to Transform Additional Banking Functions

After achieving success in core processes, look for new opportunities to scale RPA across other banking functions, such as fraud detection, customer support, and regulatory reporting. As the bank grows more familiar with automation, explore integrating RPA with AI and machine learning to handle more complex, decision-based processes. This integration can help automate predictive analytics and risk management, further driving innovation in the bank’s digital transformation efforts. Additionally, focus on continuous innovation to remain competitive in the evolving financial landscape.

Future Trends in RPA for Banking

As RPA continues to grow unstoppably, let’s delve into the RPA trends in finance in the future. With advancements in artificial intelligence and machine learning, RPA is set to revolutionize how banks operate, particularly in compliance, fraud detection, and data management. The potential for innovation in these domains is immense, promising a more agile and adaptive financial landscape that aligns with the future of RPA in the banking industry.

Hyper Automation and AI Integration

Hyper automation, which combines RPA with advanced technologies like AI and machine learning, is revolutionizing banking operations. This trend enables end-to-end automation of complex workflows, improving efficiency and decision-making. AI-driven insights enhance customer interactions through personalized support, allowing banks to optimize processes and reduce errors significantly.

RPA for Blockchain Integration

As blockchain technology gains traction in the banking sector, RPA will play a vital role in its integration and utilization. Robotics in banking operations can automate the management of blockchain transactions, ensuring accuracy and transparency while reducing the potential for fraud.

This synergy will enhance operational efficiency, particularly in cross-border payments and identity verification. Moreover, RPA can streamline compliance processes by automatically updating records and monitoring transactions in real time, ensuring adherence to regulatory requirements while minimizing manual oversight. This RPA trends in finance will pave the way for a more secure and efficient banking ecosystem.

The Rise of Cognitive RPA

Cognitive RPA, which integrates AI capabilities, is transforming traditional banking processes. Utilizing natural language processing, it can analyze unstructured data to understand customer sentiments better. Intelligent data extraction minimizes manual entry errors, while continuous learning algorithms enable RPA systems to adapt and improve over time, enhancing overall operational efficiency.

How Appinventiv Delivers Comprehensive, Cutting-Edge RPA Solutions

Appinventiv, a leading banking software development company, helps businesses transform their operations through innovative, tailored solutions. With a highly skilled team of over 1600 experts and experience in delivering more than 3000 successful projects, we’ve earned the trust of global clients.

Our approach begins with a deep understanding of each client’s needs. This personalized strategy allows us to design tailored solutions that effectively incorporate advanced technologies, such as Robotic Process Automation (RPA). By automating repetitive processes, businesses can enhance efficiency and redirect their focus toward growth and innovation.

Why Prefer Appinventiv’s RPA Solutions?

Appinventiv’s RPA solutions are crafted with a strong emphasis on scalability, security, and precision. This ensures that banking organizations can modernize their workflows, reduce manual errors, and drive significant impact across their operations. Our RPA implementations empower teams to work smarter, allowing them to engage in more strategic initiatives rather than getting bogged down by mundane tasks.

We stand out due to the following reasons:

- Customizable Workflows: Our RPA solutions can be tailored to fit the unique processes of each banking organization, ensuring seamless integration with existing systems.

- Rapid Deployment: We emphasize quick implementation to allow clients to realize the benefits of automation without prolonged disruption to their operations.

- Enhanced Compliance: Automated processes can be designed to adhere to regulatory requirements, helping organizations maintain compliance with industry standards.

- Continuous Improvement: We provide ongoing support and enhancements, ensuring that our RPA solutions evolve with the organization’s needs and the changing technological landscape.

- Performance Metrics: Our solutions include analytics capabilities to track performance improvements and measure the impact of automation on overall business outcomes.

Reach out to us to experience the transformative impact of Robotic Process Automation in the banking industry, enabling seamless automation of your core processes for greater efficiency and results. Our cutting-edge RPA solutions will help you optimize operations and drive innovation across your financial services.

FAQ

Q. What is robotic process automation in banking?

A. Robotic Process Automation (RPA) in banking refers to using software robots or “bots” to automate repetitive, rule-based tasks traditionally performed by humans. These tasks include data entry, processing transactions, account reconciliation, and compliance checks. By leveraging RPA, banks can improve operational efficiency, reduce errors, and lower costs.

Additionally, RPA enables faster customer service responses, streamlines back-office processes, and enhances productivity. With automation, banks can focus more on complex, value-added services while ensuring accuracy and compliance in routine operations.

Q. Which banking processes are most suitable for automation using RPA?

A. Robotic Process Automation (RPA) can effectively automate repetitive, rule-based tasks in banking. Some of the most suitable processes include:

- Customer onboarding: Automating the document verification and data entry process for faster customer onboarding.

- KYC (Know Your Customer) compliance: Streamlining KYC checks by automating data collection, validation, and screening against databases.

- Loan processing: Automating the extraction, validation, and verification of loan application data to speed up approval times.

- Account reconciliation: RPA can match transactions and identify discrepancies in real-time, reducing manual work.

- Fraud detection: RPA helps monitor suspicious activity transactions by automating fraud detection rules.

- Payment processing: Automating payment workflows, reducing delays, and ensuring transaction accuracy.

Q. What role does RPA play in reducing human error in banking processes?

A. RPA is crucial in minimizing human error in banking processes by automating repetitive, error-prone tasks such as data entry, transaction processing, and compliance checks. Since bots follow predefined rules without deviation:

- Accuracy: RPA ensures high accuracy in processing data and eliminates mistakes that humans might make due to fatigue or oversight.

- Consistency: Bots consistently execute tasks every time, reducing variations in performance that might occur with manual work.

- Data integrity: Automating processes ensures data is captured, processed, and transferred accurately without duplication or missing information.

- Efficiency: By reducing human intervention, RPA accelerates task completion while ensuring compliance and reducing risks associated with manual errors.