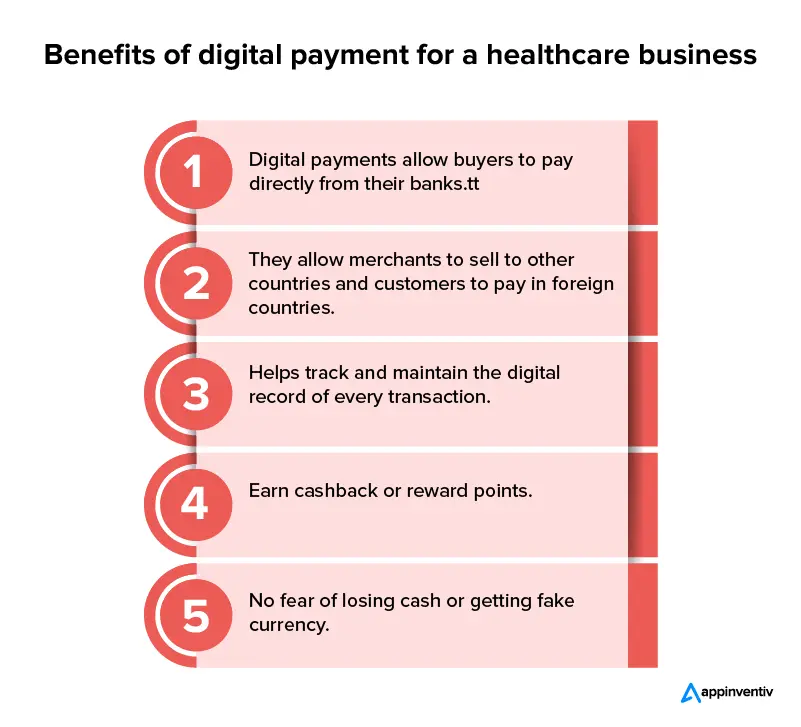

- Benefits of Digital Payments in the Healthcare Sector

- Improves business proficiency

- Simplifies record keeping in healthcare businesses

- Enables telehealth services

- Enhances practice revenue cycle management

- Timely settlement of claims

- How Digital Payments in Healthcare Enhance Patient Experience

- Improves communication and engagement

- Improves patient satisfaction

- Provides a seamless, modern check-out experience

- Creates a transparent ecosystem

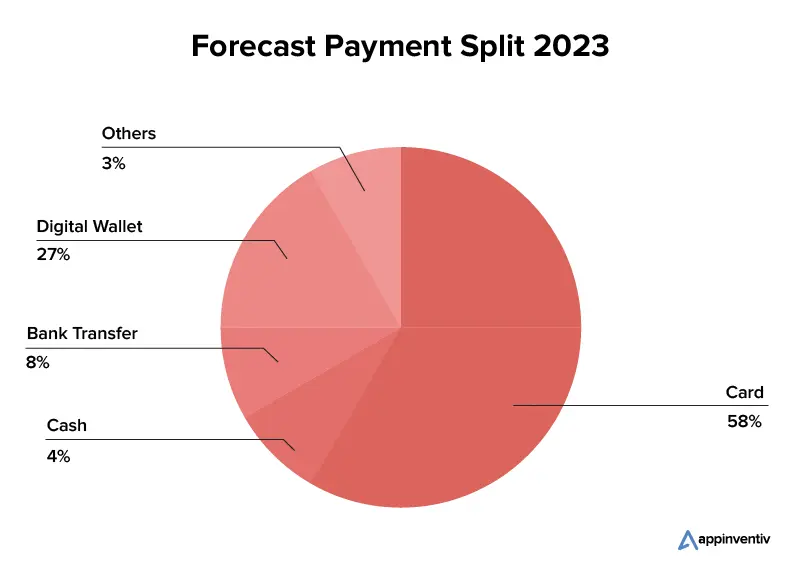

- Emerging Healthcare Digital Payment Trends

- Real-time payments (RTP)

- Electronic funds transfer

- Mobile wallets

- Healthcare Payment Technologies You Can Use

- Biometric authentication

- Open bank APIs

- Codes

- How can Appinventiv help your healthcare business go digital with your payments?

- FAQs

The pandemic has been a difficult phase for all of us. However, there is a silver lining, we have successfully digitized operations and payments in most sectors around the world. But the fact remains that digital payments in the healthcare business are still a far-fetched goal. 51% of patients still receive their medical expense bills over postal mail when receiving and paying bills online is much more convenient.

It can be frustrating for patients and medical businesses to manage this financial burden through invoices and written records. Considering the number of healthcare payments businesses have to transact each day, it can take a tiringly long time to process these through the manual method. The only efficient way to deal with this issue is to change the types of payment systems in the healthcare sector.

In accordance with the trends and demands of consumer digital payments in healthcare, the healthcare sector must collaborate with revenue cycle management companies and technology vendors to accommodate the same.

Of course, the security of payment information continues to be of utmost importance in a sector where privacy compliance is required. There has already been plenty of cybercrime and fraud news around that requires healthcare service providers to be extra careful about the services and confidentiality they provide their patients.

Accelerating digital payments for patients can help better your patient experience, quicken financial processing time, streamline manual processes, and provide multiple other benefits to your healthcare business.

Keep reading to learn about the benefits of digitalizing your healthcare payments.

Benefits of Digital Payments in the Healthcare Sector

Payments make the entire treatment process more complex and elongated. If digitizing them can make the process simpler, it would add up to benefit the healthcare business. With immediate effect, you will be able to see how efficient it makes the system. Let us discuss some benefits associated with digital payments in healthcare.

Improves business proficiency

With computerized operations, the amount of manual intervention decreases. Thus, the likelihood of human error is almost zero. The entire payment process gets streamlined. By enabling practices to text or email bills, the procedure is made simpler. Everything for patients may be handled digitally, including checking their bills and making payments.

The elimination of paper-based procedures not only relieves staff members of hours of timekeeping but also enables them to focus on delivering superior customer service and other helpful practices, such as evaluating performance metrics, seeing areas for improvement, and more.

Additionally, with just a few clicks, healthcare digital payment solutions make it simple to forecast, customize, and manage inventories while securely storing a ton of data.

Simplifies record keeping in healthcare businesses

Healthcare deals with a ton of paperwork each day. With healthcare digital payment solutions, one can create a digital invoice, submit it to a patient, and receive online payment, all in one simple transaction. It saves you and the patient from the hassle of endless billing.

By doing this, you will also save yourself from the requirement to manually track the patients who have received invoices, who have made payments, and who still need to be contacted about unpaid balances.

Billing administrators can easily access patient invoices and take care of unpaid bills using healthcare online payment solutions. This practice supports a healthy expansion strategy for smaller healthcare institutes and helps increase efficiency at every stage of the patient experience.

[Also Read: Ways Electronic Health Records Will Continue to Improve in 2022]

Enables telehealth services

Although telemedicine and virtual consultations were already commonplace before the epidemic, the number of portals has significantly increased since then. The use of telehealth services has increased almost 38 times since the pandemic. Digital payments in healthcare were initially a problem that restricted the development of telemedicine. But these services allow remote resolution of patients’ issues, so they do not have to travel far to see their healthcare professionals.

Patients can now easily get online consultations and pay for them using their preferred digital payment methods, such as bank transactions, wallets, cards, etc.

Enhances practice revenue cycle management

Manual bill-paying methods impede workflow and make the process slow. The average wait time for payment for healthcare services nowadays is 60 days or more following the patient visit. For businesses with a growth focus or who merely wish to increase monthly cash flow, these dreadful accounts receivable (A/R) figures are less than ideal.

In many instances, a business merely needs to enhance the procedure with a straightforward method of creating invoices, promptly billing patients, and accepting electronic healthcare payments. With digitization, the gap between the generation of invoices and the payment received will invariably decrease as the customers will receive their bills promptly and the payment will be made simpler. This is a crucial performance criterion that is considered for expansion.

Timely settlement of claims

With the information gathered through digital portals, agencies and policy providers communicate reminders of insurance payments, just as you receive customized communication for the repayment of loans. These websites keep track of information, including your name, outstanding debts, and preferred method of payment, and distribute reminders in line with that information. After obtaining this, paying the debt is as simple as clicking a button.

Similar to how settlements have experienced shorter cycles, it is simple to compute and distribute the necessary amount using digital information.

How Digital Payments in Healthcare Enhance Patient Experience

It is a win-win situation for both the business and the patients. Patients are more likely to seek medical attention and receive the best care, while providers are better able to offer treatments and reliably collect payments.

As noted, patients have been increasingly preferring digital healthcare payments rather than manual ones as it eases the process at every step.

Here are more ways how digitalizing your healthcare business can transform your patient experience:

Improves communication and engagement

Patients desire quick, easy access to all their information in the digital age, including test results and unpaid balances. In order for patients to check in, schedule an appointment, and pay for their visit on their laptop or smartphone, digital payments are simple to integrate with other healthcare digital solutions.

In light of the US Centers for Medicare and Medicaid Services Hospital Price Transparency Rule, implementing a digital payment system requires improving patient communication and information access. The law mandates that hospitals in the United States provide transparent and easy-to-access pricing information for procedures and devices online.

In a survey, 44% of patients confirmed paying their medical bills more quickly when they receive digital or phone billing reminders. Providers can speed up payment collection and boost both clinical and financial outcomes with the help of active online portals and healthcare digital payment models.

Improves patient satisfaction

Digital convenience has now become the norm. It is not something out of the ordinary anymore. The usage of contactless payments was broadened by COVID-19 with concerns of convenience. But as we have seen and experts have mentioned, these preferences and practices have become a habit.

Adding digital payment options to medical practices encourages more devoted and satisfied patients. In fact, according to data, a third of patients are dissatisfied with the way their healthcare provider handles manual billing. Independent healthcare practices cannot afford to lose clients because of slow billing and payment procedures in an era of escalating competition.

Therefore, digitizing operations might be a great solution if you are setting up a healthcare business or struggling to hold back your customers as an established practice.

Provides a seamless, modern check-out experience

Imagine having a patient at your office who receives a text message while waiting for their doctor in the exam room. The message would contain an invoice for their co-pay that can be paid at the time of their appointment or shortly after. These customers won’t waste time at the register paying for something they could easily send from their phone in the waiting area or at home. Patients can continue with their day immediately after seeing their provider with a modern check-out procedure.

Additionally, you will receive more patient satisfaction points if you switch every process to a contactless alternative in a post-pandemic environment. Front desk staff will have more time to focus on improving the patient experience by immediately answering any questions or notes they left rather than transacting payments on registers.

Creates a transparent ecosystem

A typical medical bill includes a lot of information that might be hard for a layman to grasp. This can confuse the patient or his or her family. But through healthcare digital payment systems, every dollar spent is monitored and verified. Misappropriation of money is next to impossible.

A great deal of trust and confidence builds because the patient agrees with the bill’s totality and receives all the information transparently. If there are any errors or misunderstandings, changes can be made right away and will be reflected in real time. This, in turn, increases customer satisfaction and builds trust.

Emerging Healthcare Digital Payment Trends

With digital payments gaining acceptance in B2B and B2C areas, there are a few models that can be useful to the healthcare industry to accelerate digital payments:

Real-time payments (RTP)

Real-time payments (RTP) transactions are initiated and settled nearly instantaneously. The funds are instantly transferred, and all information related to transactions is settled almost immediately. Real-time payment networks ideally have 24*7*365 accessibility, which implies they are always available to handle transfers, including weekends and holidays.

This can be particularly beneficial for healthcare providers as their emergency department is always open. This model is expanding at a rate of 33%, currently standing at $13.5 billion in the worldwide market.

Electronic funds transfer

When funds are transferred digitally from one bank account to another, the process is known as an electronic funds transfer (EFT). It is also known as a direct deposit.

These transfers are conducted without the involvement of bank workers. Because it is a digital transaction, no paper documentation is required. Due to its ease of use, accessibility, and directness, EFT has surpassed other money transfer methods as the most popular choice. Paper checks are becoming less and less common as firms are using EFT more frequently because it is cheaper, faster, and requires less labor overall.

According to Global News Wire, the global market for EFTs is estimated to grow at a rate of 8.9% to reach an estimated 103.5 billion by 2028.

Mobile wallets

Mobile wallets process payments using bank account, debit, or credit card information. The payment details are saved in a secure and encrypted way in a mobile wallet that processes payments. These wallets eliminate fraud, speed up payment processing, and cost nothing.

Nearly 6.5 million new users are projected to start using mobile wallets every year between 2021 to 2025, with an annual spend of almost $3000 per user.

Mobile wallets can be used to pay in-person or online to receive discounts, cashback, and rewards. With this kind of payment system, customers may “tap-and-pay” for payment and utilize a single wallet for both online and offline payments. Mobile wallets are linked and made to make payments for goods and services quick, easy, and secure.

Healthcare Payment Technologies You Can Use

While there are plenty of technologies in the market, you can use the one most suitable for your healthcare business when you decide to integrate digital payments into your services:

Biometric authentication

Biometric authentication is a type of verification that uses a person’s biological and physical traits to analyze them with different technologies like heartbeat analysis, vein mapping, facial recognition, iris identification, and fingerprint scanners.

Mobile apps and other digital payment agents can employ biometric verification to confirm a transaction in the healthcare sector. Smartphones, for instance, can send data along with a payment request that includes behavioral biometric data. By detecting discrepancies in biometric data and payment behavior, these extra signals will increase authentication’s robustness and improve fraud detection.

Open bank APIs

Through a third-party application, legacy banks can exchange data and information thanks to application programming interfaces (APIs). Any business (B2B, B2B2C, or BaaS) can incorporate its products onto a platform of a nonfinancial company by using APIs.

Codes

Europay, Mastercard, and Visa (EMV) technology has progressively gained traction and provided clients with a more automated and safe method of payment.

The EMV system is well known for utilizing unique transaction-specific codes. The security of bank accounts is greatly improved by the use of these temporary codes. It also influences how we manage banking systems. These codes are soon replacing plastic cards as a more practical and safe way to transact money.

How can Appinventiv help your healthcare business go digital with your payments?

Being a leading healthcare IT consulting firm, Appinventiv can be your partner in success by providing you with innovative solutions from start to finish. Our diverse clientele base and years of experience have given us ample opportunities to come up with solutions that have shown positive impacts on business.

For example, Appinventiv was able to introduce cryptocurrency as a source for daily transactions at a time when it was not widely accepted. They achieved this by developing a mainstream crypto-centric banking solution for Asian Bank, which allowed them to provide daily banking facilities and transactions in cryptocurrencies like Bitcoin and Ethereum. The implementation of this digital solution resulted in 250K+ app downloads and 50K+ cryptocurrency transactions through Asian Bank.

Similarly, we can help you by conceptualizing, designing, developing, and deploying solutions to provide you with the best healthcare software development services. With extensive market research and innovative designs, Appinventiv can come up with an impactful solution that will cater not only to your needs but your patients’ needs as well. So, you will be able to trust them to provide you with a safe, secure, and fraud-proof healthcare digital payment system.

With all possibilities, it is now time to make a shift to digital healthcare payments to improve your business and patient satisfaction. Reach out to a service provider like Appinventiv to create a wonderful, easy, and reliable solution for digital payments in healthcare.

FAQs

Q. Why does my healthcare business need digital payments?

A. As a customer-centric service, you will need to adapt your business to the needs and preferences of your customers. If you want your business to survive in the increasing market of online consultation portals, online pharmacies, and labs, you will also need to provide your services digitally. By providing an online portal, you will not only be able to cater services, but also digitize payments and ease the financial process for both you and your patients.

Q. What technologies can I use to digitize payments?

A. You can use a varied variety of technologies available, including open bank APIs, EVM codes, Mobile wallets, real-time payments, and more. You can choose to create an online software for your healthcare payments that your patients specifically use to pay for your services.

Q. What standards under HIPPA require me to use electronic healthcare transactions?

A. HIPPA requires you to meet standards for the following digital transactions:

- Claim status

- Eligibility

- Enrollment and disenrollment

- Referrals and authorizations

- Premium payments

- Coordination of benefits

- Payments and remittance advice

How Much Does it Cost to Build a Custom Dental Practice Management Software?

In recent years, dental practices have shifted away from manual, paper-based systems and embraced advanced software solutions. This change boosts efficiency, enhances patient experiences, and improves data management. While dealing with patient data, dentistry has ditched old-school methods like physical charts, appointment books, and manual billing. They’ve leveled up with a high-tech data handling &…

EMR Integration in Healthcare Systems - Benefits, Features, Process, Costs

EMR integration, having proved its worth in the healthcare space with improved workflows, better patient engagements, and lowered operational costs has built itself a projected market share of USD 20.7 billion. Eventhough a range of hospitals swear upon the benefits EMR system integration has garnered them, the adoption level digital healthcare industry anticipated has still…