- The Transformative Role of AI in Investment Analysis: How It Works

- Key Benefits of Harnessing AI for Investment Analysis

- Automated Trading and Order Execution

- Personalized Investment Strategies

- Enhanced Predictive Accuracy

- Advanced Risk Management

- Detection of Market Anomalies

- Efficient Data Analysis

- AI for Investing: Industry-Specific Impacts and Advancements

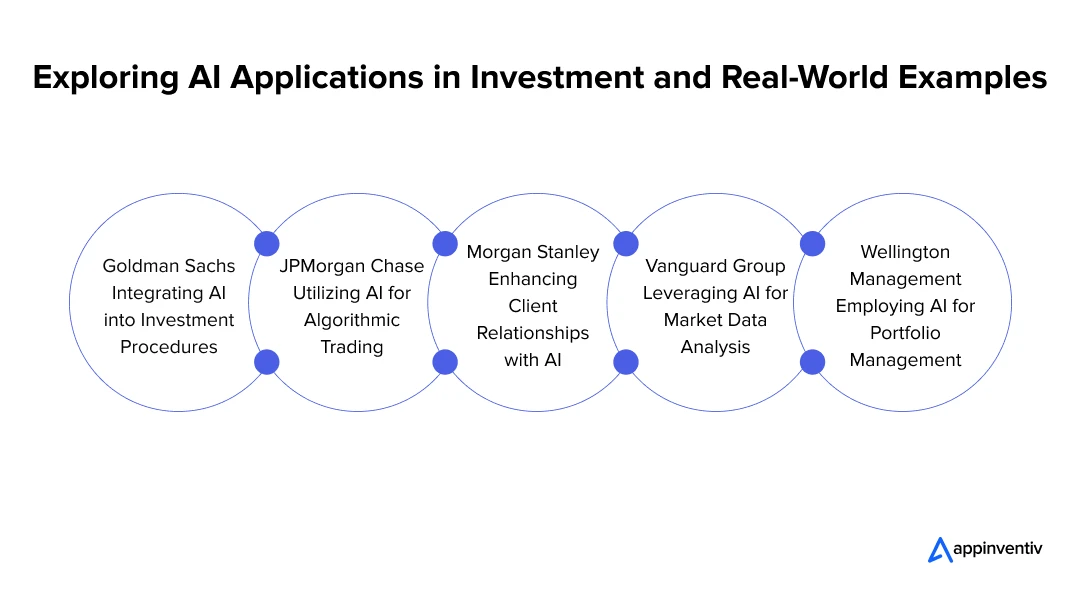

- Real Use Cases and Examples of Companies Utilizing AI for Investment

- Goldman Sachs Integrating AI into Investment Procedures

- JPMorgan Chase Utilizing AI for Algorithmic Trading

- Morgan Stanley Enhancing Client Relationships with AI

- Vanguard Group Leveraging AI for Market Data Analysis

- Wellington Management Employing AI for Portfolio Management

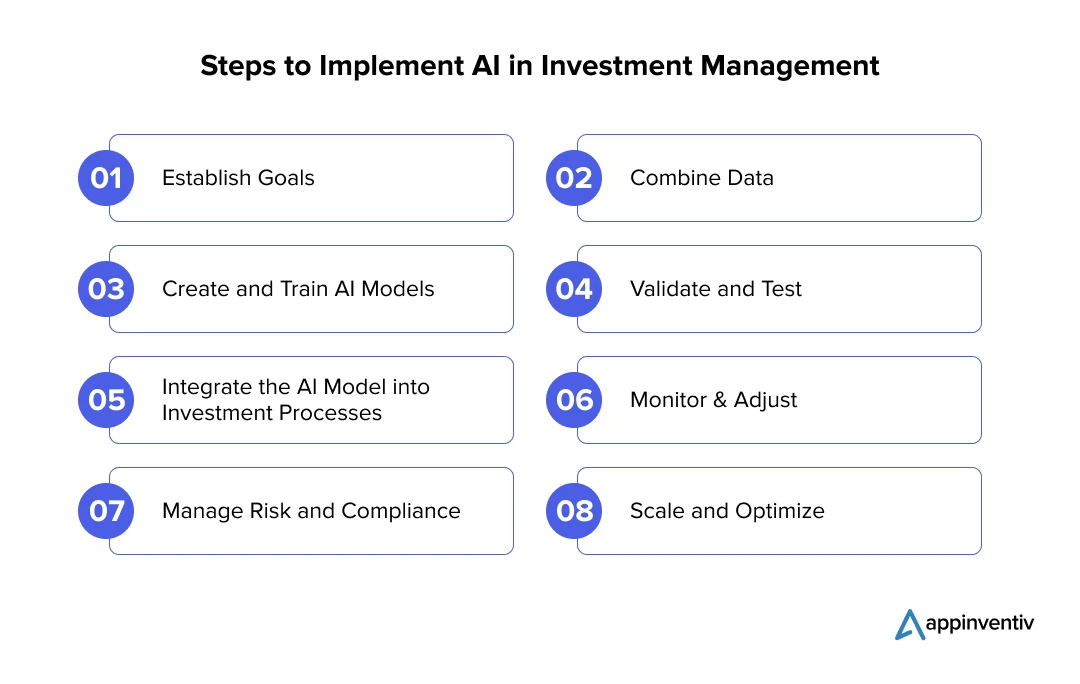

- Implementing AI in Investment Management: A Step-by-Step Approach

- Establish Goals

- Combine Data

- Create and Train AI Models

- Validate and Test

- Integrate the AI Model into Investment Processes

- Monitor & Adjust

- Manage Risk and Compliance

- Scale and Optimize

- Top 4 Ways to Use AI-Driven Investing?

- Portfolio Optimization

- Sentiment Analysis

- Algorithmic Trading

- Risk Management

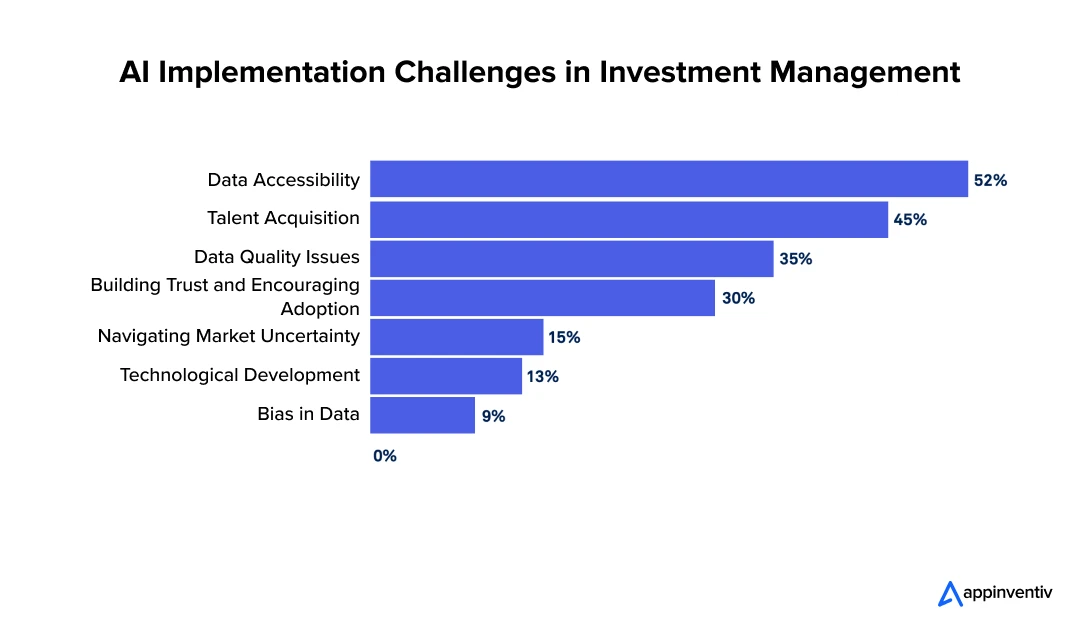

- Challenges and Solutions When Using AI to Invest

- Data Accessibility

- Talent Acquisition

- Data Quality Issues

- Building Trust and Encouraging Adoption

- Navigating Market Uncertainty

- Technological Development

- Bias in Data

- Harness AI for Investment Success with Appinventiv's Expert Guidance

- FAQs

A few years ago, investing relied heavily on manual processes and instinctive judgments, with analysts sifting through spreadsheets and market reports to make decisions based on historical data and intuition. The financial markets, though dynamic, were manageable within this traditional framework. Today, however, the investing landscape has evolved dramatically. The influx of real-time data, driven by global events and instantaneous digital communications, has accelerated market activity and complexity.

In this environment, traditional methods struggle to keep up with the speed and volume of information, posing a significant challenge for investors. Artificial intelligence and investing emerge as a transformative solution to this dilemma.

AI for investing harnesses advanced algorithms to analyze data, predict market trends, and optimize decision-making. AI investing can automate complex tasks, reduce errors, and gain insights beyond the reach of traditional methods. This shift allows for more strategic and informed investment choices, enhancing the ability to respond to market dynamics in real-time.

This blog delves into the role of AI in investment analysis, highlighting its key benefits, implementation strategies, and ways to tackle contemporary challenges. Let’s explore further.

The Transformative Role of AI in Investment Analysis: How It Works

Artificial Intelligence (AI) is fundamentally reshaping investment analysis through its advanced data processing and decision-making capabilities. Large Language Models (LLMs) are central to this transformation, offering sophisticated tools for parsing and understanding extensive unstructured data, such as financial reports, news articles, and market commentary.

LLMs enhance investment analysis by extracting valuable insights from complex textual data, helping to identify market trends and sentiment shifts that might not be visible through traditional methods. They can analyze diverse sources, such as earning reports and social media analytics, to deliver a more clear picture of market dynamics and uncover potential investment opportunities.

Furthermore, AI in investing can reduce human error and increase efficiency by automating intricate tasks such as trading and portfolio management. AI algorithms execute transactions with high speed and precision and adjust rapidly to market fluctuations. AI solutions also offer customized investment strategies, tailoring recommendations to individual risk tolerances and preferences, thereby improving investment outcomes and aligning with each investor’s goals.

This integration of artificial intelligence in investing processes majorly boosts efficiency and analytical accuracy. This gives investors a major competitive edge in navigating the volatile financial markets of today.

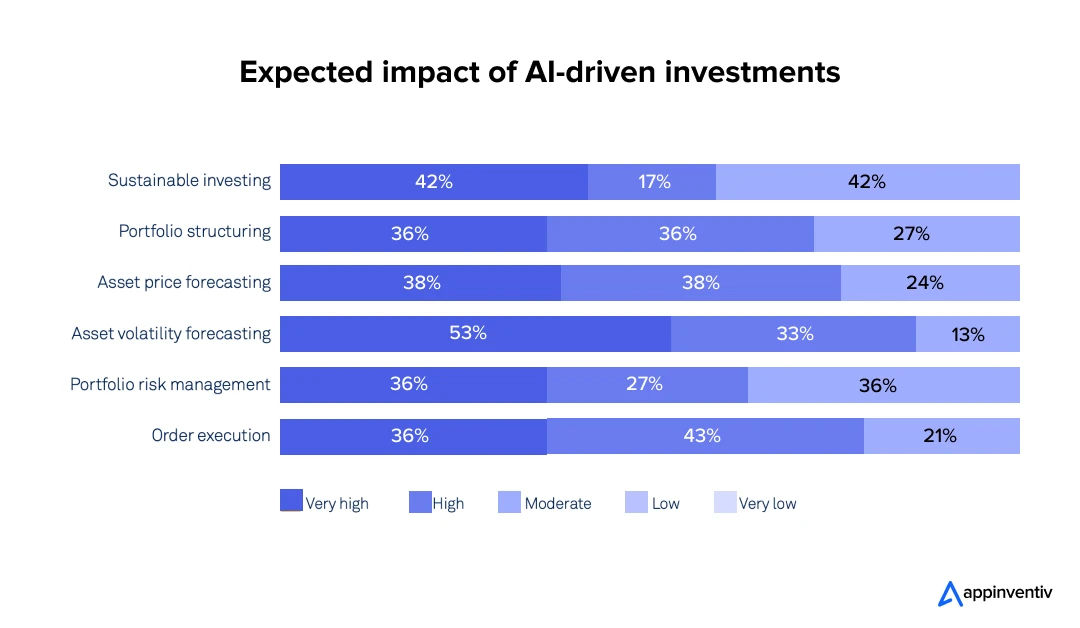

There is broad consensus on the potential advantages of AI in this field. For instance, a substantial majority of firms anticipate that AI will significantly influence investment returns, with expectations of either a ‘very high’ or ‘high’ long-term impact.

This highlights the growing acknowledgment of AI’s capacity to improve decision-making precision and operational efficiency. Additionally, AI’s ability to reveal hidden opportunities and better manage risks is fueling enthusiasm throughout the investment sector. Consequently, many organizations are increasingly investing in AI technologies and trends to secure a competitive edge and maintain their position in a rapidly evolving market.

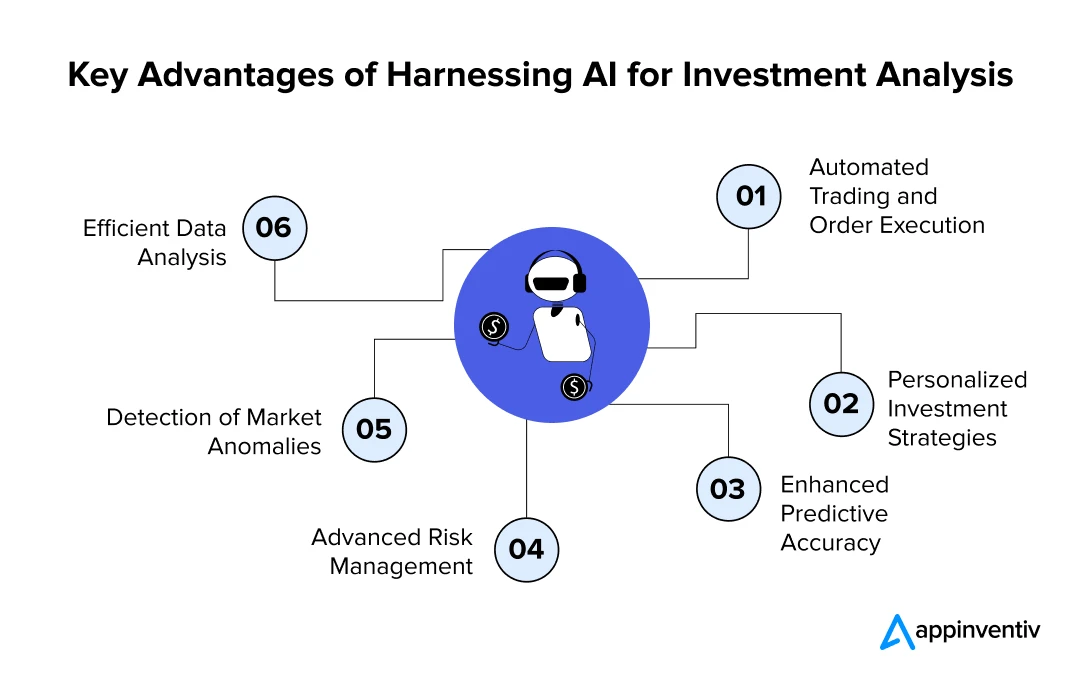

Key Benefits of Harnessing AI for Investment Analysis

As discussed in brief above, harnessing AI for investment analysis comes with a host of benefits that enable a more nuanced understanding of the market and support informed decision-making in investment strategies. Let’s have a detailed look at those.

Automated Trading and Order Execution

Trading systems with AI capabilities can process buy and sell orders quickly and accurately. These systems evaluate market conditions using algorithms and then carry out trades according to predetermined standards.

Automation lowers the possibility of human error and enables quicker responses to market changes. Furthermore, automated trading is always open, allowing it to capitalize on opportunities in international markets without requiring ongoing human supervision.

Also Read: AI in Stock Trading Unlocking Value for the Fintech Industry

Personalized Investment Strategies

Using AI for investing allows for the creation of customized investment plans tailored to each investor’s unique profile. AI-driven technologies can recommend personalized investment strategies by assessing a client’s financial status, objectives, risk tolerance, and preferences.

These strategies are continuously updated based on real-time data and evolving market conditions, ensuring that the investment approach remains aligned with the investor’s goals and risk tolerance.

Enhanced Predictive Accuracy

AI algorithms are very good at processing and analyzing large volumes of real-time and historical data, which improves predicted accuracy. Utilizing AI for investment decisions can help in the accurate prediction of market trends and asset movements by spotting patterns and connections that analysts might overlook.

Leveraging data-driven insights and predictive analytics enhances investors’ ability to make well-informed decisions. Implementing AI in investing improves the accuracy of forecasts related to stock prices, market trends, and investment opportunities, leading to more precise and strategic investment choices.

Advanced Risk Management

AI significantly improves risk management through the use of advanced models that assess and predict potential risks. Machine learning algorithms evaluate historical data, market trends, and other pertinent factors to gauge risk levels for various investments.

This proactive approach allows for the early identification and mitigation of potential risks, helping investors avoid critical issues before they escalate. Consequently, investors can craft more resilient risk management strategies, fine-tune their portfolios, and better protect themselves against unexpected market fluctuations.

Detection of Market Anomalies

AI investing tools excel at identifying anomalies and irregular patterns in the market that could signal potential opportunities or risks. By analyzing historical data and spotting deviations from typical trends, machine learning models provide early warnings of unusual market behavior.

This ability to detect anomalies early enables investors to respond promptly to emerging trends or adjust their strategies to mitigate the effects of unexpected market shifts, thereby improving their capacity to leverage opportunities or safeguard against significant changes.

Efficient Data Analysis

Leveraging AI in investing greatly improves data analysis by rapidly and accurately processing large volumes of financial information. While traditional methods may falter under the complexity and scale of data, AI algorithms excel at navigating extensive datasets, extracting valuable insights, and presenting them clearly.

This enhanced efficiency helps investors remain updated on market conditions, company performance, and economic indicators without being bogged down by information overload.

Let us now explore how AI investing is impacting various industries and transforming investment strategies.

AI for Investing: Industry-Specific Impacts and Advancements

Artificial intelligence in investing is reshaping various industries by delivering tailored insights and enhancing decision-making. Each sector benefits from AI’s ability to analyze complex datasets, predict market trends, and identify growth opportunities, leading to more strategic and informed investment decisions.

Healthcare: In the healthcare sector, AI is utilized for investment strategies, analyzing the market potential of biotech and health tech innovations, evaluating clinical trials, and forecasting the impact of new treatments on stock prices.

Energy: For the energy sector, AI helps in forecasting demand, monitors commodity prices, and evaluates renewable energy projects, providing insights for investments in both traditional and sustainable energy sources.

FinTech: AI transforms portfolio management and trading by processing extensive datasets to identify trends and make real-time predictions. AI in FinTech enhances asset allocation, automates trading, and delivers tailored investment advice.

Retail: AI supports retail investment by evaluating consumer behavior, market trends, and supply chain efficiencies. This analysis enables investors to forecast sales performance and identify emerging opportunities more accurately.

Manufacturing: AI supports manufacturing investments by focusing on companies adopting Industry 5.0 technologies, analyzing trends in automation, production efficiency, and supply chain innovations to identify promising opportunities.

Real Estate: In real estate, AI models predict property values, track market trends, and assess rental income, guiding investment decisions on property acquisitions and portfolio management.

Real Use Cases and Examples of Companies Utilizing AI for Investment

By applying AI, investors can leverage data-driven insights, enhance predictive accuracy, and optimize and streamline processes across various sectors. These real-world applications demonstrate AI’s transformative impact on investment practices and its potential to drive substantial growth and efficiency. Let’s check them out.

Goldman Sachs Integrating AI into Investment Procedures

Goldman Sachs integrates AI in its investment procedures to improve accuracy and efficiency. The world’s preeminent investment bank employs AI in its trading algorithms to evaluate large, intricate datasets and carry out trades using intricate plans. This makes better trading results and quick decision-making possible.

Artificial intelligence and investing can work together to assess potential risks by analyzing market volatility and other financial indicators. This AI-based investing helps in proactively adjusting strategies and mitigating potential losses. Goldman Sachs uses artificial intelligence in financial analysis to go through massive amounts of data and extract useful insights that help with strategic planning and improved investment decisions.

Also, as per a report by the Wall Street Journal, Goldman Sachs recently launched its first generative AI tool, the GS AI Platform, which centralizes all generative AI initiatives within the firm. Developed from an existing machine-learning platform, it integrates GPT-3.5 and GPT-4 models from OpenAI partner Microsoft, Google’s Gemini model, and open-source models like Meta’s Llama. This advanced platform assists employees in financial analysis and strategic decision-making by providing comprehensive data insights and enhancing analytical capabilities. This multi-model approach allows for flexibility across various use cases.

JPMorgan Chase Utilizing AI for Algorithmic Trading

JPMorgan Chase employs AI in several crucial aspects of its investment activities. Algorithmic trading involves the use of AI algorithms to evaluate large datasets and execute deals quickly and accurately while optimizing trading methods in response to current market conditions. AI solutions for risk assessment examine market data, spot trends, and forecast unfavorable outcomes to continuously monitor and assess possible hazards.

This aids in controlling portfolio stability and reducing financial risk. Furthermore, JPMorgan Chase uses AI in market forecasting, whereby sophisticated machine learning models evaluate recent and historical market data to anticipate future trends and investment opportunities. These AI-powered methods boost overall investment performance and decision-making.

Morgan Stanley Enhancing Client Relationships with AI

Morgan Stanley utilizes AI for investing to strengthen client relationships and deliver more tailored financial insights. The company leverages AI in investing to enhance client service by analyzing data to provide personalized investment recommendations. AI tools support decision-making by evaluating financial data, market trends, and individual client preferences.

Morgan Stanley provides more individualized investment solutions and improves strategies by utilizing real-time insights and forecasts. AI-driven automation also increases efficiency by streamlining repetitive processes, freeing advisers to concentrate on more strategic facets of client relationships. The incorporation of AI investing further enhances the formulation of investment strategies, which also supports sophisticated risk analysis and scenario planning.

According to a Morgan Stanley press release, the bank is advancing its use of artificial intelligence with a new tool named Debrief, designed to significantly reduce the workload for financial advisors. Built with OpenAI’s GPT-4, Debrief automatically logs client meetings, drafts emails, and summarizes discussions, effectively replacing manual note-taking previously handled by advisors during client Zoom calls.

Vanguard Group Leveraging AI for Market Data Analysis

Vanguard Group uses AI to invest by strategically analyzing market data and optimizing asset allocation according to customers’ risk profiles and objectives. This approach enhances investment strategies and improves risk management.

AI employs client data analysis to create personalized investment suggestions and advice in the context of client personalization. AI-assisted investing also helps with operational efficiency by automating tasks like compliance monitoring and trade execution, which eventually lowers costs and boosts efficiency.

In addition to these AI applications, Vanguard offers the Vanguard Information Technology ETF (VGT), which provides exposure to a broad range of technology companies. This ETF uses AI to track and analyze trends within the tech sector, helping investors capitalize on growth opportunities in technology while diversifying their portfolios. According to Nasdaq, if you’re considering investing in technology stocks, especially those poised to gain from AI, the Vanguard Information Technology ETF is a compelling choice.

Wellington Management Employing AI for Portfolio Management

Wellington Management leverages AI to enhance portfolio management and investment research. By analyzing vast datasets, AI algorithms identify investment opportunities and market trends, offering valuable insights for strategic decision-making.

Wellington’s use of AI in investing refines portfolio management by optimizing asset allocation and boosting performance. The technology enables more precise analysis of complex financial data and market forecasts, leading to more informed investment strategies. This application of AI allows Wellington Management to manage portfolios with greater skill and insight.

Implementing AI in Investment Management: A Step-by-Step Approach

Integrating artificial intelligence in investment management requires a thoughtful approach to embedding advanced technologies into existing workflows. This involves aligning them with investment goals and continuously refining strategies based on data-driven insights. Let’s have a quick look at the steps.

Establish Goals

Clearly state your investment objectives, including risk management, wealth accumulation, and retirement planning. Decide on your desired returns, investment horizon, and risk tolerance. This is an essential stage in ensuring that the tactics align with your financial goals and that the AI models are customized to your unique requirements.

Mention any restrictions or inclinations you may have, such as investments particular to a certain industry or ethical issues. Review and revise your goals on a regular basis to accommodate shifting market and financial conditions.

Combine Data

Assemble a comprehensive dataset encompassing economic indicators, current market data, and historical financial information. Using AI for investing requires a robust dataset to effectively identify patterns and generate precise predictions, ensuring that the AI models have the necessary information to deliver valuable insights.

Employ reliable sources and data cleaning procedures to ensure accurate and high-quality data. Also, ensure that the pipelines and tools for data integration are strong enough to manage big datasets and offer smooth updates. Audit data sources regularly to ensure integrity and resolve any anomalies.

Also Read: How Data Mining Helps in Business Intelligence

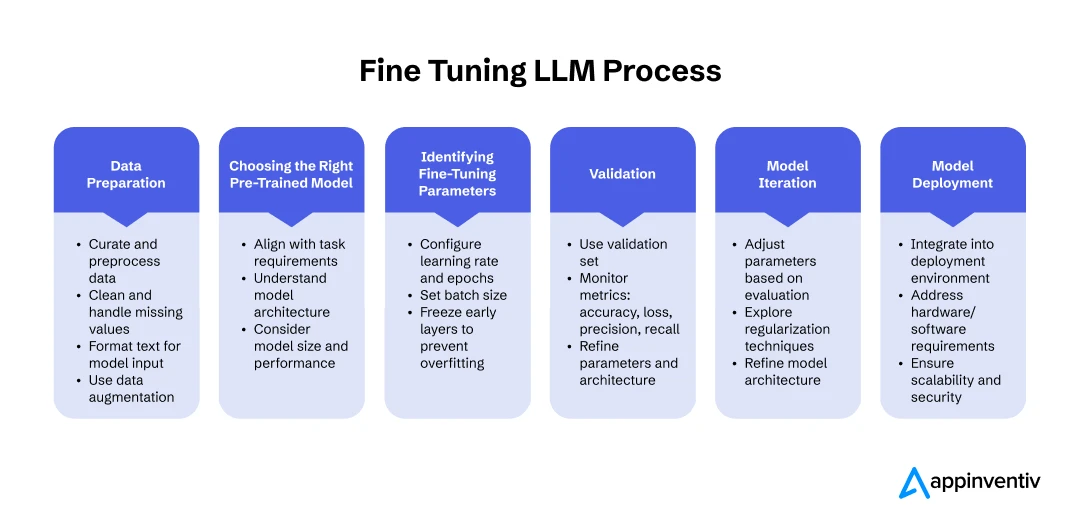

Create and Train AI Models

The merger of AI and investing techniques involves creating predictive models and algorithms to analyze market trends, forecast asset performance, and identify investment opportunities. By training machine learning models on historical data, patterns are uncovered, and effectiveness is evaluated. These models can be adjusted to fit your investment strategy and improved based on performance feedback.

To enhance accuracy, leverage various machine learning methods, such as supervised and unsupervised learning. Regularly backtest the models to assess their performance and make necessary adjustments to improve prediction precision. Maintain detailed documentation of the model development process for transparency and future reference.

Validate and Test

Thoroughly test models using unseen data to verify their reliability and prevent overfitting. Continuously assess model performance through backtesting and fine-tuning parameters to enhance predictions. Maintain comprehensive documentation of the model development process for transparency and future reference.

Additionally, stress testing should be performed to understand model behavior under extreme market scenarios. Employ a rigorous validation framework that incorporates cross-validation techniques to evaluate model stability. Regularly update and revalidate models to adapt to changing market conditions and incorporate new data.

Integrate the AI Model into Investment Processes

Integrate the AI models into your existing investment systems by ensuring they work seamlessly with your current platforms and workflows. This involves aligning the AI technology with your portfolio management and trading processes.

Ensure that the AI’s outputs are actionable and easily understandable for decision-making. A well-designed interface will facilitate effective interaction with the AI system and enhance its usability for investment professionals.

Monitor & Adjust

Continuously monitor the effectiveness of AI-based investing strategies by examining measures like volatility, returns, and goal compliance. Utilize feedback to alter models and algorithms as necessary to achieve better results. Keep up with technology developments and industry trends to ensure your AI system continues to work well.

Examine how external factors, such as shifts in the economy, affect your models regularly. Establish a systematic procedure for routine assessments to handle new challenges and guarantee compatibility with changing investment objectives.

Manage Risk and Compliance

Establish comprehensive risk management and compliance strategies to address any issues related to AI-driven investment decisions. Develop protocols to monitor AI operations and ensure they adhere to regulatory requirements and ethical standards.

Regularly update these protocols to stay current with changing regulations and best practices. Address potential risks such as model biases and data security concerns to maintain the reliability and integrity of your investment strategies.

Scale and Optimize

As the AI models demonstrate their effectiveness, consider scaling the application to cover a broader range of investment strategies and asset classes. Improve the AI system by incorporating additional data sources, refining algorithms, and expanding its capabilities.

Continuously enhance performance through iterative updates and feedback from practical use. Ensure that scaling does not reduce the system’s efficiency or effectiveness, and keep up with advancements in AI to leverage new innovations for better investment outcomes.

Top 4 Ways to Use AI-Driven Investing?

AI-driven investing can be leveraged in various ways, enhancing investment processes’ efficiency and accuracy. Here are the top 4 ways that highlight how investing with AI can be proven valuable:

Portfolio Optimization

Investing with AI helps balance portfolios by analyzing historical data and forecasting trends for more efficient asset allocation.

Sentiment Analysis

AI processes vast amounts of news, social media, and market data to gauge investor sentiment and predict market movements.

Algorithmic Trading

AI-powered investing executes trades at optimal times based on real-time data and market conditions.

Risk Management

AI enhances risk management by analyzing historical and real-time market data to identify potential risks and forecast downturns.

Challenges and Solutions When Using AI to Invest

Implementing AI for investing involves a series of benefits but also presents a set of challenges that need to be addressed. Let’s navigate the challenges of artificial intelligence in investing and solutions to overcome those.

Data Accessibility

Obtaining comprehensive and relevant data for AI models is challenging due to data silos and limited data sources. This challenge is further intensified by regulatory and privacy concerns that restrict data sharing and integration across different platforms.

Solution: Establish collaborations with data providers and deploy data integration tools to consolidate and aggregate information from multiple sources. Enhance data accessibility by investing in data-sharing agreements and open data platforms. Additionally, use synthetic data and data augmentation techniques to complement and expand existing datasets.

Talent Acquisition

Securing skilled professionals with expertise in both AI and finance is often difficult, especially as competition for these roles grows across various sectors. Retaining top talent can be equally challenging due to the high demand for their skills.

Solution: Focus on training and upskilling existing employees and expand recruitment efforts to include a wider talent pool or utilize AI consulting services to fill expertise gaps. Developing a comprehensive talent development program and providing attractive benefits can also enhance the retention of skilled professionals.

Data Quality Issues

Inaccurate and inconsistent data can significantly impact the performance of AI models. The integration of data from various sources can further aggravate these quality problems.

Solution: Establish strong data governance practices and data-cleaning protocols to maintain accuracy. Employ AI-driven tools for ongoing data validation to monitor and enhance data quality. Conduct regular audits to further improve data integrity.

Building Trust and Encouraging Adoption

Earning user trust and promoting the adoption of AI tools can be challenging due to skepticism and resistance, particularly from users who are accustomed to traditional methods.

Solution: Showcase the value of AI solutions through pilot programs and clear, transparent results. Offer comprehensive training and support to users, emphasizing the advantages and seamless integration of AI for investing. Create a feedback mechanism to address concerns and continuously refine the system based on user input.

Navigating Market Uncertainty

AI models often find it difficult to keep pace with rapid market fluctuations and economic shifts, which can result in inaccurate predictions during volatile periods.

Solution: Build AI systems that are flexible and resilient enough to handle market volatility. Integrate continuous learning and scenario analysis features to improve adaptability and responsiveness. Regularly refresh models with up-to-date data and use stress-testing techniques to better manage and anticipate unpredictable market conditions.

Technological Development

Rapid technological advancements can quickly render current AI systems outdated, leading to inefficiencies and obsolescence.

Solution: Keep abreast of the latest AI research and innovations, and commit to regular system upgrades. Implement modular and scalable AI solutions that can adapt to evolving technologies. Participate in industry forums and collaborative efforts to gain insights into emerging trends and advancements.

Bias in Data

Systemic biases within data can result in biased AI predictions and decisions, potentially reinforcing existing inequalities and inaccuracies.

Solution: Utilize diverse data sources and deploy bias detection tools to uncover and address biases. Conduct regular audits and updates of AI models to maintain fairness and accuracy. Adopt inclusive data practices and involve diverse teams in the development process to effectively reduce and manage bias.

Harness AI for Investment Success with Appinventiv’s Expert Guidance

Integrating AI into investment management can significantly enhance decision-making, streamline portfolio optimization, and boost client engagement. By tackling challenges such as data access, talent shortages, and systemic biases, firms can fully harness AI’s transformative potential. Effective solutions include strong data governance, continuous updates to models, and fostering diversity within development teams.

AI adoption not only refines operational processes but also provides critical insights, enabling investment strategies to adjust dynamically to market shifts. Staying updated with technological advancements is essential for maintaining a competitive edge.

As one of the leading artificial intelligence development services providers, Appinventiv plays an instrumental role in navigating and executing AI strategies, helping businesses unlock new opportunities and achieve outstanding results.

Our experts have worked on several AI-based projects like YouComm, Vyrb, Mudra, JobGet and others, assisting these companies in seamlessly integrating AI into their systems.

Using AI to invest ensures a forward-looking approach, driving growth and improving efficiency in the investment sector. Connect with our experts to harness AI for investing and unlock new opportunities for innovation, precision, and enhanced decision-making.

FAQs

Q. Can AI help with investing?

A. Yes, AI can enhance investing by examining large volumes of financial data, spotting patterns, and forecasting market trends. It can refine portfolios, automate trading strategies, and offer tailored investment advice, potentially improving returns and managing risks more efficiently than conventional approaches.

Q. How to use AI for investing?

A. To utilize AI and investing, follow these steps:

Establish Investment Objectives: Set clear goals, risk tolerance, and investment timeframes.

Aggregate Data: Collect and integrate relevant financial data, including historical and current market information.

Develop and Train Models: Build AI models to analyze data, predict trends, and uncover investment opportunities.

Validate and Test Models: Test the AI models with historical and real-time data to ensure their accuracy and effectiveness.

Monitor and Refine: Continuously evaluate the performance of AI-driven strategies and adjust them as market conditions change.

Q. What are some of the ethical and legal considerations in AI-powered investment analysis?

A. In AI-assisted investing, several ethical and legal considerations must be addressed:

Privacy and Data Protection: Safeguarding sensitive financial data and complying with various privacy regulations such as GDPR and CCPA is essential to protect investor information and prevent breaches.

Equity and Impartiality: AI models must be carefully designed to avoid biases that often leads to unfair or discriminatory outcomes. Ongoing monitoring and necessary adjustments are required to ensure just treatment.

Legal Compliance: AI systems need to follow financial regulations and industry standards to ensure they operate within legal boundaries and maintain market integrity.

Ethical Use and Safeguards: Measures should be in place to control the misuse of AI tools for unethical trading or market manipulation activities.

Q. What are the benefits of AI for investing?

A. Some of the top benefits of AI for investing include:

- Personalization of strategies

- Cost reduction

- Automation of routine tasks

- Real-time monitoring

- Risk management

- Predictive analytics

- Enhanced data analysis

- Improved decision-making

- Efficiency gains

- Fraud detection

How Much Does it Cost to Build a Custom AI-based Accounting Software?

The accounting industry has been evolving very fast, and the expanding use of AI in accounting is becoming evident. According to The State of AI in Accounting Report 2024, 71% of accounting professionals believe that artificial intelligence in accounting is substantial. Considering the given number, it is easy to grasp why companies are keen on…

Generative AI in Manufacturing: 10 Popular Use-Cases

Introduction Manufacturing is truly getting a serious makeover for the future, and it's not full of buzzwords and techno-speak; with the dawning of AI technologies, manufacturing is no longer about nuts and bolts and conveyor belts. Yes! We are talking about how Generative AI in manufacturing is transforming the entire industry. It was the next…